Over the past few years, energy markets have been pushed to the brink, and we’ve seen unprecedented market volatility brought on by the pandemic, supply and demand issues, extreme weather conditions, and more. We recently reported that natural gas prices have significantly fallen over the last several months. And while electricity rates typically follow natural gas prices, customers in Ohio who are on default service with the utility may be surprised to see their rates materially increase in June.

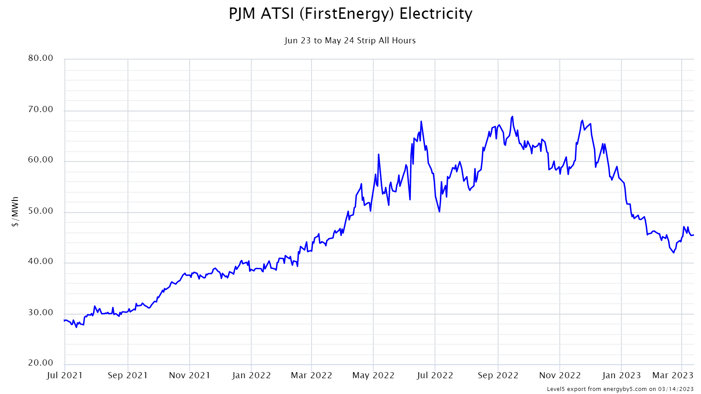

The utility companies in Ohio determine their standard offer service rates by conducting a set of auctions, which establish rates for a planning year from June through May. These auctions are carried out between November and April to procure the supply of electricity. The November auctions have played a significant role in the anticipated surge in prices due to elevated wholesale electricity prices witnessed in the fall of 2022, shown in Figure 1. The current price to compare to supplier rates in Columbus (AEP’s Ohio Power) is 7.4¢/kWh and is only valid for two more months. November’s auction for this utility cleared at 11.9¢/kWh for 45% of their expected load. An additional incremental auction held this month cleared at 8.9¢/kWh for the remaining 55%, softening some of the price increase. Rates for the planning year 2023/2034 are now fixed at a weighted average price of 10.3¢/kWh for energy. After additional cost components are factored in, the forecasted price to compare in AEP starting in June is 12¢/kWh, a 55% increase from current commercial rates. Commercial customers in FirstEnergy utilities (Ohio Edison, Toledo Edison, and The Illuminating Company), Duke, and AES territories can expect similar rate increases in the range of 10 to 13¢/kWh beginning in June 2023.

Figure 1: By 5

Rising default rates have created excellent buying opportunities for commercial customers. These customers should consider offers from third-party suppliers and take advantage of current, more favorable market conditions to lock in lower rates. Figure 1 shows that wholesale electricity prices in northern Ohio for the period of June 2023 to May 2024 peaked at $68/MWh in November. As of 3/10/2023, those prices were trading just above $45/MWh, or 4.5¢/kWh, which is more than 50% less than the upcoming default rates which take effect in June. It is important to note that these prices refer to wholesale electricity costs and do not include any additional shaping premiums applied to commercial loads or other cost components incorporated into a supply rate. Even with those cost components, commercial clients in Ohio are likely to see a reduction of approximately 30% compared to the default rates offered by utilities across the state.