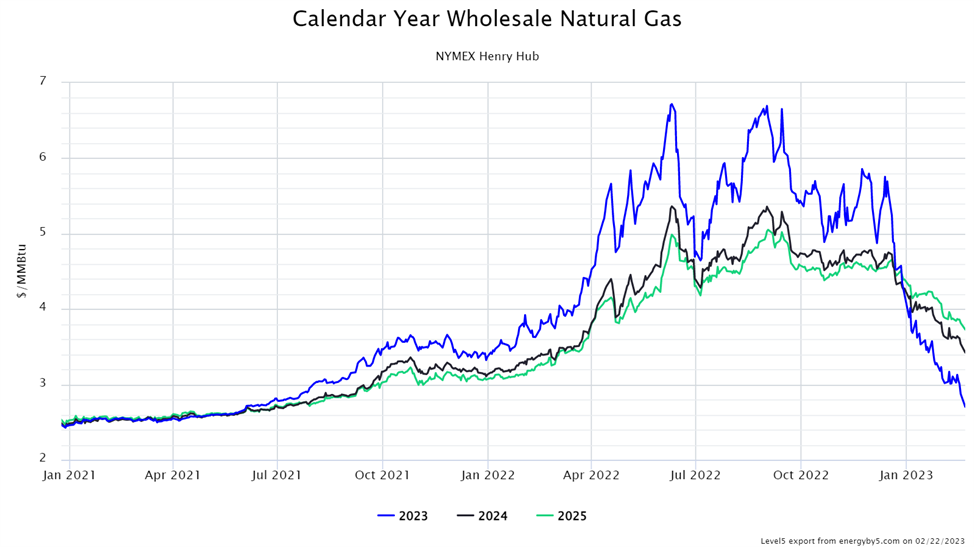

Earlier this month, the weather sage, Punxsutawney Phil, saw his shadow, retreated into his burrow and proclaimed six more weeks of winter. The problem is that Phil doesn’t seem very plugged into the latest meteorological observations or forecasts. Natural gas markets aren’t listening to Phil either. In fact, just looking at natural gas prices, one might guess that winter either never arrived or ended when the Astros won the World Series in the first week of November. Figure 1 shows how natural gas prices for the calendar year 2023 (blue line), 2024 (black line) and 2025 (green line) have traded since January 2021. This chart clearly shows that prices have dramatically fallen across those three calendar years over the last six months. On September 1, natural gas for 2023 was trading at $6.69/Dth. Today, it has lost 60% of its value and is trading at $2.70/Dth. Prices for 2024 and 2025 have fallen by similar amounts. This natural gas correction is being driven by a very mild winter and warmer than average temperatures.

Figure 1: By 5

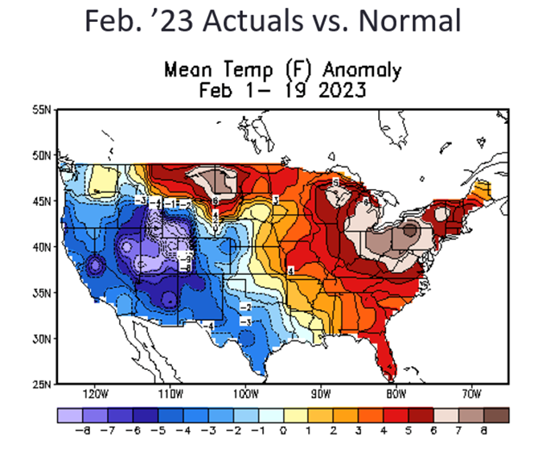

Figure 2 compares actual temperatures across the US with what is average for February. Note that for most of the Midwest and Eastern states, temperatures have been 5 to 8 degrees above normal. A chart of January’s average temperatures would show a similar pattern. And while some may recall the arctic blast that descended across most of the US in late December, that seems to be a distant memory. These mild temperatures have enabled significant amounts of natural gas to be placed into storage rather than being used for winter heating demand.

Figure 2: National Weather Service’s Climate Prediction Center

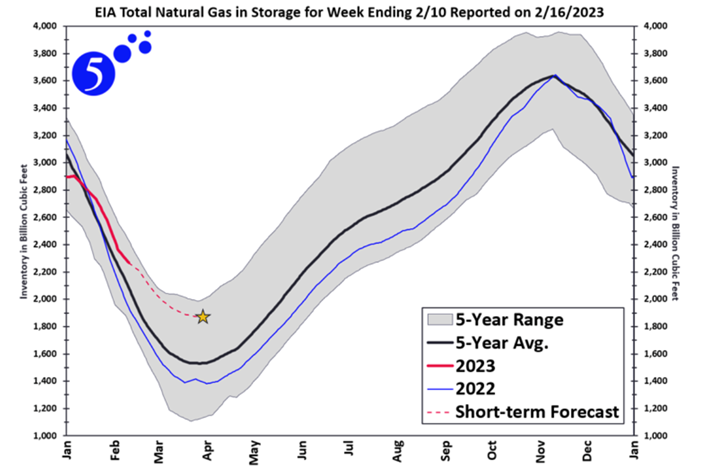

Figure 3 shows current natural gas storage levels (red line) compared to the 5-year average (black line) and last year (blue line). It is almost always the case that natural gas is placed into storage during the summer months and withdrawn in the winter. This January and February, withdrawals from storage have been significantly less than normal, producing storage levels that exceed the 5-year average and are higher than storage levels this time last year. Current projections suggest that natural gas supplies will be well above that 5-year average by April and the beginning of injection season.

Figure 3: By 5

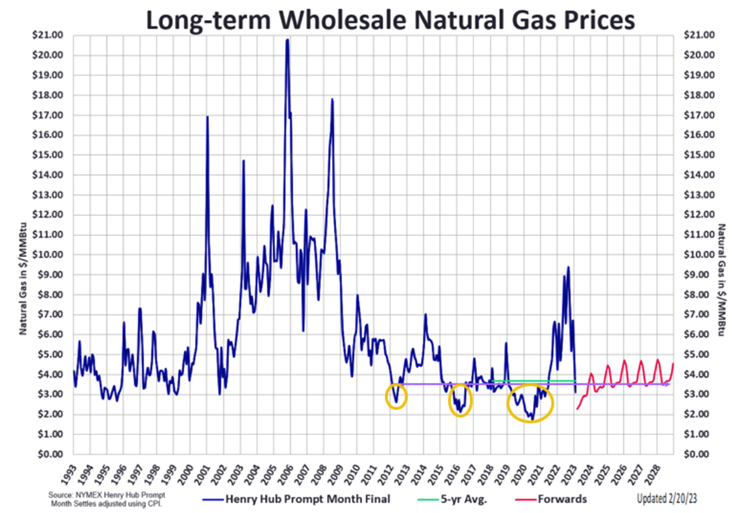

Low demand and high inventory levels have put a significant amount of downward pressure on natural gas prices and created very attractive purchasing opportunities that may turn out to be short-lived. Figure 4 shows prompt month natural gas prices over the last 30 years after adjustment for inflation using the CPI (blue line) in contrast to current forward prices (red line) and the 5-year historical average (green line). The recent collapse in gas prices is only rivaled by those observed in 2012, 2016 and during the pandemic in 2020, which are highlighted in the yellow circles. The question on everyone’s mind is how much farther can gas prices fall? Of course, no one knows. But it is interesting to note that each of the market lows in yellow are followed by an equally considerable rebound. The consensus among market analysts is that there is substantially more upside risk to this market than potential gains to the downside.

Figure 4: By 5

Despite what the groundhog might think, this market believes that winter is likely over. High storage levels, built up from the mild weather, mean that natural gas supplies are plentiful. Today, the biggest bullish force is that current prices are within 10 cents of 30-year lows. Other potential bulls include continued overseas demand for domestic natural gas and other foreign risks such as the crisis with Russia and Ukraine. And while Punxsutawney Phil may have returned to his burrow, clients who have any open natural gas positions should not retreat from this current market opportunity. The current collapse in natural gas prices in the prompt and future years means that buyers can find some compelling relief from a market that was on a bullish run for almost two years. Could prices come down some more? Sure. But the risk that natural gas prices increase by $1 far exceed the probability that it will come down by that same amount. The bottom line is that there are some attractive gas purchasing opportunities right now and as everyone knows, a groundhog in the hand is worth two in the hole…or something like that.

Be sure to connect with your 5 Energy Advisor to see how this might affect your business.