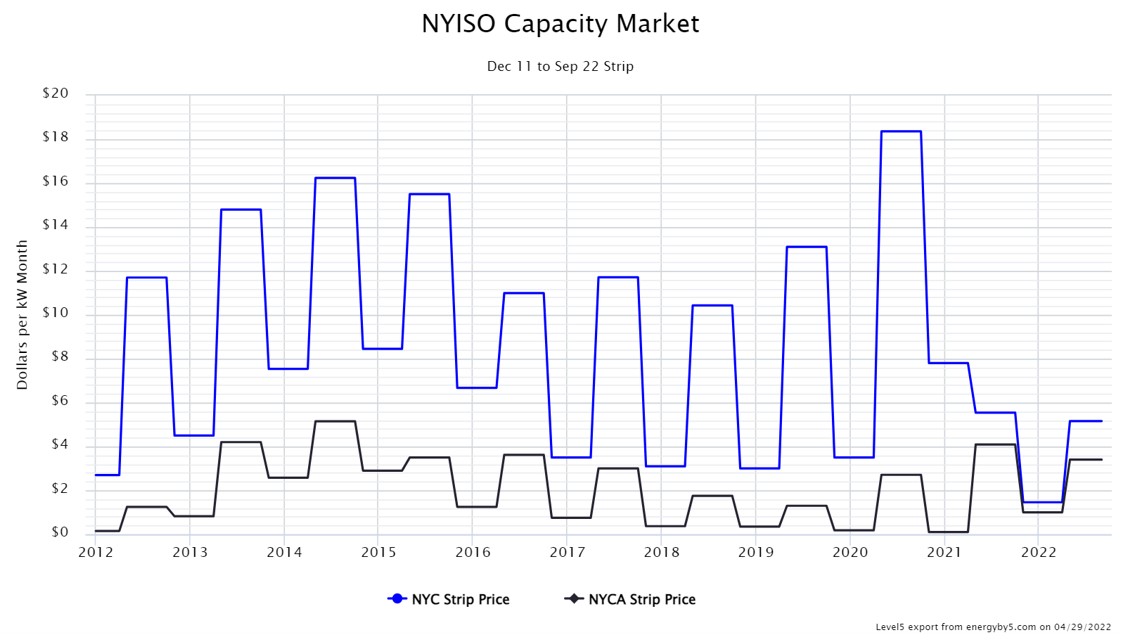

On April 1, 2022, the NYISO published the results of the six-month capacity Strip Auction for this coming summer period (May through October), establishing the first auction-based price signal for capacity for the upcoming months. This is important because capacity is the second largest cost component in a retail electricity contract. Often, when the wholesale price of energy increases, capacity prices decrease. Many expected lower capacity prices given how high wholesale power prices in the state have been, and that is exactly what happened with this most recent auction.

Figure 1 shows how the price of capacity in NYC (blue line) and in the rest of the state (black line) has traded over the last 10 years. Note the significant drop in capacity prices over the last 18 months, which coincides with the bull market that has been in place since the middle of 2020. In this most recent auction, the clearing price for the New York City capacity settled at $5.16 per kW per month, the lowest summer capacity settlement in the past decade. The rest of New York State, known as the New York Control Area (NYCA), cleared at $3.40 per kW per month, slightly below where summer of 2021’s auction price.

Figure 1: NYISO Capacity Market December '11 to September '22 Strip from 5

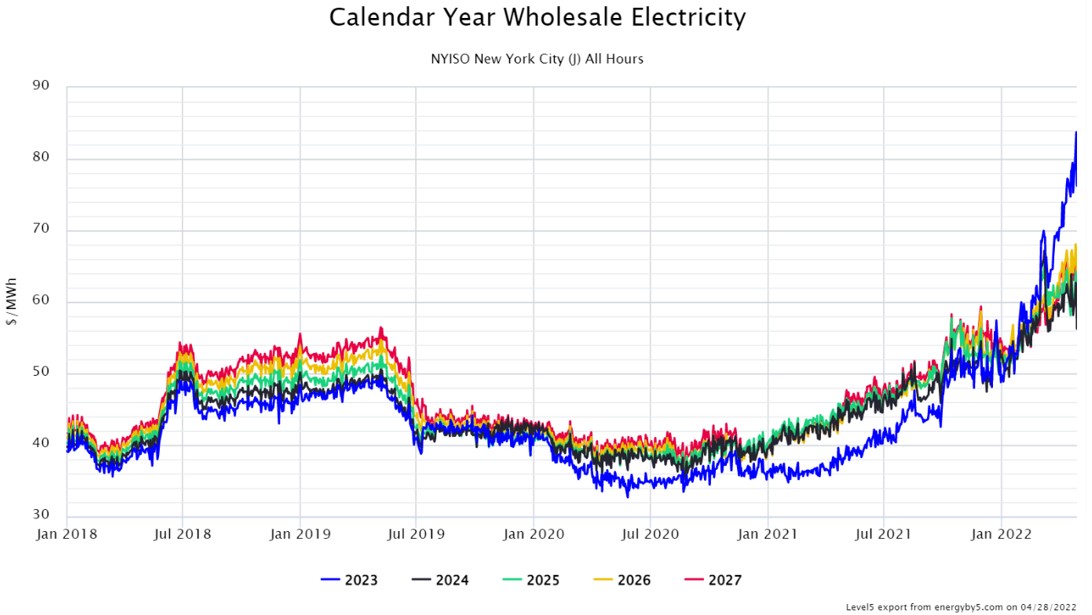

Capacity prices in New York often follow in an inverse relationship to wholesale power prices. The intent of the capacity market is to ensure proper price signals are given to generation owners when reserve margins start to diminish. The reserve margin is the difference between the peak forecasted load and the amount of installed generating capacity available to meet the grid’s electricity demand. When reserve margins are low, financial incentives, in the form of capacity payments, are necessary to ensure there is enough electricity supply to keep up with demand. Therefore, when wholesale power prices are high, generation assets should, in theory, collect higher revenues and need less in the form of capacity payments. Given the exponential rise in energy prices, it was no surprise when NYC's summer 2022 capacity settled near record lows. Figure 2 shows the upward trajectory in wholesale energy prices in New York City for calendar years 2023 to 2027 over the last four years.

Figure 2: Calendar Year Wholesale Electricity Zone J from 5

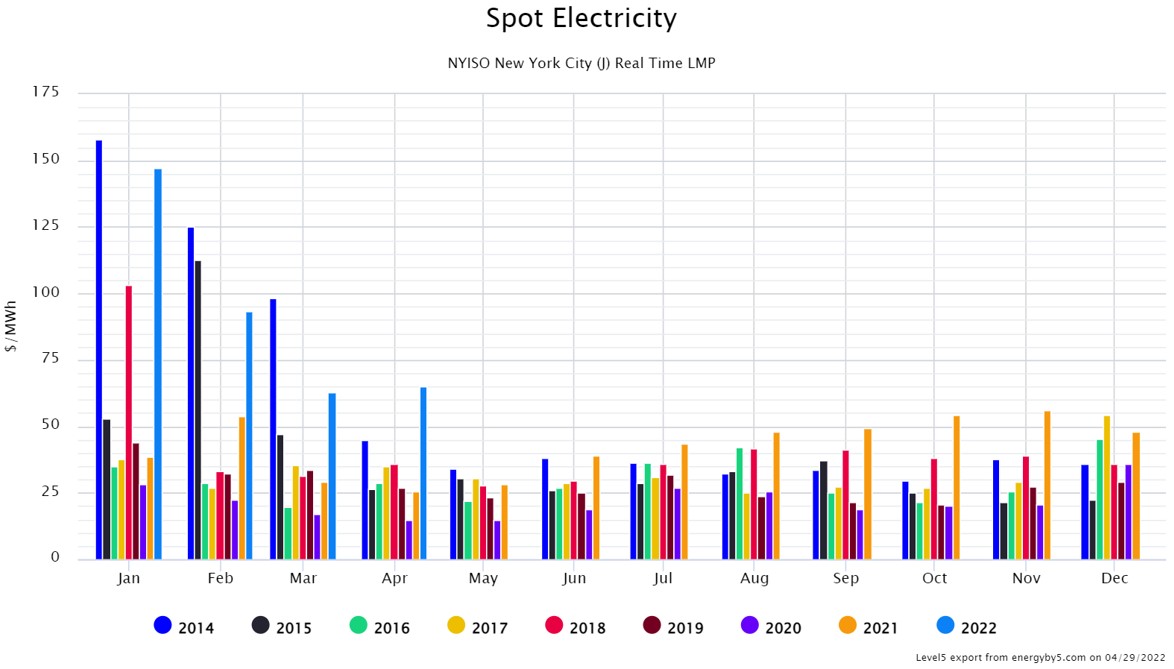

This current bull market for New York power prices, like many other electricity markets across the country, is driven by increased global demand for US natural gas and the record high prices that demand has produced. Most analysts do not see many bearish indicators to suggest that this market will change direction in the near future. In addition to higher forward electric prices, New York City spot prices for 2022 have been at the highest levels since winter 2014 as shown in Figure 3. The one piece of good news is that this recent drop in capacity prices will provide some relief to a market that has only been going in one direction.

Figure 3: Spot Electricity NYISO Zone J from 5

If you have hedged yourself against the rising wholesale prices with either a fixed price or power hedges, but left open positions on forward capacity in NYC, this is likely the best-case scenario for you. If you still have open positions for both wholesale power and capacity this coming summer, at least record-low capacity prices will help in this time of elevated energy prices.