In 2019, the New York State Department of Environmental Conservation (DEC) adopted a regulation to limit nitrogen oxide (NOx) emissions from simple-cycle combustion turbines. Combustion turbines known as “peakers” typically operate to maintain bulk power system reliability during the most stressful operating conditions, such as periods of peak electricity demand. Pursuant to the Peaker Rule, 1,500 MW of peakers were to shut down by 2025 to comply with the emissions requirements. Around 1,000 MWs of peakers retired by May 2023 and another 590 MWs were scheduled for retirement by May 2025.

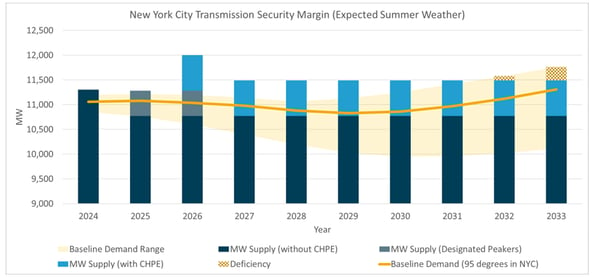

On November 21, 2023, the NYISO determined that the peaker retirements scheduled for 2025 had to be postponed. The NYISO concluded that retirement of the peaker plants could cause a shortfall in generation for New York City on a 95˚ day in 2024 and 2025. Figure 1 shows that in those years, the Reserve Margin (the difference between the forecasted amounts of supply and demand) is especially tight. The NYISO’s solution is to keep four barge-mounted peakers running until the later of May 2027 or the date on which the Champlain Hudson Power Express (CHPE) line is completed. CHPE, a 1,250 MW transmission line being developed by an affiliate of Blackstone, will bring power from Canada into New York City. The CHPE line is scheduled for completion in the spring of 2026.

From a market perspective, one might assume the addition of 508 MW of capacity from these barge generators added to summer reserves would lower forward capacity prices for the summer of 2025, but that does not appear to be the case. It is likely that the market was assuming the NYISO would take these steps to account for a possible capacity shortfall. That and the additional market risk still present in the demand curve reset and capacity accreditation changes that are planned for roll-out in May 2025 means the market has not really seen any material change in forward capacity or energy prices for the summer of 2025.