6 min read

By 5

December 9, 2025

2026 Energy Price Forecast for Large Commercial & Industrial Users Electricity markets across the United States are heading into 2026 with a combination of accelerating demand growth, constrained supp...

READ MORE >

4 min read

By 5

December 5, 2025

The rapid growth of AI data centers, widespread electrification across transportation and industry, and years of underinvestment in utility infrastructure are placing unprecedented pressure on the nat...

READ MORE >

2 min read

By 5

December 4, 2025

NGL Energy Partners is a diversified midstream service provider that delivers essential solutions across the energy value chain. With operations spanning water solutions, crude oil logistics, and natu...

READ MORE >

3 min read

By 5

November 19, 2025

5 Honored as TEPA’s ABC of the Year At The Energy Professionals Association’s (TEPA) National Conference on November 5, 2025, our team at 5 was honored with the ABC (Aggregator, Broker, Consultant) of...

READ MORE >

1 min read

By 5

November 18, 2025

Brian Hayduk, Eric Bratcher, and Jon Moore, senior members of 5’s team and former executives at energy supply companies offer an inside look at how retail electricity rates are built and what really d...

READ MORE >

-1.png)

1 min read

By 5

September 16, 2025

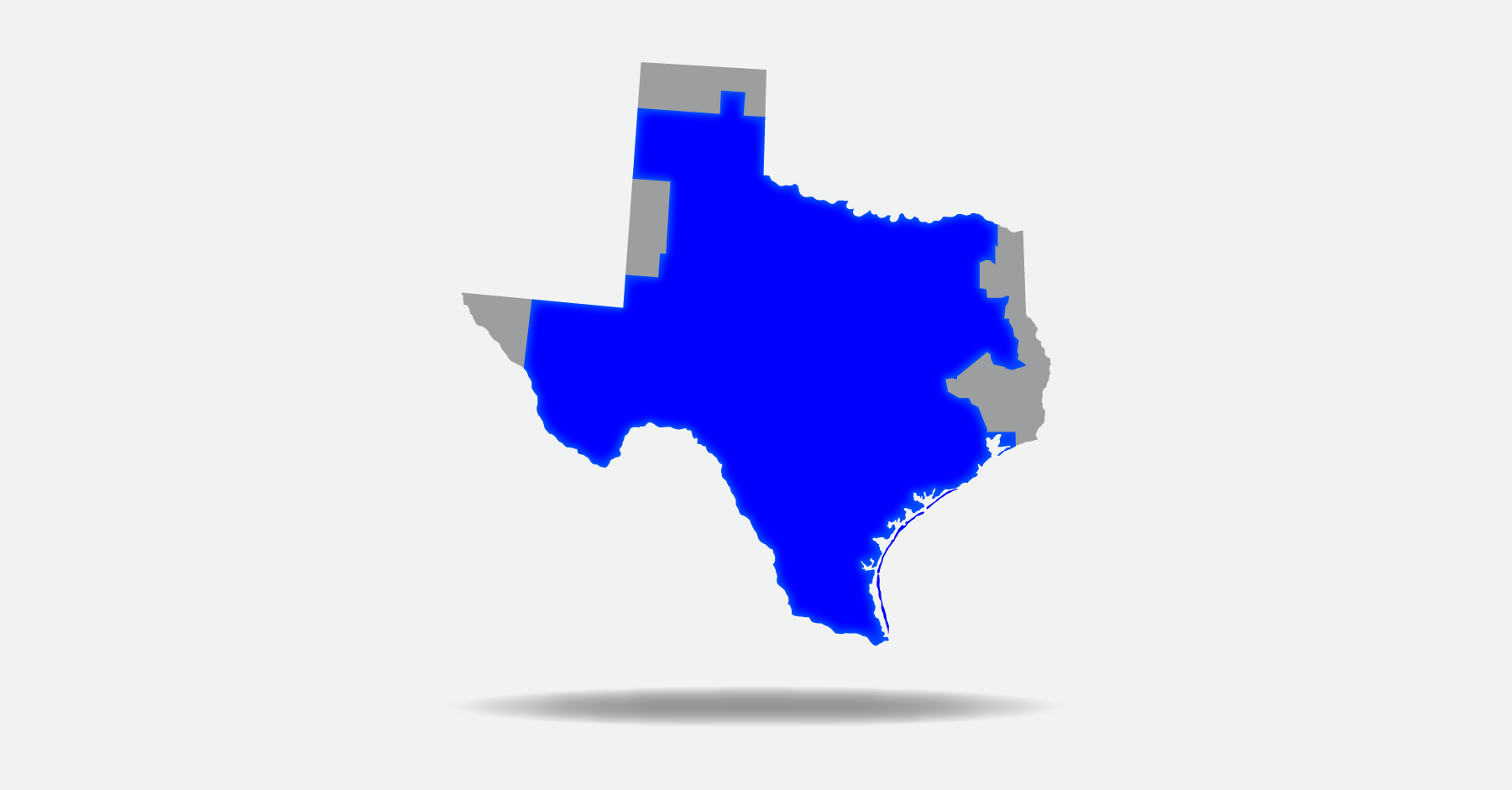

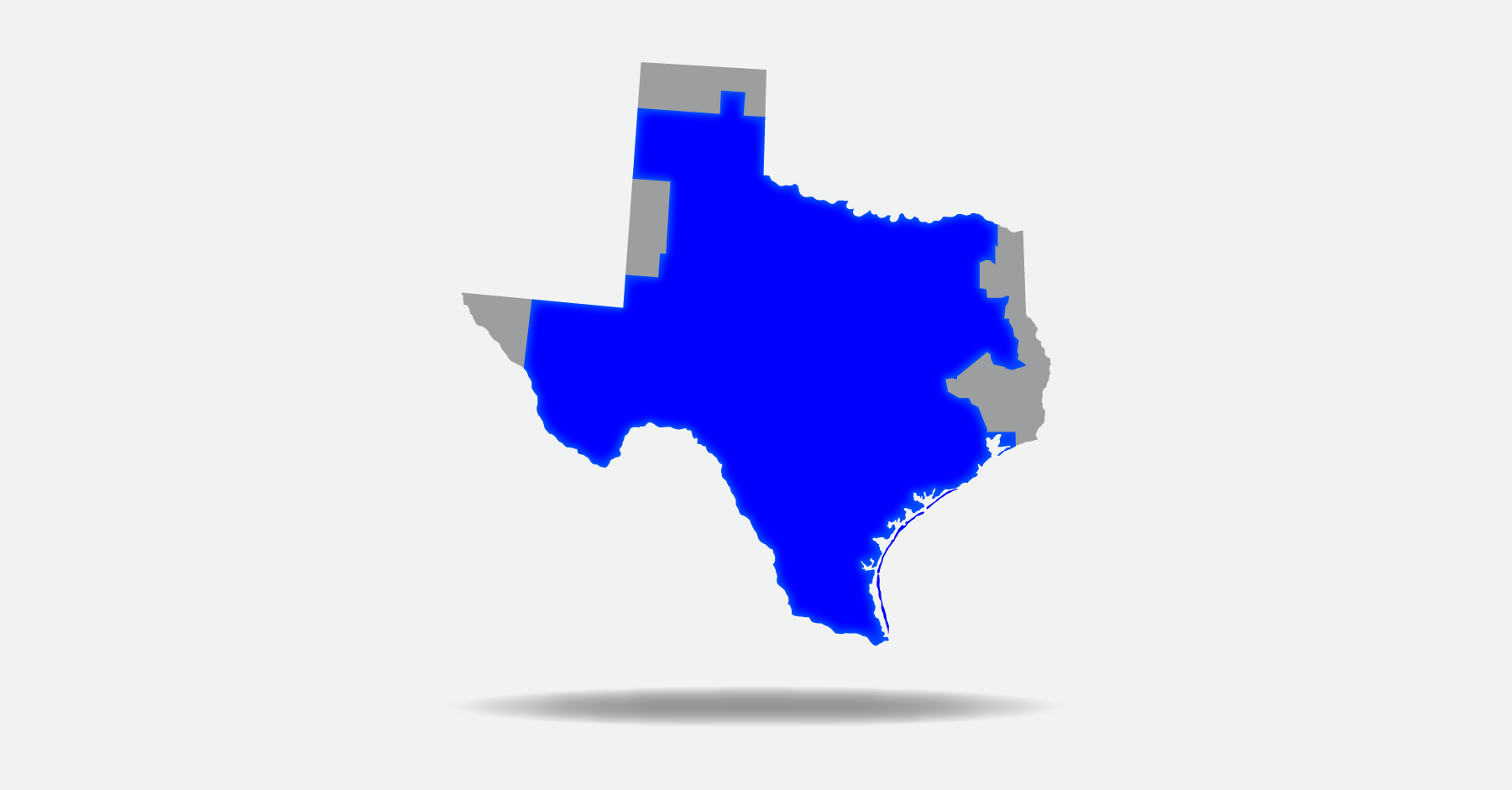

Join Brian Hayduk , Abby Grasshoff, and Eric Bratcher as they discuss why ERCOT real-time prices stayed low in summer 2025 while forward prices remain high. The session covers ERCOT’s summer performan...

READ MORE >

1 min read

By 5

September 9, 2025

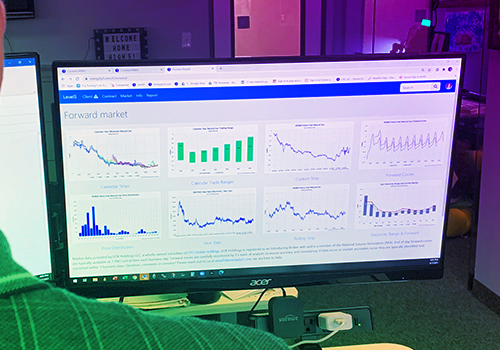

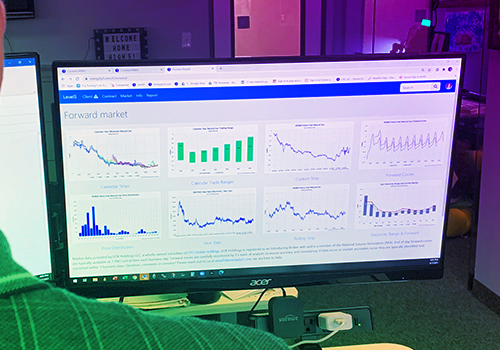

According to Michael Clifton, two features of our platform often surprise customers. The first is forward market prices, which shows how wholesale electricity and natural gas are trading. The second i...

READ MORE >

1 min read

By 5

September 9, 2025

As Taylor Duncan explains, 5’s advice is better because it brings together expertise from every area that is important to clients. From legal and load forecasting to sustainability, energy analytics, ...

READ MORE >

1 min read

By 5

September 9, 2025

For Tracy Hodge, what sets 5 apart is the quality of advice we deliver. Our recommendations go beyond short-term needs. We study market trends, analyze past outcomes, and use data to show clients why ...

READ MORE >

1 min read

By 5

September 9, 2025

At 5, analysts work closely with advisors to uncover opportunities for clients. Behind the scenes, they dig deep into data to identify ways to manage energy costs more effectively. They also join clie...

READ MORE >

1 min read

By 5

September 9, 2025

Brian Hayduk and many others at 5 bring supplier-side experience to the table. They helped design original energy products, wrote contracts, and traded in wholesale markets. That firsthand knowledge o...

READ MORE >

1 min read

By 5

September 9, 2025

As Ben Manna explains, "You don't know, what you don't know." That's why surrounding yourself with industry experts matters. At 5, the depth of knowledge and experience across our team is unmatched, a...

READ MORE >

1 min read

By 5

September 9, 2025

For Chris Watson, the real reward comes from helping clients like school districts save on energy costs. Every dollar saved can mean more teachers in classrooms and more meals for children who need th...

READ MORE >

1 min read

By 5

September 9, 2025

At 5, executional excellence is more than a goal, it is our standard. We take the time to conduct deep dives and post mortems, refining our processes to ensure accuracy and quality. This commitment me...

READ MORE >

1 min read

By 5

September 9, 2025

At 5, our team of engineers, lawyers, former traders, and market experts brings diverse perspectives to every challenge. Backed by powerful analytics, we deliver insights shaped by many disciplines, n...

READ MORE >

16 min read

By Jon Moore

August 20, 2025

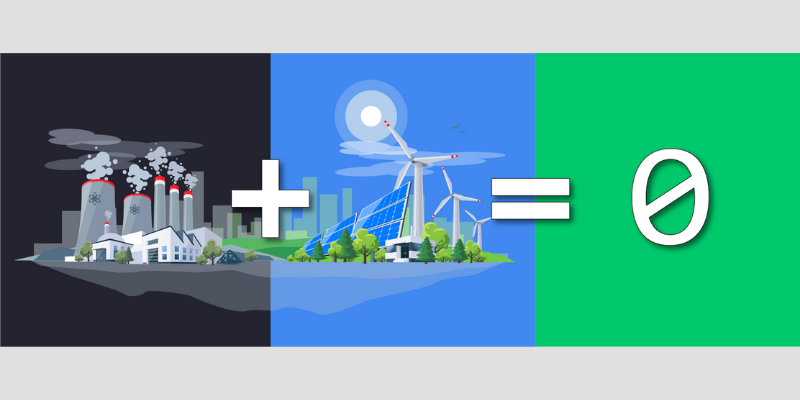

Lately, many of our clients have been asking, “What happened to the energy transition?” The answer brings to mind the phrase, “The King is dead, long live the King.” While the original context of that...

READ MORE >

3 min read

By 5

July 31, 2025

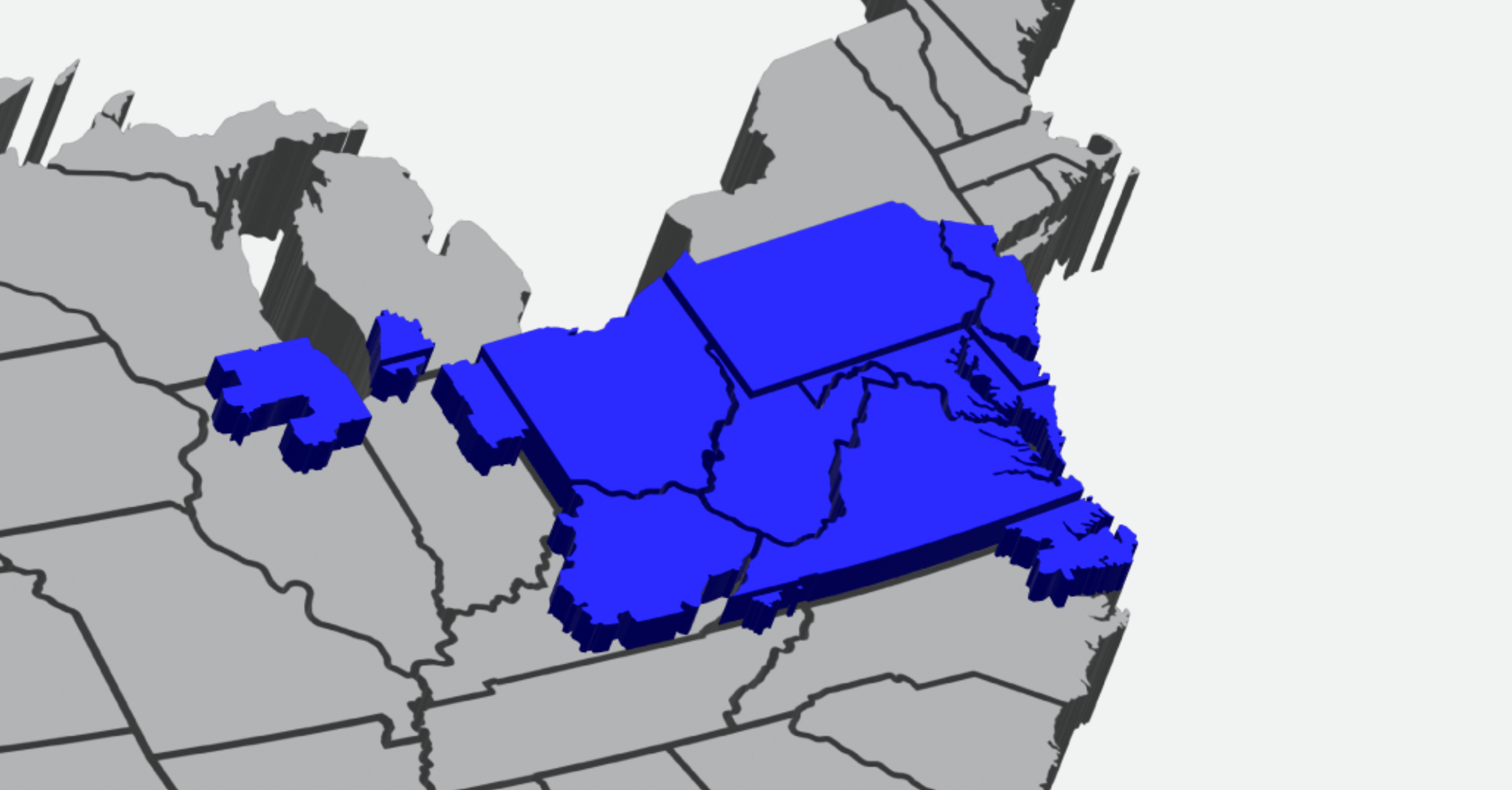

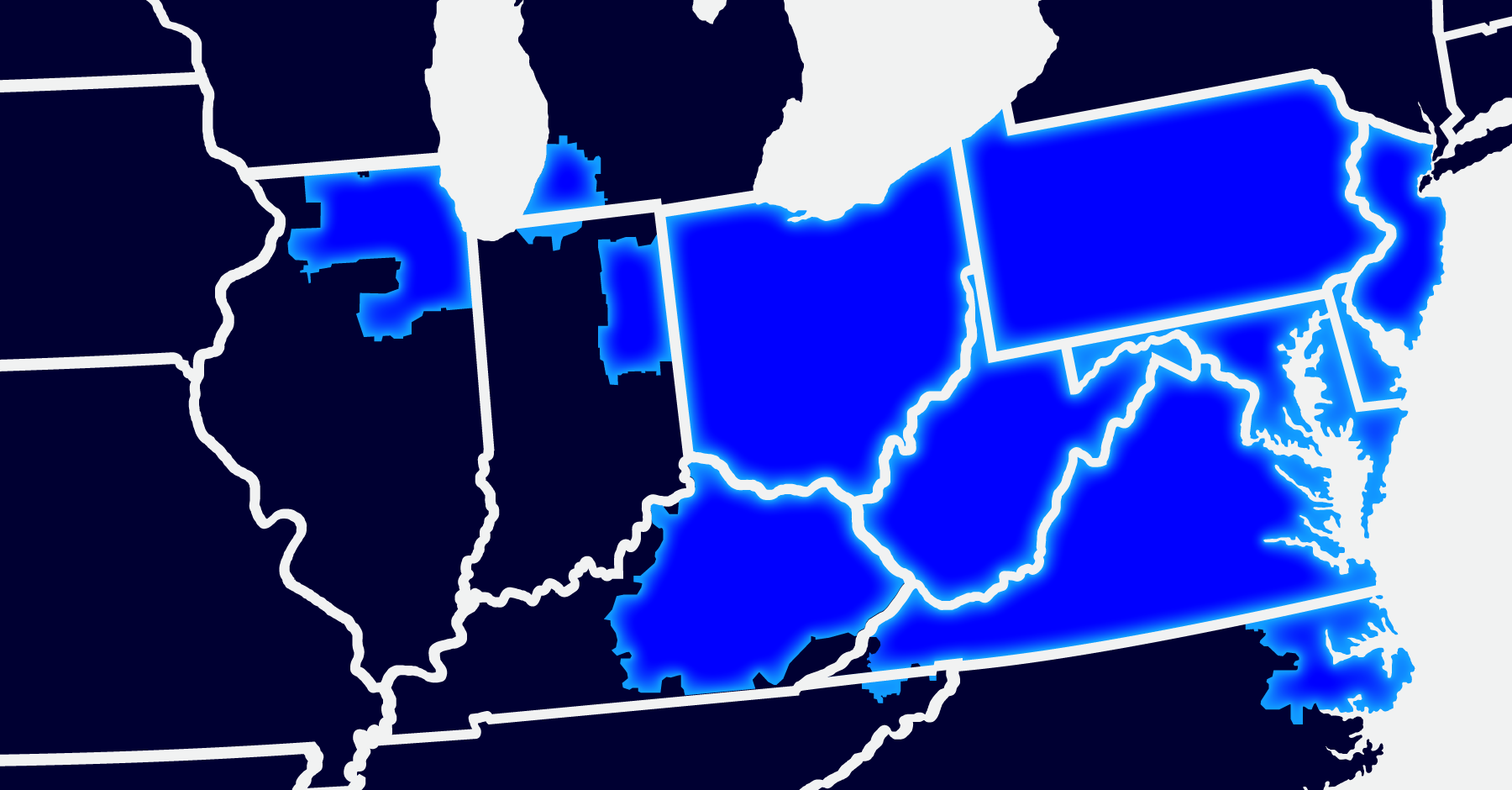

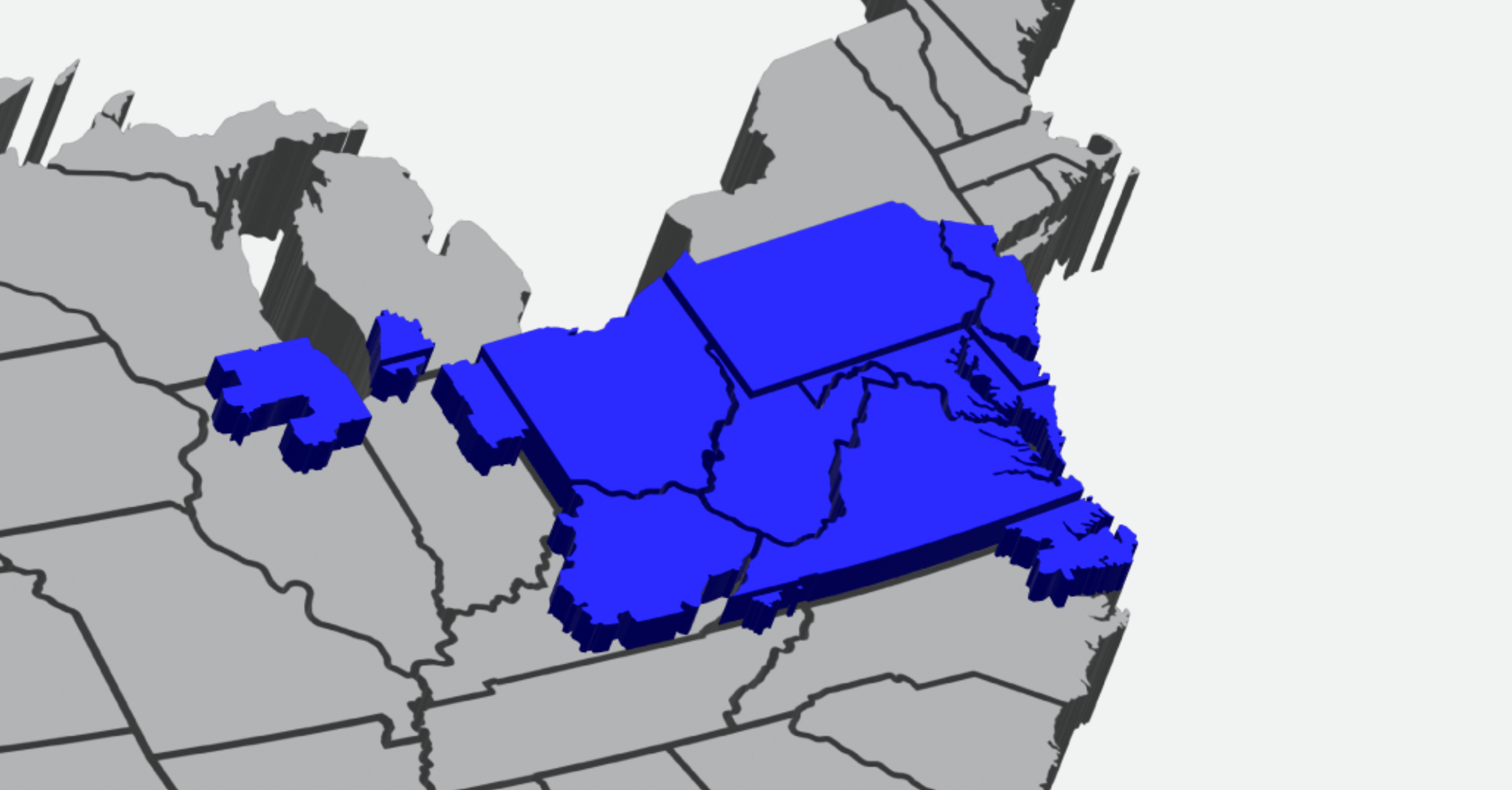

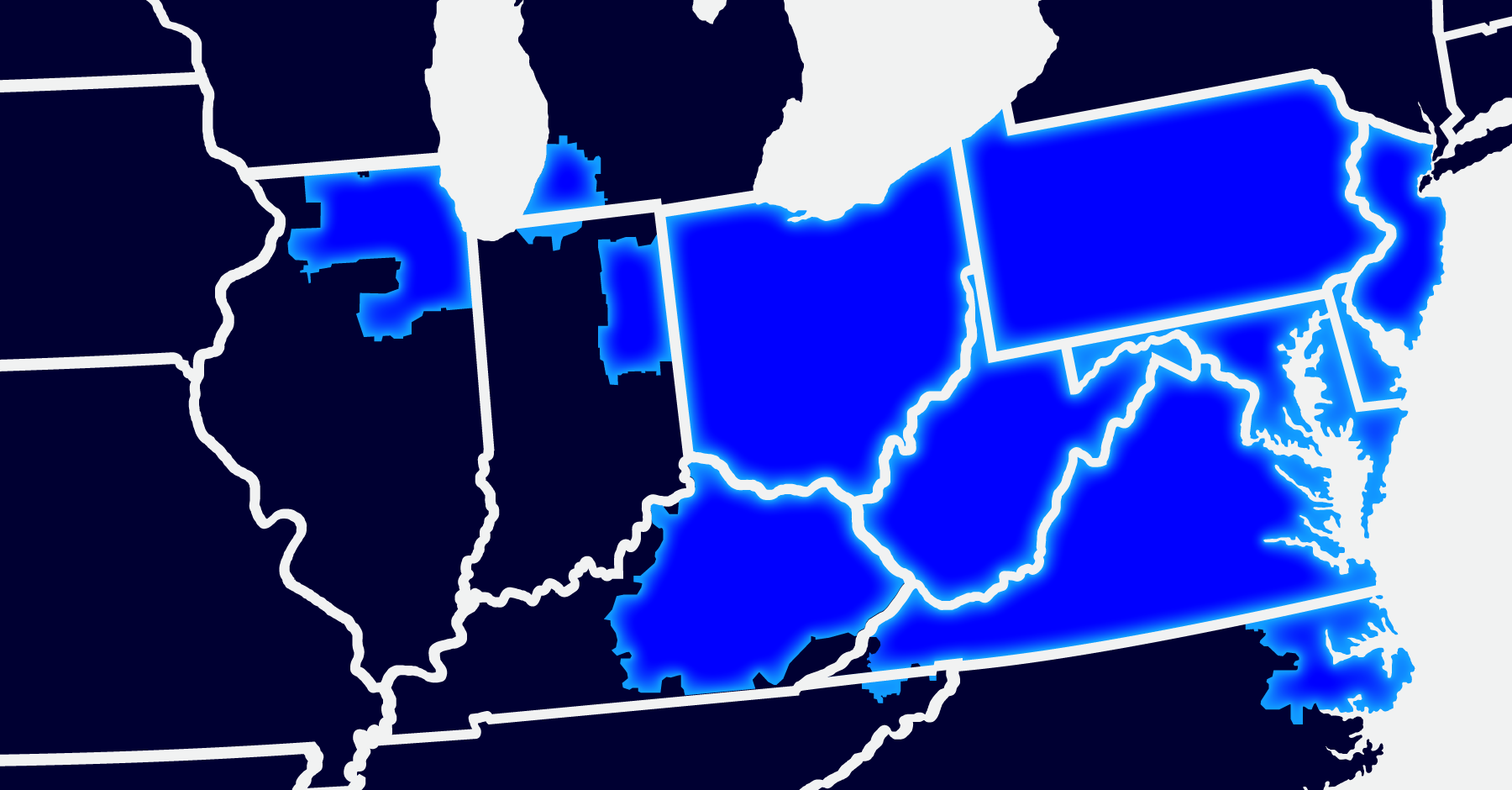

Late last summer, many were shocked by the outcome of PJM’s long-delayed capacity market auction. Most zones cleared at approximately $270/MW-day for the current planning year, which began on June 1, ...

READ MORE >

2 min read

By 5

July 7, 2025

On July 4, the budget reconciliation bill was signed into law by President Trump. Key renewable energy incentives were cut. The Investment Tax Credit (ITC) and Production Tax Credit (PTC) will be effe...

READ MORE >

1 min read

By 5

July 2, 2025

5 was founded with a clear mission: to Help People. We do this by helping clients to manage their energy needs and make smart, informed decisions. We believe that energy has the power to improve lives...

READ MORE >

1 min read

By 5

July 2, 2025

What sets 5 apart from other energy consulting firms? One thing: Better Advice. That better advice comes from the industry veterans who serve as trusted energy advisors to our clients. But it’s not ju...

READ MORE >

1 min read

By 5

July 2, 2025

How does 5 deliver best-in-class energy advice? It starts with the strength of our team and the tools behind them. Our energy advisors are supported by a deep bench of specialists, including engineers...

READ MORE >

2 min read

By 5

June 25, 2025

The hottest topic in energy regulation is the President’s reconciliation bill. As passed by the House, the legislation effectively terminates the Investment Tax Credit (ITC) and Production Tax Credit ...

READ MORE >

4 min read

By 5

June 25, 2025

During the overnight hours of June 12 and 13, Israel conducted the first of several air strikes against targets in Iran. Over the hours and days that followed, multiple counterattacks occurred, awaken...

READ MORE >

3 min read

By 5

June 25, 2025

Managing transmission costs in the ERCOT market by curtailing facility load during one of the four summer peak demand intervals (June through September) used to be relatively straightforward. Operator...

READ MORE >

1 min read

By 5

May 21, 2025

PJM’s latest capacity auction is set to drive up capacity charges starting June 1, 2025 — and the impact could be significant. Join our expert-led webinar to understand what these changes mean for you...

READ MORE >

2 min read

By 5

May 15, 2025

We spend most of our lives in classes, sports and jobs that reinforce the need to look good and to be right, often at the expense of others. Many of our relationships become a zero-sum game; for me to...

READ MORE >

7 min read

By 5

May 9, 2025

From tariffs and recession risks to renewables and rising demand, this article outlines actionable procurement strategies tailored to today’s evolving energy landscape. Macro Energy Drivers The passin...

READ MORE >

4 min read

By 5

April 28, 2025

Capacity costs in the PJM Interconnection cleared at unprecedented levels in the latest auction. As shown below in Figure 1, the cost of capacity increased in many parts of PJM by 5x. While this chart...

READ MORE >

4 min read

By 5

April 25, 2025

The official kick-off to summer is almost here. The beginning of summer is also when many regional power grids start to measure a business’ Coincidental Peak demand. The Coincidental Peak (CP) is the ...

READ MORE >

3 min read

By 5

April 25, 2025

Why didn’t the tomato cross the border? It couldn’t ketchup with the tariff hike. Okay, maybe it’s a bit early for tariff humor. But in all seriousness, the recent tariff announcements have only added...

READ MORE >

1 min read

By 5

April 8, 2025

The team at 5 discussed how winter’s colder temperatures have significantly affected energy prices and market volatility in Upstate New York. Key Topics: Major factors influencing market prices post-w...

READ MORE >

7 min read

By 5

January 14, 2025

Before each winter, many organizations responsible for overseeing North America's power grids release risk assessments. These reports primarily focus on reliability and resiliency, with less emphasis ...

READ MORE >

1 min read

By 5

January 14, 2025

Many of the largest data center owners (e.g. Google, Microsoft, and Amazon) are exploring the co-location of data center load adjacent to new or existing power plants. Energy regulators now struggle t...

READ MORE >

5 min read

By 5

January 14, 2025

Did you get the Simpson’s Nuclear Power Plant play set with the Homer Simpson action figure for Christmas? No? You must not have been good this year, because it seems like nuclear power is all anyone ...

READ MORE >

2 min read

By 5

January 14, 2025

On December 9, PJM proposed a series of changes to its capacity rules. These changes are designed to address: (i) the high clearing prices in the 2025/2026 auction, and (ii) the increasing risk of cap...

READ MORE >

1 min read

By 5

November 20, 2024

The team at 5 discussed the rapidly evolving energy landscape including actionable strategies to help manage costs and secure a reliable energy supply. This first webinar in the series covered what th...

READ MORE >

6 min read

By 5

November 13, 2024

The election was a resounding win for President-Elect Trump and provides him with a clear mandate to change federal energy policy. His ability to implement policies is further supported by the fact th...

READ MORE >

5 min read

By 5

October 22, 2024

Did you get the Simpson’s Nuclear Power Plant play set with the Homer Simpson action figure for Christmas? No? You must not have been good this year, because it seems like nuclear power is all anyone ...

READ MORE >

3 min read

By 5

October 22, 2024

In late August, we wrote that while the result of the Presidential election will have a significant impact on Federal energy policy, it will not materially affect energy prices. We now have a somewhat...

READ MORE >

1 min read

By 5

September 26, 2024

The team at 5 discussed the critical topic of increased capacity costs in PJM and the financial impact on your organization's budgets. This is a unique opportunity to gain valuable insights and action...

READ MORE >

4 min read

By 5

August 29, 2024

As we approach the end of August, the focus of the summer typically begins to shift towards things like kids returning to school, parents seeking a more normal schedule, the excitement and optimism of...

READ MORE >

2 min read

By 5

August 29, 2024

The departure of President Biden and the nomination of Vice-President Harris challenges anyone predicting the impact of the 2024 election on energy policy. Unlike President Biden or former President T...

READ MORE >

2 min read

By 5

August 29, 2024

Evie Porter is not the kind of person you want to hang around with. Unless of course, you want to be scammed, you are into dishonest people, you embrace blackmail, and you are OK if people you know wi...

READ MORE >

3 min read

By 5

August 29, 2024

Daisy Jones and the Six is a novel written by Taylor Jenkins Reid about the California music scene in the late 1970s. The book revolves around the seven members of a fictional rock band and all the su...

READ MORE >

6 min read

By 5

August 1, 2024

The good news is that we now know the price of capacity through May 2026. The bad news is that capacity prices have increased by approximately 5x over the last auction. The surge in price was fueled b...

READ MORE >

2 min read

By 5

July 29, 2024

DALLAS, July 16, 2024 Industry veteran Tracy Hodge joins 5, a leading energy advisory firm in North America, as Senior National Energy Advisor. 5 is pleased to announce that industry veteran Tracy Hod...

READ MORE >

1 min read

By 5

July 11, 2024

The team at 5 with NYSERDA’s Program Manager, Mark R. Gundrum and colleague Kevin Ramcharitar discuss the upcoming voluntary sale of Tier 1 Renewable Energy Credits to commercial and industrial entiti...

READ MORE >

4 min read

By 5

June 26, 2024

ERCOT There are two words that describe the reaction of most commercial clients shopping for electricity in Texas: Sticker Shock. Figure 1 shows how the wholesale price of electricity for calendar yea...

READ MORE >

6 min read

By 5

June 26, 2024

W. Edwards Deming, the father of Total Quality Management, famously stated, "Without data, you're just another person with an opinion." Deming was instrumental in using data and statistical process co...

READ MORE >

3 min read

By 5

June 26, 2024

Hurricane season officially began this month and in a report at the end of May, NOAA predicted between 17 and 25 named storms for the period between June 1 and November 30. According to NOAA, “The upc...

READ MORE >

5 min read

By 5

June 20, 2024

New York, like many states across the country, has a standard by which certain qualifying renewable generation assets are awarded one Renewable Energy Certificate (REC) for each MWh of electricity del...

READ MORE >

4 min read

By 5

May 14, 2024

The official kick-off to summer is almost here. The beginning of summer is also when many regional power grids start to measure a business’ Coincidental Peak demand. The Coincidental Peak (CP) is the ...

READ MORE >

4 min read

By 5

May 14, 2024

One of the most common questions clients ask when purchasing electricity or natural gas is, “How much money am I going to save?” This is a reasonable question and for many years, savings could be real...

READ MORE >

11 min read

By Jon Moore

May 14, 2024

On behalf of the team at 5, I am pleased to forward our May 2024 market letter. In this edition, we discuss several interrelated topics. First, we look at ongoing legal challenges to two new federal e...

READ MORE >

1 min read

By 5

April 25, 2024

The team at 5 is back for 5’s first 2024 energy discussion for Upstate New York consumers. Our panelists dived into the latest regulatory news and shared recent commodity moves and risk management str...

READ MORE >

1 min read

By 5

April 10, 2024

Bradley University is a prestigious private university located in Peoria, Illinois. Known for its commitment to academic excellence and community engagement, Bradley University offers a comprehensive ...

READ MORE >

2 min read

By 5

March 5, 2024

PEORIA, Ill., March 5, 2024 5, a leading energy and sustainability advisory firm, orchestrated a community solar deal between Bradley University and Nexamp that will help to add renewable energy to Il...

READ MORE >

3 min read

By 5

February 26, 2024

2024 will be a busy year for the Federal Energy Regulatory Commission (FERC). FERC is typically run by five commissioners, appointed by the President of the United States and confirmed by the Senate.1...

READ MORE >

4 min read

By 5

February 22, 2024

In late January, the Biden Administration paused all LNG export facility applications, so that the Department of Energy (DOE) can assess whether any additional LNG export capacity is in the public int...

READ MORE >

2 min read

By 5

February 22, 2024

On January 30, 2024, the Texas Supreme Court heard oral arguments in a ground-breaking case related to Winter Storm Uri. At the heart of the case is the question of whether the Texas PUC had the autho...

READ MORE >

1 min read

By 5

February 2, 2024

Ambitious environmental and reliability goals in New York along with aggressive decarbonization efforts are putting pressure on large energy users to improve energy efficiency and reduce carbon footpr...

READ MORE >

2 min read

By 5

January 29, 2024

DALLAS (May 5, 2023) 5, one of North America’s top energy advisory and management firms, announced its acquisition of BidURenergy (“BUE”) and NRG Advisory Services from NRG Energy, Inc. Based in Buffa...

READ MORE >

3 min read

By 5 (Mexico)

January 23, 2024

ACTUALIZACIONES DEL MERCADO “Presenta CRE anteproyecto para validar Unidades de Inspección para Código de Red para Centros de Carga” La Comisión Reguladora de Energía (CRE) presentó un anteproyecto co...

READ MORE >

1 min read

By 5

December 11, 2023

The team at 5 discussed the challenges for ERCOT's power grid, including higher prices and volatility. Increased costs associated with ERCOT's grid management The disassociation of natural gas and ele...

READ MORE >

2 min read

By 5

November 28, 2023

In 2019, the New York State Department of Environmental Conservation (DEC) adopted a regulation to limit nitrogen oxide (NOx) emissions from simple-cycle combustion turbines. Combustion turbines known...

READ MORE >

4 min read

By 5

November 28, 2023

By most accounts, the winter of 2022/2023 was relatively mild. Only 2.3 inches of snow fell in New York City all winter, which is the lowest snowfall total in the 150 years that the National Oceanic a...

READ MORE >

3 min read

By 5

November 28, 2023

While it has become common over the last few years for the bears of the natural gas market in the US to rule the month of December and drive down the coming winter’s (January and February) contract, t...

READ MORE >

1 min read

By 5

November 1, 2023

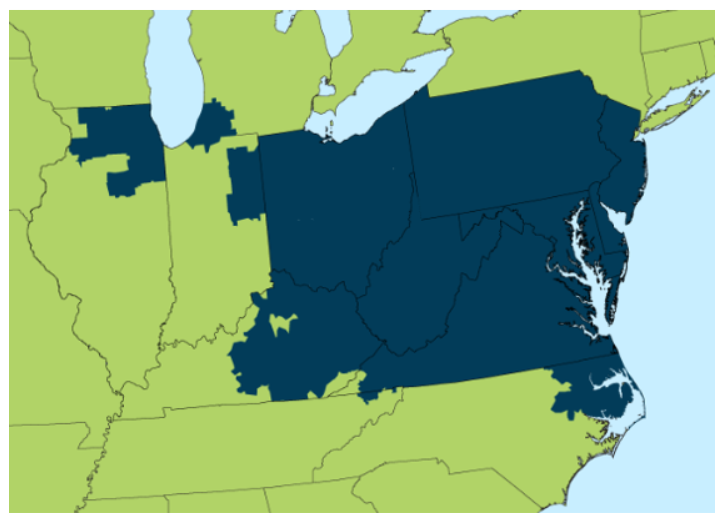

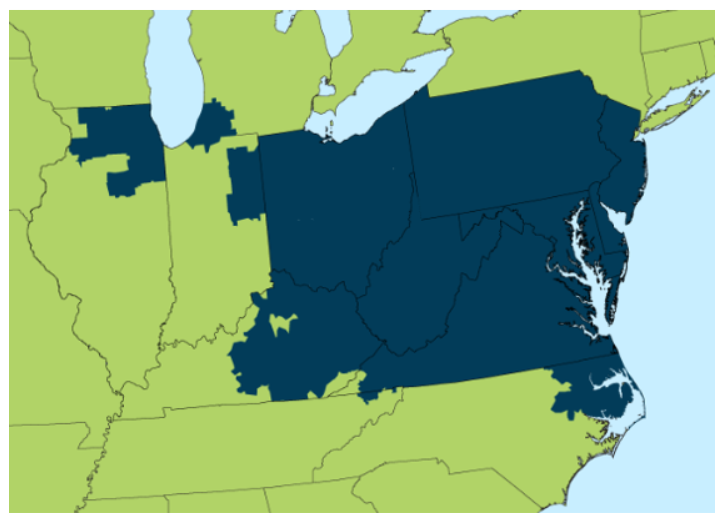

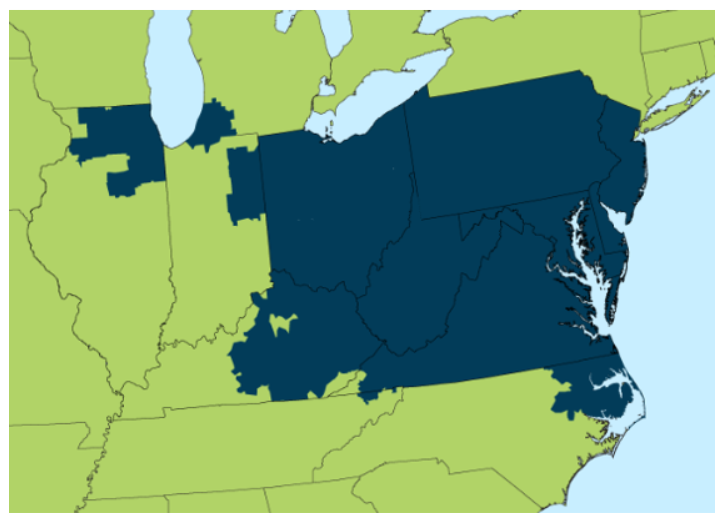

The team at 5 discusses what is driving the energy markets in OH, PA, MD, NJ, and DC and what customers can do to best manage energy costs ahead of this winter.

READ MORE >

1 min read

By 5

October 26, 2023

The team at 5 examined the latest regulatory news affecting Upstate New York energy clients. They also discussed recent changes in energy prices in addition to risk management strategies.

READ MORE >

3 min read

By 5

September 19, 2023

This summer, temperatures in Texas have been significantly higher than average, with record-breaking ERCOT demands and Real-Time prices reaching their maximum cap on multiple days in both June and Aug...

READ MORE >

14 min read

By Jon Moore

September 18, 2023

On behalf of the team at 5, I am pleased to forward our September market letter. If you had any doubts that the energy transition is happening, recent events in Texas and New York confirm that the ans...

READ MORE >

4 min read

By 5

September 18, 2023

When examining electricity offers from different suppliers, clients will often ask about how to choose the best term length for a new contract. There are several factors that must be considered but th...

READ MORE >

1 min read

By 5

August 30, 2023

The team at 5 examined the latest regulatory news affecting Downstate New York energy clients. They also discussed recent changes in energy prices in addition to risk management strategies.

READ MORE >

By 5

August 1, 2023

The team at 5 examined the latest regulatory news affecting Upstate New York energy clients. They also discussed recent changes in energy prices in addition to risk management strategies.

READ MORE >

4 min read

By 5

July 18, 2023

Many are surprised to learn that there are several cost components that are added together to establish the rate in cents per kilowatt-hour in an electricity supply contract. Those components are summ...

READ MORE >

5 min read

By 5

July 17, 2023

One of the most utilized pieces of fundamental analysis in the natural gas industry is the Energy Information Agency’s (EIA) Natural Gas Storage Report, which is released every Thursday morning at 10:...

READ MORE >

4 min read

By 5

July 17, 2023

Given that we are halfway through July, we thought it would be appropriate to provide an update on how major power markets have performed as they relate to each ISO’s coincident peak demand management...

READ MORE >

3 min read

By 5

July 11, 2023

Why Install Electric Vehicle Chargers? In 2022, according to the World Economic Forum, one in seven cars purchased globally were fully electric with countries such as Norway leading the way, where 79%...

READ MORE >

1 min read

By 5

June 2, 2023

Jeff Shoaf and Eric Bratcher discussed 4CP demand management opportunities for this summer, short and long-term changes to the ERCOT market based on the current legislative session, changes in market ...

READ MORE >

4 min read

By 5

May 22, 2023

Memorial Day is coming up soon, which means that the official kick-off to summer is almost here. The beginning of summer is also when many regional power grids start to measure a business’ Coincidenta...

READ MORE >

3 min read

By 5

May 22, 2023

Early this month, ERCOT released the Seasonal Assessment of Resource Adequacy (SARA) report detailing market conditions as they exist going into the summer of 2023. This report takes into consideratio...

READ MORE >

2 min read

By 5

May 18, 2023

On May 11, 2023, the U.S. Environmental Protection Agency (EPA) proposed new rules designed to limit emissions from existing and new coal and natural gas fired power plants. This is the EPA’s third sw...

READ MORE >

By 5

April 27, 2023

The team at 5 dove into the latest regulatory news impacting Upstate New York energy consumers. They also discussed recent commodity moves and risk management strategies.

READ MORE >

2 min read

By 5

April 17, 2023

On March 17, 2023, the Texas Court of Appeals added significant uncertainty to the state’s electricity market. The Court sided with Luminant in their ruling that the Texas Public Utility Commission’s ...

READ MORE >

3 min read

By 5

April 12, 2023

Here is the good news: in February, PJM posted the results of its latest capacity auction for the planning year June 2024 to May 2025. And for the most part, those prices are similar or lower than tho...

READ MORE >

2 min read

By 5

March 14, 2023

Over the past few years, energy markets have been pushed to the brink, and we’ve seen unprecedented market volatility brought on by the pandemic, supply and demand issues, extreme weather conditions, ...

READ MORE >

4 min read

By 5

March 3, 2023

One might legitimately expect a future TV series to be called, “It’s Always Sunny in New York City.” This is not because there is a spin-off of the acclaimed FX series in the works, but because the ec...

READ MORE >

3 min read

By 5

March 2, 2023

Why did Lubbock vote to deregulate the LP&L service territory? Lubbock, Texas, the 11th most populous city in the state and birthplace of rock ‘n roll legend Buddy Holly, is becoming a deregulated ele...

READ MORE >

2 min read

By 5

February 28, 2023

Over a year ago we reported that Con Edison had filed for a one year rate case to increase electric delivery rates by 17.6% and gas delivery rates by 28.1%, resulting in a system-wide cost increase of...

READ MORE >

3 min read

By 5

February 22, 2023

Earlier this month, the weather sage, Punxsutawney Phil, saw his shadow, retreated into his burrow and proclaimed six more weeks of winter. The problem is that Phil doesn’t seem very plugged into the ...

READ MORE >

12 min read

By Jon Moore

February 22, 2023

On behalf of the team at 5, I am pleased to forward our February market letter. This letter discusses: (i) the recent fall in natural gas prices and increasing natural gas price volatility, (ii) the 1...

READ MORE >

1 min read

By 5

February 2, 2023

Mark Detor, Taylor Duncan, Steve Kass, Jon Moore, Karen Sweeney, and Eric Bratcher discuss the energy market in Upstate New York covering the recent material selloff in natural gas, important state an...

READ MORE >

1 min read

By 5

December 9, 2022

Steve Kass, Jon Moore, Karen Sweeney, and Eric Bratcher discuss the energy market in ERCOT covering important state and local regulatory developments and other notable regional utility changes.

READ MORE >

By 5

December 9, 2022

Steve Kass, Jon Moore, Karen Sweeney, and Eric Bratcher discuss the energy market in PJM covering important state and local regulatory developments and other notable regional utility changes.

READ MORE >

1 min read

By 5

December 2, 2022

Steve Kass, Jon Moore, Karen Sweeney, and Eric Bratcher discuss the energy market in Downstate New York covering important state and local regulatory developments and other notable regional utility ch...

READ MORE >

3 min read

By 5

November 29, 2022

What a difference three months make in the constantly changing landscape of the natural gas market in the US. Last September, the December delivery contract for NYMEX’s Henry Hub, was trading at appro...

READ MORE >

3 min read

By 5

November 29, 2022

Volatility continues to be the name of the game in the energy markets for Downstate New York and New England. An example is the rollercoaster ride of international liquefied natural gas (LNG) prices t...

READ MORE >

3 min read

By 5

November 28, 2022

The New Jersey Board of Public Utilities (NJBPU) recently approved nearly $1.1 billion in transmission system upgrades to the state’s electricity grid. These upgrades will enable electricity generated...

READ MORE >

2 min read

By 5

November 28, 2022

After Winter Storm Uri in February 2021, the Texas legislatures passed Senate Bill 3, which includes provisions intended to improve the reliability of the grid. One specific portion of this law in Sec...

READ MORE >

1 min read

By Jeff Schiefelbein

November 28, 2022

Thank You. Why is it so easy to say “thank you” when someone lends us a hand, yet we avoid saying it when we receive a compliment? Instead of showing appreciation, we often deflect that gesture of gra...

READ MORE >

4 min read

By 5

November 28, 2022

Community solar is a financial structure implemented by states and utilities that allows the financial benefits of solar electricity production to be shared with members of the community. Here is how ...

READ MORE >

2 min read

By 5

November 28, 2022

In many ways, Mark Detor defines why it is important to work with an energy advisor with regional energy market expertise. Mark was born and raised in Syracuse, NY, and spent a good portion of his you...

READ MORE >

2 min read

By 5

November 17, 2022

Who's Who of Deregulation Here is an overview of the different entities in a deregulated market. PUCT: The Public Utilities Commission of Texas regulates and implements legislation of the state's util...

READ MORE >

10 min read

By Jon Moore

November 2, 2022

On behalf of the team at 5, I am pleased to forward our November market letter. This letter discusses: (i) the upcoming Mid-Term Elections, and how the results could impact energy policy; and (ii) the...

READ MORE >

3 min read

By 5

September 29, 2022

Forward commodity markets were created to allow market participants to mitigate price risk for a given commodity. Long before the world ran on oil and natural gas, agricultural commodities traded in t...

READ MORE >

4 min read

By 5

September 29, 2022

Often in commodity trading, it isn’t always the straight-forward market drivers that catch the market off guard. Rather it’s the counter-intuitive things that seem to side-swipe a market. Lately, ther...

READ MORE >

2 min read

By 5

September 29, 2022

Leaves are changing and temperatures are falling, which can only signify one thing: PJM’s coincidental peak season is behind us. In PJM, there are five Coincidental Peaks (5CP) that are determined by ...

READ MORE >

3 min read

By 5

September 29, 2022

There is no doubt that the rapid growth of utility-scale solar in Texas has helped the state meet its ever-increasing electricity demand during hot and dry summer afternoons. The 10X increase in solar...

READ MORE >

5 min read

By 5

September 29, 2022

Imagine the reaction of a modest homeowner in America who received an invoice from their electric utility that was more than $1,000 per month, or a monthly natural gas bill that exceeded $500. While t...

READ MORE >

2 min read

By Jeff Schiefelbein

September 29, 2022

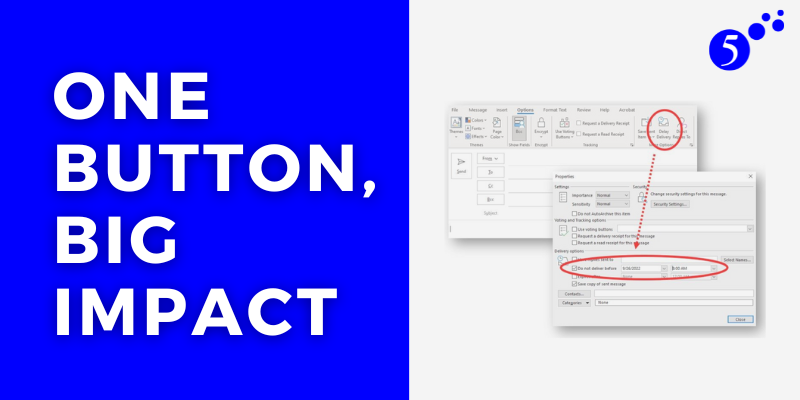

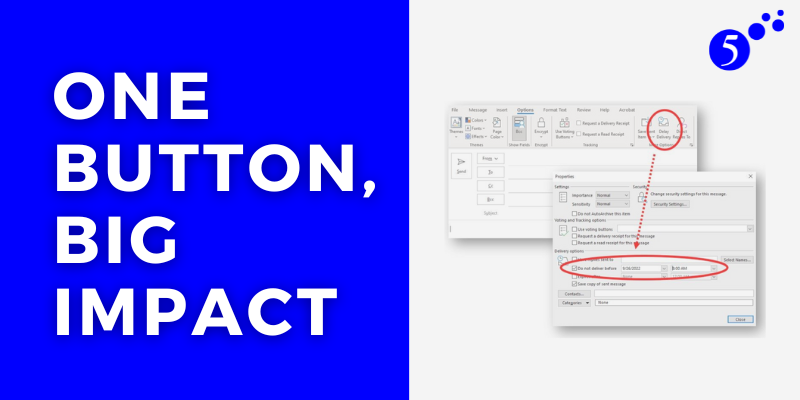

Using one button can immediately improve your workplace culture. It is not new, but most people never use it. For years I have watched leaders send emails to their team throughout the evenings and wee...

READ MORE >

1 min read

By 5

September 29, 2022

The Beta Crude Connector (BCC) project is jointly owned by Frontier Midstream Solutions IV, LLC (FMSIV) and ConocoPhillips. FMSIV is the operator of BCC. BCC is one of the premier midstream solutions ...

READ MORE >

1 min read

By 5

September 29, 2022

Meet 5's Special Teams Captain, Michael Clifton. In this role, Michael helps clients beyond their procurement needs as they rely on him to find energy solutions that require meticulous research and an...

READ MORE >

2 min read

By 5

August 31, 2022

As the calendar flips from August to September, ICAP management season is winding down, school is back in session and both the Mets and the Yankees are in first place. And while this summer was pretty...

READ MORE >

3 min read

By 5

August 31, 2022

Earlier this year, we wrote an article describing the rapid acceleration of price volatility in the natural gas markets, with a chart that showed daily price movement at the Henry Hub, the national be...

READ MORE >

2 min read

By 5

August 31, 2022

Shriners Children’s began out of the polio epidemic in the late 1910s, with the first hospital opening in Shreveport in 1922. Today, they operate locations throughout the US and in two other countries...

READ MORE >

4 min read

By 5

August 31, 2022

The Inflation Reduction Act was signed into law this month. As a budget reconciliation law, it impacts federal income and spending. For 5 and our customers, this law provides increased incentives for ...

READ MORE >

3 min read

By 5

August 31, 2022

Last fall, 5 discussed the mechanism by which costs associated with the high-voltage transmission system are allocated across end-users in Texas. The current system enables the four Investor-Owned Uti...

READ MORE >

3 min read

By 5

August 31, 2022

Power prices across the country have been on the rise since the summer of 2021 and PJM is certainly no exception. Anyone with an electricity supply contract expiring in the next 12 months, has seen a ...

READ MORE >

1 min read

By 5

August 31, 2022

Meet 5's Corporate Coordinator, Caitlin Connolly. Caitlin got her start in energy applying for a social media internship, which eventually led to a full-time job offer. Shortly after, she found hersel...

READ MORE >

2 min read

By Jeff Schiefelbein

August 31, 2022

One of my favorite things to witness as the leader of a business is the personal growth and development of the people around me. It is simply amazing to see what happens when leaders step out of the w...

READ MORE >

3 min read

By 5

July 28, 2022

What is Driving the Extreme Volatility in the Natural Gas Market? The NYMEX Henry Hub prompt month future contract continued to push the volatility envelope this past month, with the daily change for ...

READ MORE >

1 min read

By 5

July 28, 2022

Autobahn Motorcars has been a Fort Worth institution since 1979 selling luxury vehicles including Volvo, Jaguar, Porsche, Volkswagen, Land Rover, and BMW, as well as certified pre-owned cars. Autobahn...

READ MORE >

2 min read

By Jeff Schiefelbein

July 28, 2022

Most people do not get excited about accountability. When you see “accountability” listed as one of a company’s core values, what is your first reaction? Accountability does not tug at the heartstring...

READ MORE >

1 min read

By 5

July 28, 2022

Meet Karen Sweeney, 5's Energy & Sustainability Specialist. Karen's interest in sustainability which started in high school led her to pursue roles in renewable technology and energy efficiency. To fu...

READ MORE >

2 min read

By 5

July 28, 2022

NYISO Creating More Access to Renewables On July 11, New York celebrated the commissioning of the Empire State Transmission line. The 20-mile line connects the Dysinger switchyard in Royalton to the E...

READ MORE >

4 min read

By 5

July 28, 2022

What is Driving the Increased Load in Texas? This summer, it is clear how much the state of Texas has grown over the last few years. When Texas first deregulated its power grid about 20 years ago, the...

READ MORE >

3 min read

By 5

July 28, 2022

PJM Summer Spot Prices Now Higher Than Winter Anyone who has entered into a new electricity agreement in the last twelve months knows that prices are between two and three times higher than previous c...

READ MORE >

8 min read

By Jon Moore

July 26, 2022

On behalf of the team at 5, I am pleased to forward our market letter for the second quarter of 2022. The dramatic increase in the price of electricity and natural gas noted in our Q1 letter continued...

READ MORE >

1 min read

By 5

June 29, 2022

The All-Electric Building Act, known as New York S6843C, has died on the proverbial vine without getting a vote from the full New York State Senate or Assembly. The bill’s introduction came on the hee...

READ MORE >

1 min read

By 5

June 29, 2022

Xpressdocs was founded nearly 25 years ago as an innovator in marketing technology solutions and helps clients build better brands by providing unique products. Xpressdocs is focused on the creation, ...

READ MORE >

1 min read

By 5

June 29, 2022

Meet 5's Inside Sales Representative, Marisa Streett. She is a member of the SMB (Small/Medium Business) Team that helps small and medium businesses navigate the complicated energy market. Marisa's ab...

READ MORE >

4 min read

By 5

June 29, 2022

A greenhouse gas (GHG) is any gas in the atmosphere that absorbs thermal energy (heat) emitted from the earth’s surface and reflects it back to the earth’s surface. Certain gases serve as a trap for t...

READ MORE >

2 min read

By 5

June 29, 2022

Over the last year, forward electricity prices in ERCOT have continued to climb and set new highs every month. Figure 1 shows the price of wholesale electricity for calendar years 2023 through 2026 ov...

READ MORE >

4 min read

By 5

June 29, 2022

On Wednesday, June 8, 2022, from 10:00 AM to about 12:00 PM CDT, the July contract for NYMEX Henry Hub was trading around $9.60 per MMBtu. Even so, $9.60 is not an all-time high price for NYMEX Henry ...

READ MORE >

2 min read

By Jeff Schiefelbein

June 29, 2022

Sometime during the recent work-from-home transition, I came to view our unlimited time off policy differently. From the beginning of 5, we always took the approach that our employees were fully forme...

READ MORE >

3 min read

By 5

June 29, 2022

On June 21, 2022, PJM posted the results of its capacity auction, also known as the Reliability Pricing Model (RPM), for the planning year June 2023 to May 2024. The execution of this auction has been...

READ MORE >

4 min read

By 5

May 31, 2022

A Review of ERCOT's Seasonal Assessment of Resource Adequacy report for Summer 2022 The Seasonal Assessment of Resource Adequacy report, otherwise known as SARA, is a quarterly publication from ERCOT ...

READ MORE >

4 min read

By 5

May 31, 2022

An Overview of Coincidental Peak Costs by ISO Coincidental Peak (CP) is the measurement of an electricity meter’s actual usage at the time of the regional grid’s highest demand and determining that me...

READ MORE >

3 min read

By 5

May 31, 2022

A Review of Resources Adequacy Risk in PJM On May 17, 2022, PJM released the second phase of its “living study”, titled Energy Transition in PJM: Emerging Characteristics of a Decarbonizing Grid, whic...

READ MORE >

4 min read

By 5

May 31, 2022

Natural Gas Update for May 2022 This past month, the US natural gas market continued the recent trend that was established in mid-February. Strong bullish tendencies set new highs and blew past previo...

READ MORE >

2 min read

By Jeff Schiefelbein

May 31, 2022

The Conscious Evolution of Our Company Swag With so many industry and company changes over the past decade, one aspect of 5 has remained the same – our love for this great team and our desire to share...

READ MORE >

1 min read

By 5

May 31, 2022

5 began working with The Museum of Modern Art, New York by providing services that helped the museum capitalize on energy-related tax rebates that are available to non-profit institutions in Con Ediso...

READ MORE >

3 min read

By 5

May 31, 2022

NYISO Power Market Update for May 2022 Near-term electricity prices in New York City continue to climb like an Aaron Judge home run that has not reached the apex of its arc. Figure 1 shows calendar ye...

READ MORE >

2 min read

By 5

April 29, 2022

If you have been shopping for retail power in Texas, then what we are about to report will not come as a surprise. However, if you have not seen wholesale power prices in ERCOT in a few months, you sh...

READ MORE >

2 min read

By 5

April 29, 2022

On April 1, 2022, the NYISO published the results of the six-month capacity Strip Auction for this coming summer period (May through October), establishing the first auction-based price signal for cap...

READ MORE >

4 min read

By 5

April 29, 2022

Pennsylvania joins RGGI, Largest Coal-Fired Power Plant Announces Continuation of Operations. On April 23, 2022, Pennsylvania became the 12th member of the Regional Greenhouse Gas Initiative (RGGI), a...

READ MORE >

3 min read

By 5

April 29, 2022

Over the last few months, these updates have focused on the steady run-up in natural gas prices, and the correlation between US natural gas prices and gas prices in other parts of the world, specifica...

READ MORE >

1 min read

By Jeff Schiefelbein

April 29, 2022

This month we are taking a break from sharing our own culture corner insights to spotlight the inspiring work of James Rhee and his TED Talk about The Value of Kindness at Work. James recently appeare...

READ MORE >

1 min read

By 5

April 29, 2022

Time flies when you have great people like Julia Smith on the team, it's hard to believe her one-year anniversary is just weeks away. Take a moment to learn more about Julia’s deregulated power journe...

READ MORE >

By 5

April 29, 2022

For the second year in a row, 5 is spotlighting one of our most innovative and iconic clients, Empire State Realty Trust. Earlier this month, ESRT announced their groundbreaking Empire Building Playbo...

READ MORE >

10 min read

By Jon Moore

April 27, 2022

On behalf of the team at 5, I am pleased to forward our market letter for the first quarter of 2022. In this issue, we continue our focus on the energy transition and the strain that this has put on t...

READ MORE >

6 min read

By 5

March 31, 2022

What is the Jones Act and how does it impact our energy markets? In January 2018 a cold snap descended across the Northeast. And in Boston Harbor, a liquified natural gas (LNG) tanker appeared on the ...

READ MORE >

3 min read

By 5

March 31, 2022

What is causing global forces to outweigh the domestic signals for natural gas prices? If you still buy into the old trader’s tale of “buy natural gas in the fall and spring when it is cheaper” it’s l...

READ MORE >

4 min read

By 5

March 31, 2022

A current look into the market drivers and prices throughout PJM PJM, the largest wholesale electricity market, covering 13 states including the District of Columbia, and serving a whopping 65 million...

READ MORE >

4 min read

By 5

March 31, 2022

Why are power prices increasing throughout New York? Like many other commodities, the price of wholesale electricity has drastically increased over the last 12 months nationwide. In the middle of Marc...

READ MORE >

2 min read

By Jeff Schiefelbein

March 31, 2022

One of the most striking insights that I gained through the work-from-home shift of the last two years is realizing how many employees are engaged in caregiving for their loved ones on a regular basis...

READ MORE >

1 min read

By 5

March 31, 2022

MacArthur Boulevard Baptist Church is a large church community in Irving, Texas with many families throughout the Dallas-Fort Worth Metroplex. The church campus consists of two large, interconnected b...

READ MORE >

4 min read

By 5

February 28, 2022

How is the Situation in Ukraine Impacting Global and Domestic Natural Gas Markets? On February 21, 2022, Russia declared that the Eastern Ukrainian regions of Donetsk and Luhansk were independent terr...

READ MORE >

3 min read

By 5

February 28, 2022

A Two-Year Pause on Solar Projects in PJM The geographic area served by the PJM Interconnection spans from Virginia all the way to northeast Illinois. And despite the name of the hit show, “It’s Alway...

READ MORE >

4 min read

By 5

February 28, 2022

An In-depth Comparison of Winter Storm Landon Versus Winter Storm Uri Earlier this month, the first big test of the post-Uri Texas electrical grid was blowing south across the plains. Many had legitim...

READ MORE >

3 min read

By 5

February 28, 2022

Higher Delivery Rates on the Way with Con Edison's 2022 Rate Case ConEdison, the largest investor-owned utility (IOU) in the state of New York, has an obligation to its investors to operate profitably...

READ MORE >

1 min read

By 5

February 28, 2022

Black Rifle Coffee Company (BRCC) is a Veteran-owned business that was founded in 2014 by former U.S. Army Green Beret, Evan Hafer. Through the company’s tremendous growth, they have committed to hiri...

READ MORE >

1 min read

By 5

February 28, 2022

Meet Maggie Connally, a member of 5's Pit Crew. Maggie started out as an assistant but her tenacity and willingness to help others landed her a spot on the team that supports all our advisors and clie...

READ MORE >

2 min read

By Jeff Schiefelbein

February 28, 2022

A Special Opportunity for Texas Educators to Teach Sustainability The feature-length documentary film, Beyond Zero, tells the story of Ray Anderson and his visionary leadership as the founder and CEO ...

READ MORE >

2 min read

By 5

February 1, 2022

Conserve Power and Prepare for Potential Outages Conservation Prep for Cold Weather More cold weather is in the forecast this week, driving temperatures down with ice and snow expected in parts of Nor...

READ MORE >

1 min read

By 5

January 27, 2022

Brightview Senior Living was founded in 1999, built on the idea that a great place to work is a great place to live. Today Brightview builds, owns, and operates 45 senior living communities in eight s...

READ MORE >

By Jeff Schiefelbein

January 27, 2022

5’s Stakeholder Map highlights our focus on impacting each of our stakeholders and fulfilling our mission to Help People As practitioners of Conscious Capitalism, we value the interdependent nature of...

READ MORE >

4 min read

By 5

January 27, 2022

What are the Drivers of Natural Gas Production and Pricing? The dramatic changes in demand for many commodities over the past 24 months have wreaked havoc on supply chains across the world - energy ma...

READ MORE >

2 min read

By 5

January 27, 2022

What Caused the Most Recent PJM Capacity Auction Delay? On December 22, 2021, the Federal Energy Regulatory Commission (FERC) ordered PJM to change its reserve market rules. This move, yet again, dela...

READ MORE >

4 min read

By 5

January 27, 2022

A Review of the Texas Energy Grid Performance Throughout This Winter As February approaches, the Texas winter has included an abnormally warm December, followed by two major cold fronts throughout Jan...

READ MORE >

2 min read

By 5

January 27, 2022

Energy Storage is Helping to Solve NYISO’s Zero Emission Puzzle Earlier this month, Governor Hochul proposed legislation that would require all buildings constructed after 2027 to produce zero emissio...

READ MORE >

11 min read

By Jon Moore

January 25, 2022

“Few things will impact capital allocation decisions – and thereby the long-term value of your company – more than how effectively you navigate the global energy transition in the years ahead.” - Larr...

READ MORE >

3 min read

By 5

December 21, 2021

At the end of last month, the news was buzzing about the newly discovered Omicron variant. On the last day of trading for the December NYMEX contract, the December price jumped up almost 50¢ to close ...

READ MORE >

3 min read

By 5

December 21, 2021

New York City’s electricity is primarily generated by fossil fuel-fired power plants which typically produce higher levels of greenhouse gases than generators in the rest of the state. Physical bottle...

READ MORE >

3 min read

By 5

December 21, 2021

On December 15, 2021, PJM released the initial findings of a multiphase, multiyear "living study" that captures the potential impacts of an evolving grid resource mix that includes more electricity fr...

READ MORE >

4 min read

By 5

December 21, 2021

To say that 2021 was a challenge for energy practitioners in Texas is a serious understatement. Certainly, 2020 was difficult as the market reacted to a global pandemic and energy demand destruction t...

READ MORE >

2 min read

By 5

December 21, 2021

The Highlands School, located in Irving, Texas, has been educating and forming future leaders since the school’s humble beginnings in a Dallas family’s home in 1986. Having moved to a more permanent l...

READ MORE >

4 min read

By 5

December 21, 2021

Natural gas, also commonly referred to by its chemical name, methane, is one of the single most controversial topics of the energy transition so far. On the one hand, natural gas is an energy commodit...

READ MORE >

2 min read

By Jeff Schiefelbein

December 21, 2021

As our company recently celebrated 10 years of industry-changing impact, the entire team presented the Founding 5ers with one of the most thoughtful and energizing gifts to recognize this important mi...

READ MORE >

2 min read

By Jeff Schiefelbein

November 30, 2021

“If not me, then who? If not now, then when?” Ray Anderson, Founder of Interface. Throughout the evolution of any great company, there are hallmark moments that define each new chapter. These experien...

READ MORE >

2 min read

By 5

November 30, 2021

On Friday, the last day of trading for the December NYMEX Henry Hub contract, trading was light, but the news was heavy. The newest COVID-19 variant B.1.1.529, named by the World Health Organization (...

READ MORE >

3 min read

By 5

November 30, 2021

The team at 5 has spent many months, complemented by countless charts, graphs, and blog posts, discussing the rising prices and volatility in the energy markets. When you spend so much time in the wee...

READ MORE >

5 min read

By 5

November 30, 2021

As winter approaches in Texas, many in the Lone Star State continue to share memories and horror stories from Winter Storm Uri. The exceedingly rare, multi-day winter storm from February 14th - 18th c...

READ MORE >

1 min read

By 5

November 30, 2021

Consumer Power Advocates (CPA) serves as a regulatory advocate for non-profit institutional organizations in New York. Launched at the onset of electricity deregulation by Luthin Associates, a leading...

READ MORE >

1 min read

By 5

November 30, 2021

Jeff Shoaf is one of the most experienced and well-respected leaders in the energy industry. His robust background fuels 5’s growth as we help clients navigate the energy transition across North Ameri...

READ MORE >

3 min read

By 5

November 30, 2021

EPA’s stricter wastewater rules among reasons for additional coal-fired power plant retirements across PJM In July 2021, the Environmental Protection Agency (EPA) announced new initiatives to strength...

READ MORE >

3 min read

By 5

November 30, 2021

In October we discussed heating oil in New York City and the potential liabilities purchasers may have in the future given the city’s established clean energy policy goals in the Climate Mobilization ...

READ MORE >

10 min read

By Jon Moore

November 5, 2021

On behalf of the team at 5, I am pleased to forward our market letter for the third quarter of 2021. World leaders convened in Glasgow on October 31st to address international commitments to lower gre...

READ MORE >

4 min read

By Jeff Schiefelbein

October 28, 2021

5 was formed with a higher purpose – to Help People. That sounds overly simplistic. The natural tendency is to try to enhance this statement by adding a set of modifiers and details that highlight our...

READ MORE >

2 min read

By 5

October 28, 2021

Liberty Science Center is a 300,000-square-foot learning center located in Liberty State Park on the Jersey City bank of the Hudson River near the Statue of Liberty. It houses 12 museum exhibition hal...

READ MORE >

1 min read

By 5

October 28, 2021

Kat Campayo is an Account Manager who helps clients navigate the complex energy space by providing solutions that best fit their needs. Find out where Kat got her passion for energy and what motivates...

READ MORE >

5 min read

By 5

October 28, 2021

On October 31, the 26th United Nations Climate Change Conference (aka COP26) will kick off in Glasgow, Scotland. This event will mark what many energy and sustainability leaders consider to be an impo...

READ MORE >

1 min read

By 5

October 28, 2021

In July 2021, the Federal Energy Regulatory Commission (FERC) unanimously voted to approve an Advanced Notice of Proposed Rulemaking (ANOPR), allowing the public to provide comments and recommendation...

READ MORE >

3 min read

By 5

October 28, 2021

Heating oil is facing an image issue in New York City. Pressure continues to mount against fossil fuels from many angles including environmental groups, policymakers, and competing energy sources that...

READ MORE >

3 min read

By 5

October 28, 2021

Twice per year, in March and then in September, the four major Transmission Distribution Utilities (TDUs) in Texas file with the Public Utility Commission of Texas (PUCT) to update their tariffs to ac...

READ MORE >

3 min read

By 5

October 28, 2021

Liquified Natural Gas (LNG) is produced through a process that super-cools pure methane gas to approximately -260ºF, which enables it to be stored in liquid form at normal atmospheric pressures and co...

READ MORE >

5 min read

By 5

September 30, 2021

Doesn’t the first cold front of fall always just feel so glorious? Texans will tell you that 85 degrees Fahrenheit never felt so good. After over four months of sweltering heat in Texas, with triple-d...

READ MORE >

2 min read

By 5

September 30, 2021

In many ways, Ben Steed personifies what it means to be an entrepreneur. He was born and grew up in Henrietta, Texas, which is about 120 miles northwest of Dallas. Ben and his family lived on a 100-ac...

READ MORE >

3 min read

By Jeff Schiefelbein

September 30, 2021

Even prior to the last 18-months of social distancing frustrations and video call exhaustion, most organizations conducted meetings that were sorely lacking in creativity, energy, and inspiration. If ...

READ MORE >

2 min read

By 5

September 30, 2021

Con Edison electricity customers have likely noticed a significant increase in delivery costs over the last 12 months. There are two specific variable components that have caused these rates to skyroc...

READ MORE >

-1.png)