On behalf of the team at 5, I am pleased to forward our market letter for the fourth quarter of 2018. In this letter we focus on two topics, (i) the development of long-term retail contracts backed by renewable energy generation, and (ii) the pending bankruptcy of PG&E. We also provide brief updates on (i) an important change in the District of Columbia’s renewable regulations that will materially impact the price of electricity, and (ii) how energy issues fared in last November’s mid-term elections.

Long Term Retail Contracts: A New Option?

Our last quarterly letter focused on the growth of virtual power purchase agreements or VPPAs. Corporate purchasers of renewable power under VPPAs do not actually consume the purchased power. Instead, the renewable power they purchase is sold at or near the location of the power plant. The buyer can claim credit for the incremental production of renewable power, and usually purchases the renewable energy credits (RECs) generated by the plant. The facility’s generation is sold by the plant into the spot market. If the electricity price negotiated in the VPPA is lower than the spot market price, the corporate purchaser is paid the difference. If the VPPA price is higher than the market price, the corporate purchaser pays the generator the difference.

A VPPA is a common way for a large energy purchaser to meet aggressive renewable energy targets, however, there are drawbacks to these products. Most VPPAs do not act as an effective hedge against rising power prices, since the power price at the plant’s location is almost always different from the power price paid by the purchaser at its operating facilities. Other factors that limit the appeal of VPPAs include: (i) these are complex commodity agreements that can be very expensive to negotiate, and (ii) only the largest corporate buyers qualify as a VPPA purchaser. The buyer must have investment grade credit and typically must purchase at least 25,000 MWh/yr. of electricity (10MWs or more of peak demand). Few energy purchasers meet these requirements. The risk of a VPPA with a specific generation unit is often underestimated. Recent developments at PG&E are a clear reminder of these risks.

As I noted at a recent Bank of America Merrill Lynch conference on clean energy, we have started to see new and much more flexible renewable products for retail customers. The developer and supplier world alike acknowledge the consumer issues (e.g., risk, legal complexity, accounting) with VPPAs and are working to develop more consumer-friendly renewable products. We refer to these contracts as Retail Renewable Contracts or RRCs. The RRC structure shifts most of the risk that is assumed by a VPPA buyer to the supplier. RRCs are generally longer in term than standard retail contracts and have renewable attributes/benefits beyond simple REC purchases. 5 has already utilized some of these newer structures with our clients and we expect this market to continue to develop rapidly. While these renewable product offerings are still in the development stage, we are excited by the prospect of a retail product that meets the needs of purchasers that do not qualify for a VPPA.

The PG&E Bankruptcy: California Gets Complicated

On January 29, 2019 PG&E, the parent of Pacific Gas and Electric Company, one of the nation’s largest utilities and the electricity and natural gas supplier to the northern two thirds of California, filed for bankruptcy. The bankruptcy filing was driven by liability for wildfires in 2017 and 2018. The unusual weather in Northern California has been linked to climate change, a relationship that is reflected by the WSJ who labeled the PG&E case as the “The First Climate-Change Bankruptcy…”

PG&E estimates its potential liability for damages relating to the fires could exceed $30 billion. The company argues that the best way to address these liabilities (as well as the potential for future fire related liabilities) is through a Chapter 11 bankruptcy process. The bankruptcy filing reminds us how quickly things change in the energy market. Until recently, the company had investment grade credit. Since it was a regulated utility, it was viewed as protected from the risk of the competitive energy markets. So much for the safety net of regulation.

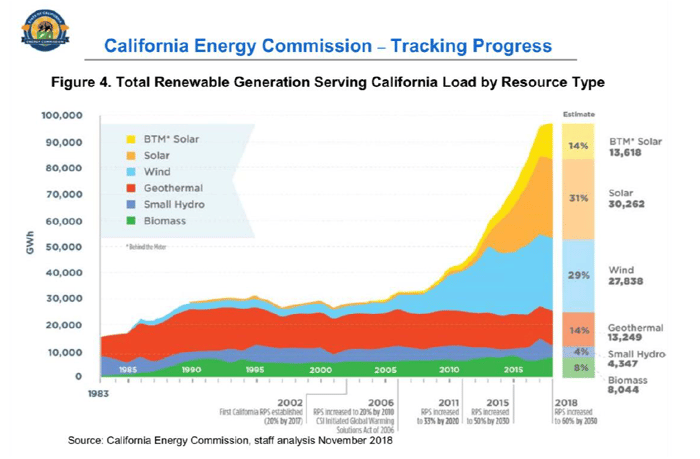

The bankruptcy will have a significant impact on renewable power purchase agreements between PG&E and power plant owners. As the chart on the following page sets out, California has had one of the earliest and most aggressive renewable mandates in the country. Renewable energy procurement requirements go back to 2002 and were increased in 2006, 2011, 2015 and 2018. As a result of these mandates, thousands of MWs of utility scale solar and wind projects were built, and a large portion of these plants were financed on the basis of long-term power purchase agreements with PG&E. The cost of the power purchased from these projects is ultimately passed through to ratepayers.

Unfortunately, a large number of solar and wind assets in California were built well before the price of solar and wind generation declined in recent years. This is reflected in the price that PG&E currently pays for renewable power, an average of $140/MWh for 2017. Current market rates are $40 to $50/MWh. In a typical bankruptcy, the bankrupt party has the ability to reject contracts. If PG&E rejects its renewable contracts and re-contracts with the same plants at current market rates, their annual power cost will go down by over $2 billion.

Clean energy companies, investors, and energy regulators are all focused on whether PG&E can reject these contracts in bankruptcy. Answering this question requires a complex legal analysis of FERC rules, bankruptcy rules, the rules of the California Public Utility Commission and regulators at the state and federal level. The politics is equally complex. On one side, the $2.2 billion per year in savings may be sufficient to fully offset the fire liability. On the other side, since PG&E is a regulated utility, the high renewable power prices are passed on its ratepayers. If the contracts are rejected and replaced by lower priced contracts, ratepayers will see lower costs but PG&E’s economics are largely unchanged.

The stakes are so high that the nation’s largest owner/developer of renewable assets, NextEra Energy, did not wait for PG&E to file for bankruptcy. On January 18, 2019, NextEra filed a petition at FERC asking the Commission to order that “if it (PG&E) files a petition for bankruptcy, PG&E may not abrogate, amend or reject in bankruptcy…its wholesale power purchase agreements” without FERC approval. For our clients looking at long term power purchase agreements, the PG&E case provides a reminder of the importance of managing risk, and the extent to which the nature of these risks will change as the power market continues to evolve. Regardless of your views on climate change, the PG&E case demonstrates that even regulated utility monopolies are not safe from the risks associated with extreme weather events.

Washington DC Ups It Renewable Portfolio Standard: An Immediate Opportunity For DC Clients

The PG&E bankruptcy has not slowed regional efforts to pursue aggressive renewable generation to address climate change. A good example of this is the Clean Energy DC Omnibus Act of 2018. Recently signed by Mayor Muriel Bowser and pending Congressional approval, the bill significantly increases the amount of renewable power that energy suppliers must purchase on behalf of DC customers.

The new legislation contains a provision that grandfathers the current law’s lower renewable portfolio standard (RPS) through January 1, 2022 for any “contract entered into before the effective date of the Clean Energy Act.” The effective date is not set but it should be a date in early March 2019. The increased cost of complying with the new act is significant – we estimate that for 2019, 2020 and 2021, the increased cost of compliance is between $2 and $5/MWh. For a client that uses 4,000 MWh/year (i.e., 4,000,000 kWh), extending a contract at the current compliance levels can save between $8K and $20K annually over the next three years. We are currently working with our clients in DC to make sure they take advantage of the grandfathering provision and lock in their RPS purchases through January 1, 2022. If you have facilities in DC, please contact us so that we can help you calculate the amount you can save by contracting before the new act takes effect.

Legislative Changes – An Update on the Mid Terms

In our last letter, we mentioned several energy issues on the ballot in Washington State, Nevada, and Arizona. Overall, pro-environmental energy legislation fared poorly in the mid-term elections. The initiatives and the results are summarized below:

- Washington State: Initiative 1631 proposed a fee of $15 per metric ton on carbon emissions beginning in 2020. The initiative was rejected, 43.5% of voters supported the tax, 56.3% opposed the tax.

- Nevada:

- An initiative to deregulate Nevada’s electricity market was defeated; 67%of voters opposed the change to Nevada’s energy rules. An estimated

$100 million was spent by both sides on this ballot initiative, making it Nevada’s most expensive ballot measure. - Another ballot initiative sought to increase the state’s RPS standard to 50% by 2030. This bill passed, however, it will have to be reconsidered in 2020. We expect greater opposition to this bill in 2020.

- An initiative to deregulate Nevada’s electricity market was defeated; 67%of voters opposed the change to Nevada’s energy rules. An estimated

- Arizona:

- Proposition 127 would amend the constitution and require utilities to source 50% of their power from renewable resources by 2030. An overwhelming 69% of voters opposed this Proposition.

As we look over the legislative landscape, one thing is clear: we will see greater and greater differences in how energy is regulated across different states. For example, while aggressive renewable mandates fared poorly at the ballot box in Arizona, Nevada and Washington, other states, like New York, California and the District of Columbia are accelerating the promotion of low carbon generation. As this quarterly letter confirms, environmental regulations will continue to be introduced and the unintended consequences we have seen in California are a good reason to carefully evaluate federal and state energy policy across your company’s footprint.

Of course, please do not hesitate to contact me or other members of the 5 team if you would like more information on renewable purchase opportunities and/or if you would like to discuss other issues covered in this letter in more detail.