Capacity costs in the PJM Interconnection cleared at unprecedented levels in the latest auction. As shown below in Figure 1, the cost of capacity increased in many parts of PJM by 5x. While this chart shows the expected capacity price increase in PPL as an example, this is representative for other parts of PJM as well. These new higher capacity costs will be assessed for the 2025-2026 planning year (June 2025 - May 2026) impacting electricity pricing across its 13-state footprint. Every electricity supplier will be required to pay the new capacity obligations and, therefore, consumers should be prepared to see these higher costs passed onto them beginning June of this year.

4 min read

What a 5X Increase in PJM Capacity Costs Means For Your Electric Bill

By 5 on April 28, 2025

Topics: PJM

4 min read

2025 Coincidental Peak Alerts

By 5 on April 25, 2025

Topics: Markets PJM NYISO ERCOT Demand Response Resiliency

7 min read

WINTER POWER OUTLOOK: RELIABILITY & RISK ASSESSMENTS ACROSS KEY MARKETS

By 5 on January 14, 2025

Before each winter, many organizations responsible for overseeing North America's power grids release risk assessments. These reports primarily focus on reliability and resiliency, with less emphasis on wholesale prices. Although wholesale prices can indicate risk, forward prices do not always fully capture the potential risk of energy scarcity. Conversely, forward price volatility may sometimes reflect risks that are less likely than the prices suggest. This article summarizes some of these risk assessments and highlights the risks currently indicated by forward market prices for January and February 2025.

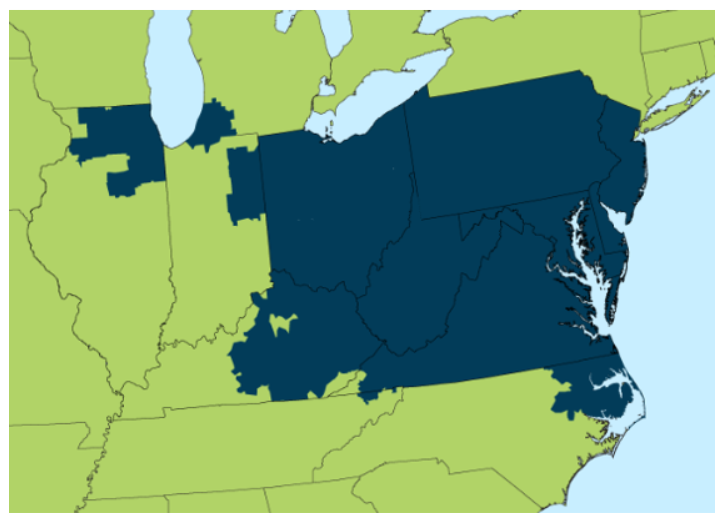

To start, the North American Electric Reliability Corporation (NERC) releases a Winter Reliability Assessment (WRA) each fall, covering key markets and regions across North America, including PJM, New York, New England, and Texas. This year’s report largely aligns with expectations, indicating that most deregulated regions face reliability risks during periods of "above-normal" load conditions. This risk summary is shown below in Figure 1.

Figure 1. Winter Reliability Risk Area Summary, by NERC

According to NERC, the primary risk facing most regions this winter is the availability of natural gas. While the power industry has made significant strides since 2021 to enhance power plant performance, much of this progress has focused on improvements in planning and forecasting. However, the most significant challenge remains the capacity of natural gas pipelines and maintaining adequate pipeline pressure levels during periods of extreme cold, which continue to pose the greatest threat to reliable power production during the winter months.

Topics: Natural Gas PJM NYISO ERCOT Procurement

2 min read

UNDERSTANDING PJM'S CAPACITY RULE CHANGES: IMPLICATIONS FOR AUCTION PRICES AND GRID RELIABILITY

By 5 on January 14, 2025

On December 9, PJM proposed a series of changes to its capacity rules. These changes are designed to address: (i) the high clearing prices in the 2025/2026 auction, and (ii) the increasing risk of capacity shortfalls. As discussed in earlier 5 by 5s, this capacity shortfall is driven by numerous factors including the construction of new data centers that require significant amounts of electricity, the retirement of older fossil fuel units, and delays in the development of new generation and transmission lines.

Topics: Markets PJM Education capacity

5 min read

BARRIERS TO A REAL NUCLEAR POWER RENAISSANCE

By 5 on October 22, 2024

Topics: Natural Gas PJM NYISO ERCOT Procurement

1 min read

Webinar Recording: PJM Capacity Auction Results and Their Impact to Your Budget Webinar

By 5 on September 26, 2024

Topics: Markets Clients PJM Videos Education Regulatory

4 min read

SUMMER 2024 MARKET REVIEW

By 5 on August 29, 2024

As we approach the end of August, the focus of the summer typically begins to shift towards things like kids returning to school, parents seeking a more normal schedule, the excitement and optimism of each football team’s upcoming season, and hopefully milder temperatures across our power grids.

Given this, we thought it would be appropriate to give a quick update of how the summer has played out so far, by region and commodity (gas and power).

Topics: Natural Gas PJM NYISO ERCOT Procurement

6 min read

Big News in PJM's Latest Capacity Auction

By 5 on August 1, 2024

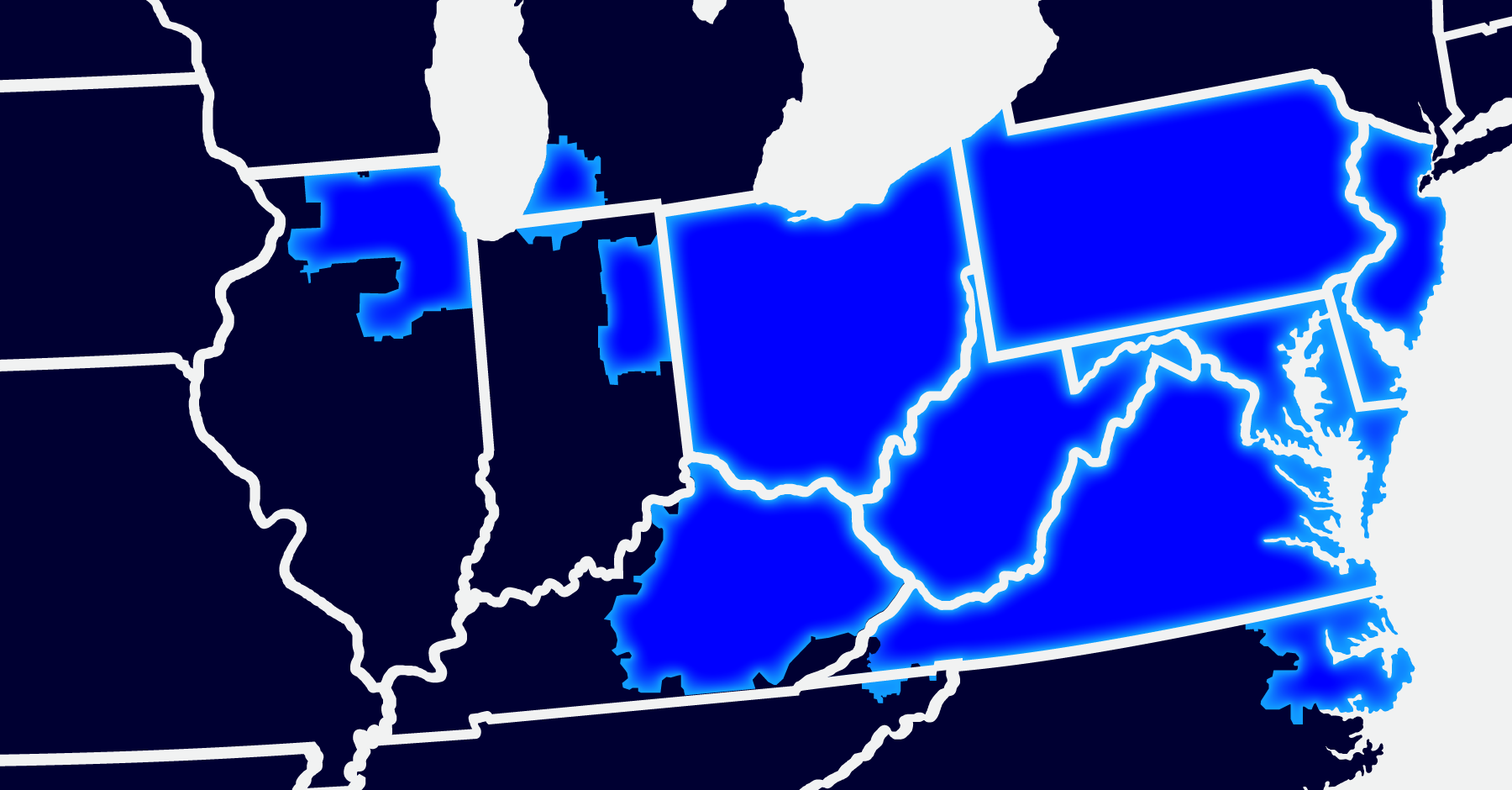

The good news is that we now know the price of capacity through May 2026. The bad news is that capacity prices have increased by approximately 5x over the last auction. The surge in price was fueled by power plant retirements, rising regional demand, and regulatory requirements seeking to address the participation of renewables and how much capacity they can provide during periods of system stress. Before examining the details of this latest auction, it’s important to review how the capacity market got to where it is today. As a refresher, the PJM Interconnection operates the largest competitive wholesale electricity market in the United States, serving 65 million people across 13 states and the District of Columbia as shown in Figure 1. Its primary function is to coordinate the flow of power and develop market rules such that the system operates reliably and safely. A critical component of PJM's operations is its capacity market, which ensures long-term reliability by securing sufficient resources to meet future electricity demand.

Topics: Markets PJM Education capacity

4 min read

Electricity Market Update

By 5 on June 26, 2024

ERCOT

There are two words that describe the reaction of most commercial clients shopping for electricity in Texas: Sticker Shock. Figure 1 shows how the wholesale price of electricity for calendar years 2025 through 2028 has traded over the last four years. In ERCOT, electricity markets were at all-time lows of approximately $20/MWh in the months immediately before the pandemic. Over the last 48 months, power prices in ERCOT have more than doubled as wholesale prices are now more than $50/MWh for calendar years 2025 through 2028. The steady rise of electricity prices in ERCOT is largely driven by concerns that there is not enough supply to meet growing demand across the state. This demand is coming from power-hungry data centers used to support the rapid growth in AI, technology, and cryptocurrency mining in addition to manufacturing and population growth throughout the state. While substantial amounts of electricity from new solar and wind-generating assets have come online, those intermittent resources cannot be counted on to operate on demand. These are some of the dominant factors that have pushed up wholesale electricity prices in ERCOT.

Topics: PJM NYISO ERCOT Procurement

4 min read

Coincidental Peak Alerts 2024

By 5 on May 14, 2024