A Review of Resources Adequacy Risk in PJM

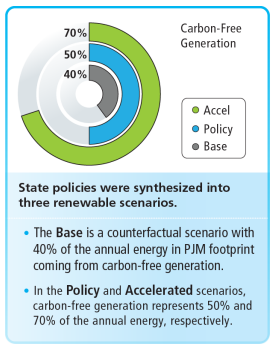

On May 17, 2022, PJM released the second phase of its “living study”, titled Energy Transition in PJM: Emerging Characteristics of a Decarbonizing Grid, which analyses the potential impacts associated with the evolving resource mix. The report, which follows the initial framework released in December 2021, studies three scenarios: Base, Policy, and Accelerated (see Figure 1). Each scenario represents an increasing amount of annual energy in PJM served by carbon-free generation in 2035: 40%, 50%, and 70% respectively. For reference, according to Monitoring Analytics, the grid operator’s market monitor, in 2021 39% of the power produced in PJM was from carbon-free resources.

Figure 1: State Policies Synthesized into Three Renewable Scenarios from pjm.com

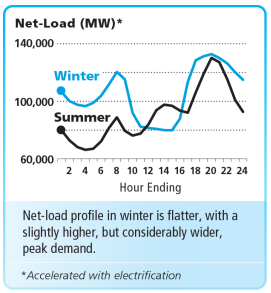

Resource adequacy risk in PJM has traditionally been contained in the summer months. However, with anticipated electrification, specifically electric heating, the study found that in an Accelerated scenario, winter demand growth more than doubled than in summer (see Figure 2). Not only does this cause a shift in seasonal demand profiles, but the study found a fundamental shift in the winter hourly demand profile that would shift demand higher and wider than in the summer.

Figure 2: Winter Net-Load Hourly Profile from pjm.com

Given the shift to higher winter demand, PJM indicates that adequate thermal resources (e.g.; natural gas) would be needed to meet this demand until a different technology can provide the same level of capacity to avoid potential outages. PJM also recognized how the value of storage increases with electrification and load shifts.

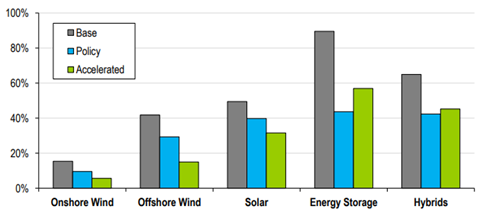

In the Accelerated scenario, PJM found that 60% of the load-loss risk in the winter is concentrated in the last 4 hours of the day. Because of this, solar’s effective load carrying capability (ELCC), the measure of a resource’s reliability value, drops from 32% to 6%. While wind farms perform well in the winter, solar suffers and with a winter-peaking demand profile, solar becomes a less valuable resource. However, solar-hybrid resources, such as solar and storage increase the capacity value of the resource. The ELCC of various generating resources is shown in Figure 3.

Figure 3: Effective Load Carrying Capability Results by Resource Type from pjm.com

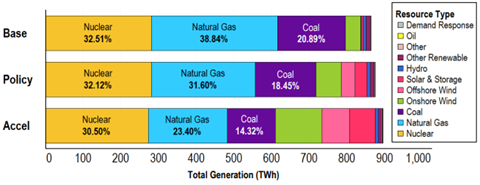

PJM’s study also analyzed the effect of decarbonization efforts across annual generation. As shown in Figure 4, in the three scenarios, gas-fired generation fell by 40% while coal-fired production dropped by 35% from the base scenario to the accelerated scenario. The accelerated scenario resulted in a 40% decrease in carbon dioxide emissions.

Figure 3: Annual Energy Generation by Fuel Type (TWh) from pjm.com

Glen Thomas, president of the PJM Power Providers Group, a trade organization, stated that “increased electrification and the shift to a winter peaking system will fundamentally change what it means to be reliable in PJM. Decarbonization is important, but it must be done reliably, and reliability is going to be more challenging than it has been in the past.”[1]

With all eyes on PJM with the long-awaited 2023/2024 capacity auction set to be held on June 8, 2022, this multiyear, multiphase study seems to indicate that significant efforts are being made as we continue on this energy transition.

[1] https://www.utilitydive.com/news/pjm-power-plants-blackout-risks-transition-report/624031/