Here is the good news: in February, PJM posted the results of its latest capacity auction for the planning year June 2024 to May 2025. And for the most part, those prices are similar or lower than those for the 2023/2024 planning year. Historically, PJM holds annual capacity auctions to secure capacity three years in advance. However, recent auctions have been delayed over the last few years due to FERC rulings on the validity of the PJM’s auction design. These auctions are important because the results determine future capacity rates paid to generators, which are a major component of overall electricity rates for all retail customers in PJM states. Without this clarity and price transparency, electricity customers in PJM states risk paying high premiums to fix the price of capacity in future electricity contracts. The results of the latest auction provide price certainty for contracts through May 2025. The good news is that overall, the price of capacity fell again in most parts of PJM.

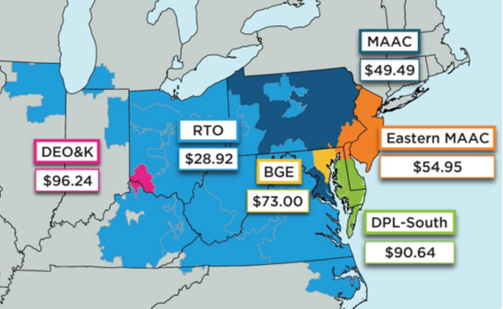

Figure 1 shows the latest auction clearing prices in dollars per MW per day across different Locational Delivery Areas (LDAs) in PJM. The capacity price for most of PJM cleared at $28.92/MW day (see the light blue area in Figure 1 labeled “RTO”), which is down from $34.13/MW day from last year’s auction for planning year 2023/2024. Capacity in eastern parts of PJM cleared at higher rates because of regional differences in the generation mix (natural gas, nuclear, coal) and the electricity infrastructure across various states and utilities. For example, capacity prices are higher in the BGE and Eastern MAAC LDAs because there is congestion on the electricity grid when power is moved from Ohio to Maryland and New Jersey during periods of peak power demand.

Figure 1: From PJM

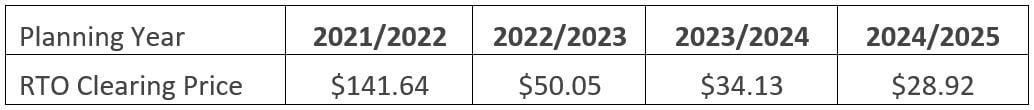

It is worth noting that for planning year 2021/2022, capacity prices were nearly an order of magnitude higher in certain parts of PJM. For example, capacity prices in Com Ed (IL), BGE (MD), and PSEG (NJ) were close to $200/MW day while the average capacity price approached $150/MW day. Changes in the RTO clearing price are shown in Table 1.

Table 1: By 5

The data in Table 1 shows that PJM’s marginal price for capacity has fallen by nearly 75% over the last four auctions. Often, energy and capacity prices are inversely proportional to one another - when power prices are low, capacity prices are high, and vice versa. Figure 2 shows how wholesale energy prices in the eastern part of PJM have traded for calendar years 2022 through 2025. Anyone who has had to purchase electricity in the last eighteen months has felt the sticker shock from these very high energy prices. When energy prices are as high as they have been over the last several years, it puts strong downward pressure on capacity prices as shown in Table 1. The silver lining in today’s high-priced energy market is the record low capacity price across all of PJM.

.png?width=1600&height=900&name=Calendar_Strips_PJM_East_All_Hours%20(1).png)

Figure 2: By 5

Here’s the bad news: Capacity prices are so low that PJM believes its pricing mechanism may be flawed. In late March, PJM informed stakeholders that it would delay the capacity auction for 2025/2026, which was scheduled for June. In an email on March 27, PJM informed stakeholders, “The Board therefore determined that PJM should postpone executing any further auctions under the current rules until we go through the stakeholder process and file resulting rule change proposals to FERC.” This delay in the capacity auction places uncertainty around the price of capacity for electricity contracts beyond June 2025. And while low capacity prices are ultimately good for clients, it does not incentivize the development of new electricity generation or adequately compensate generators to operate their power plants when demand on the grid is high and electricity supplies are tight. This creates serious reliability issues for the region’s power grid. Adequate price signals need to be created to ensure the stability of the electricity grid during periods of peak demand, while at the same time encouraging the development of new generating assets. These are the issues PJM must address as it considers revisions to its capacity market.