On behalf of the team at 5, I am pleased to forward our market letter for the first quarter of 2022. In this issue, we continue our focus on the energy transition and the strain that this has put on the energy market. Our last letter quoted Larry Fink of Blackrock on the importance of navigating the “global energy transition.” The past quarter’s events add geopolitical risks to the navigational challenges associated with this transition.

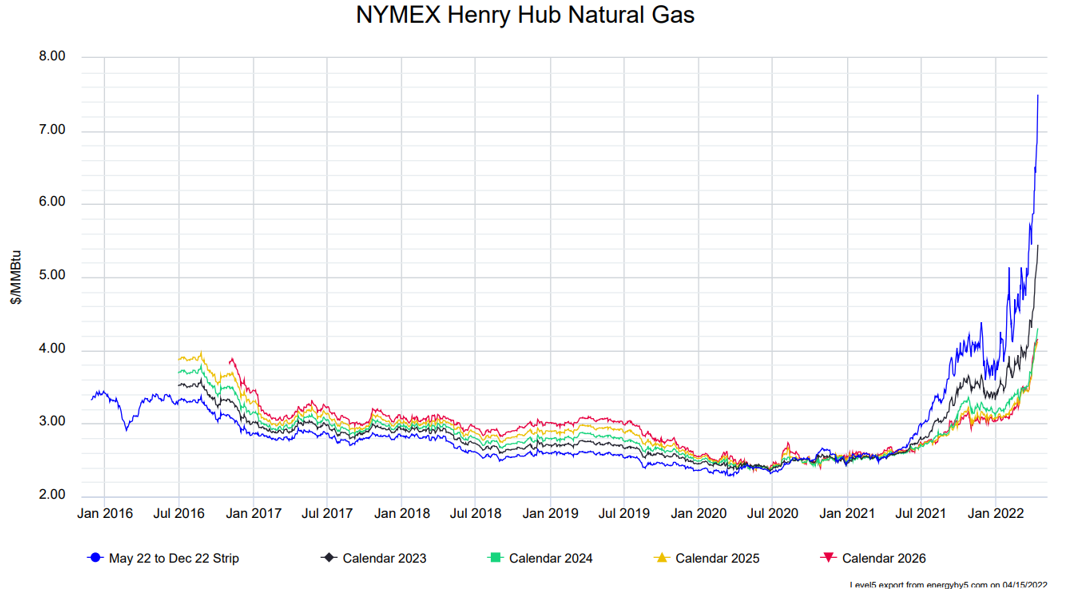

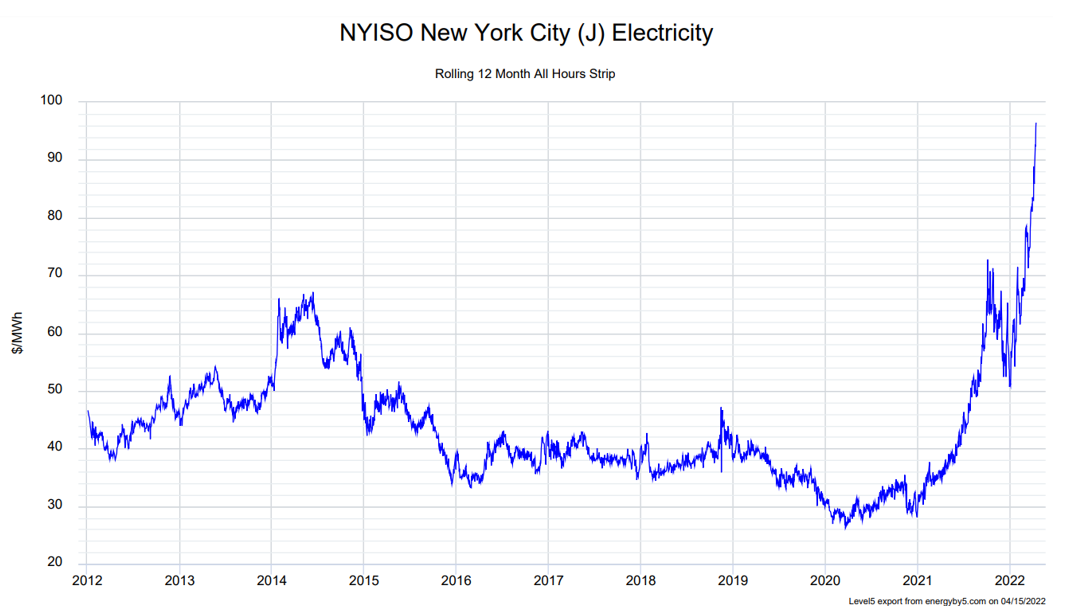

Russia’s invasion of Ukraine tore through the energy market – precipitating a run-up in the price of electricity and natural gas that rivals or exceeds the impacts caused by Hurricanes Rita and Katrina in 2005. Figures 1 and 2 track the invasion’s impact on Henry Hub natural gas prices and the price of electricity in New York City. These extraordinary price increases were also observed in most gas and power markets across the country.

Figure 1: NYMEX Henry Hub Natural Gas from 5

Figure 2: NYISO New York City (J) Electricity from 5

The war has forced many countries, especially those that relied on Russian natural gas, to reconsider the importance of energy security. Climate change advocates focus on the risk that Europe’s reliance on natural gas and oil has caused to its economy and the general increase in energy costs across the globe. Those that oppose a rapid transition to a low carbon economy highlight the risk now highlighted by Europe in moving too quickly to transition away from traditional sources of energy, including coal and nuclear power, and relying too much on intermittent renewable energy and Russian natural gas.

It is difficult to predict the war’s ultimate impact on the energy complex. There is no doubt, however, that the geopolitical conflict will result in new regulations, some that promote renewable investments and some that act to defer those investments. After the Ukraine invasion, Germany announced that it would speed up the installation of wind and solar projects to help reduce its dependence on Russian natural gas. China, on the other hand, responded to energy security issues and its economy’s exposure to the high price of natural gas by accelerating the use of domestic coal. As reported by the Washington Post, in March, Chinese miners dug more coal per day than ever before and efforts to tap additional coal reserves are moving forward.

Wind and Solar Dominate New Generation in the US

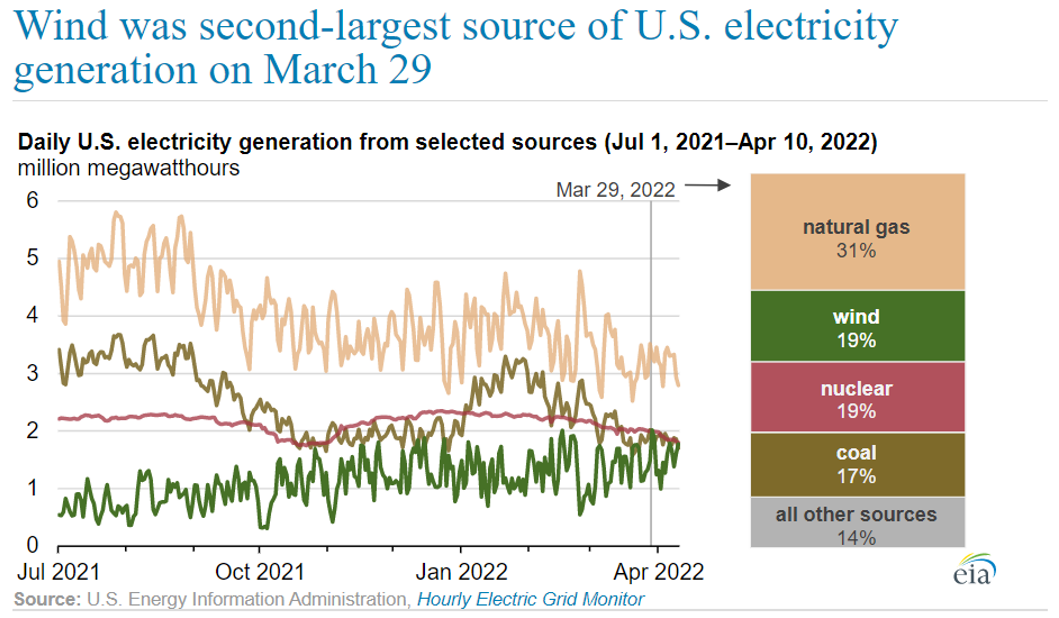

In the US, the war is likely to increase the politicization of the country’s energy policy, but it appears unlikely to slow the energy transition. Renewable power continues to be the dominant source of new electricity generation, and the high price of natural gas and electricity, and the increased importance of energy independence, should support the continued development of wind and solar projects. In Q1, the EIA reported that for the first time, wind generation exceeded both coal and nuclear generation in a single day as shown in Figure 3.[1]

Figure 3: Daily US Electricity Generation From Selected Resources from eia.gov

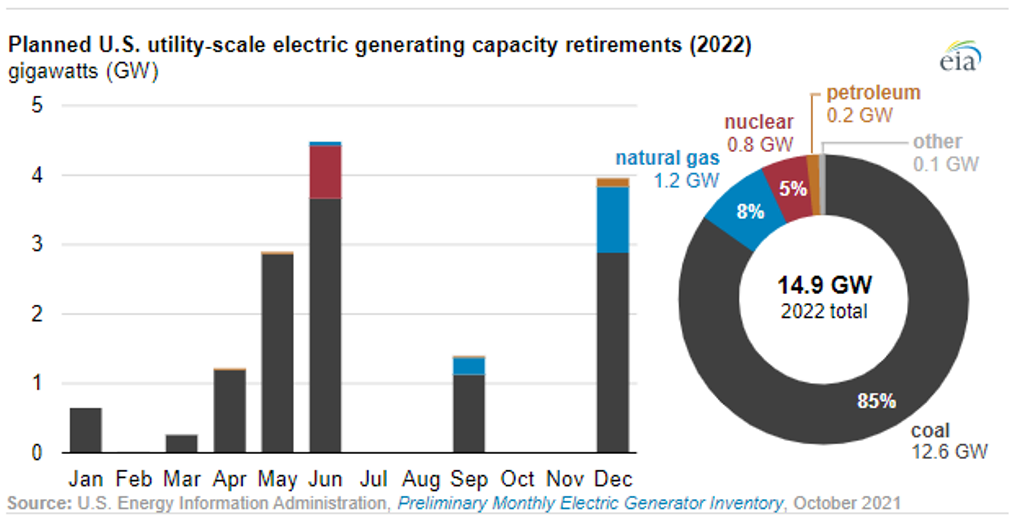

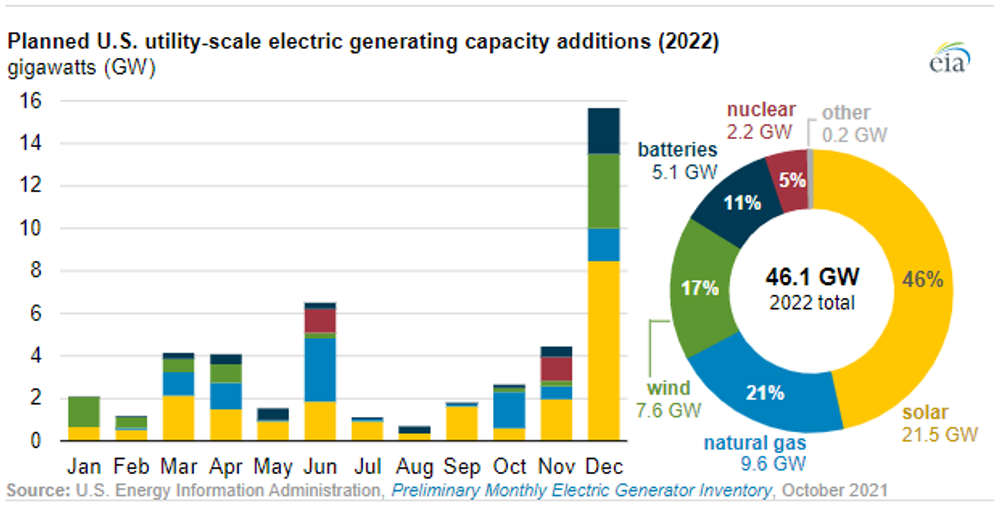

EIA does not expect wind to exceed coal or nuclear for a month in 2022 or 2023. However, as more coal plants and nuclear plants shut down, intermittent supply sources (wind and solar) will continue to grab market share from coal and nuclear plants. As shown in Figure 4, the EIA forecasts that 800 MWs of nuclear plants, 1.2 GWs of natural gas plants, and 12.6 GWs of coal plants will cease operations in 2022. Figure 5 shows that the majority of the new electricity supply will be from intermittent resources – with the dominant new resource being solar (21.5 GWs). The rest of the new capacity is expected to come from wind (7.6 GWs), natural gas (9.6 GWs), batteries (5.1 GWs), and Nuclear (2.2 GWs).

Figure 4: Planned US Utility-Scale Electric Generating Capacity Retirements (2022) from eia.gov

Figure 5: Planned US Utility-Scale Electric Generating Capacity Additions (2022) from eia.gov

Increasing Risks Of Delay: Generation Projects Face Development Challenges

The energy transition continues to surface new challenges to reliable supply. Because natural gas plants typically set the price of electricity in the US, the dramatic increase in natural gas prices caused a comparable increase in the price of electricity. Proponents of renewable generation correctly argue that this correlation does not apply to the renewable generation that is in operation since a solar or wind plant does not have to pay for its fuel. However, the grid’s dependence on increasing volumes of to-be-developed renewable generation units puts energy supply at risk should the delivery of these projects be delayed. As detailed below, supply delays caused by COVID, regulatory proceedings, and the rapid increase in the cost of electricity all increase the risk of delays in the on-time completion of renewable generation projects.

COVID Related Supply Constraints and Inflation

COVID continues to cause supply constraints which have delayed the delivery of important parts and caused a dramatic increase in the cost of key materials such as aluminum, nickel, and lithium. These supply constraints are of particular concern to battery developers. For example, Ameresco, a large developer of energy projects, saw its stock decline significantly in early April when it announced that COVID lockdowns in China caused a negative impact on [Ameresco’s] ability to deliver batteries on schedule for large projects under construction in Southern California for utility SoCal Edison. Not surprisingly, Ameresco plans to claim that this delay is excused by force majeure. We expect that SoCal Edison will contest this determination. Similar supply constraints and inflationary pressures challenge solar and wind plants as well.

Regulatory Risk: Anti-Dumping Lawsuit

On February 8, 2022, a US solar manufacturer, Auxin, filed a petition with the Department of Commerce, alleging that various Southeast Asian countries were being used by Chinese manufacturers to circumvent tariffs and other regulations targeted at Chinese solar panel manufacturers. This case sent shock waves through the solar industry. A large solar association found in a recent survey that almost 80% of the respondents expected solar module deliveries to be delayed or canceled as a result of the Commerce Department’s investigation.

Financing Risk

While it is somewhat counterintuitive, a driver of increased demand for renewables (the high cost of natural gas and high electricity prices), is also creating a significant risk to the successful completion of renewable projects. Historically, solar panels behaved like computer chips and followed Moore’s Law, with output increasing and cost decreasing each year. Developers took advantage of this trend by executing a fixed-price Power Purchasing Agreement (PPA) with an offtaker that fixed the price for the project’s output (electricity generated) and then going to the market to purchase the necessary equipment. As long as the price of solar panels or wind turbines continued to decline between the time that the PPA was signed and when the equipment was purchased, the project economics outperform projections.

Solar panels no longer follow Moore’s Law. Not only has the price decline slowed, but it has also reversed. Now, many projects that followed this strategy and executed fixed price PPAs prior to purchasing panels, turbines and related equipment are now uneconomic to build. Many developers are looking for ways to cancel these projects without incurring penalties (for example, claiming Force Majeure). Utilities and clients that are depending on these projects to be built may have to scramble to replace this generation.

SEC issues landmark climate change regulations: Greenwashing Concerns Increase

At the same time that renewable developers are facing increased project risk, US-based companies are facing more pressure to address climate change. On March 21, 2022, the Securities and Exchange Commission (SEC) issued landmark regulations that require public companies to disclose climate risks and carbon emissions. These rules are in draft form only (the rules are 550 pages long) and even if adopted by the SEC, they are likely to be challenged in court. As drafted, the rules take effect for the largest companies in 2023 (to be included in filings made in 2024). Smaller public companies have more time to comply.

Among other things, the rules require reporting companies to:

-

Report climate-related risks and potential impact of climate change on a company’s strategy and outlook

-

Report how the company manages exposure to climate-related risk

-

Disclose information about direct emissions (Scope 1)

-

Disclose information about emissions from purchased electricity or other forms of energy (Scope 2)

-

Disclose information about Scope 3 emissions if, and only if, (i) the company has set a GHG emission target or goal that includes emissions from upstream or downstream activities (Scope 3), or (ii) if such Scope 3 emissions are material

The SEC Chair argues that these rules are well within the SEC’s rulemaking power which is intended to let investors determine which risks they want to assume as long as companies provide full disclosure of key risks. Almost immediately upon release of the draft rules, a group of Republican Senators filed a comment letter stating that “the proposed rule is not within the SEC’s mission to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.” [April 5, 2022 letter from 19 Senators to SEC Chair Gary Gensler]

While the SEC rules are bogged down in political debate, we should not underestimate the pressure that the draft rules put on large companies to monitor and report on their emissions. Motivated by global warming and increasing demand from capital markets, employees and other stakeholders, our clients are increasingly asking us for help in addressing climate-related issues.

Carbon Offsets: An Interesting Option but with Risk

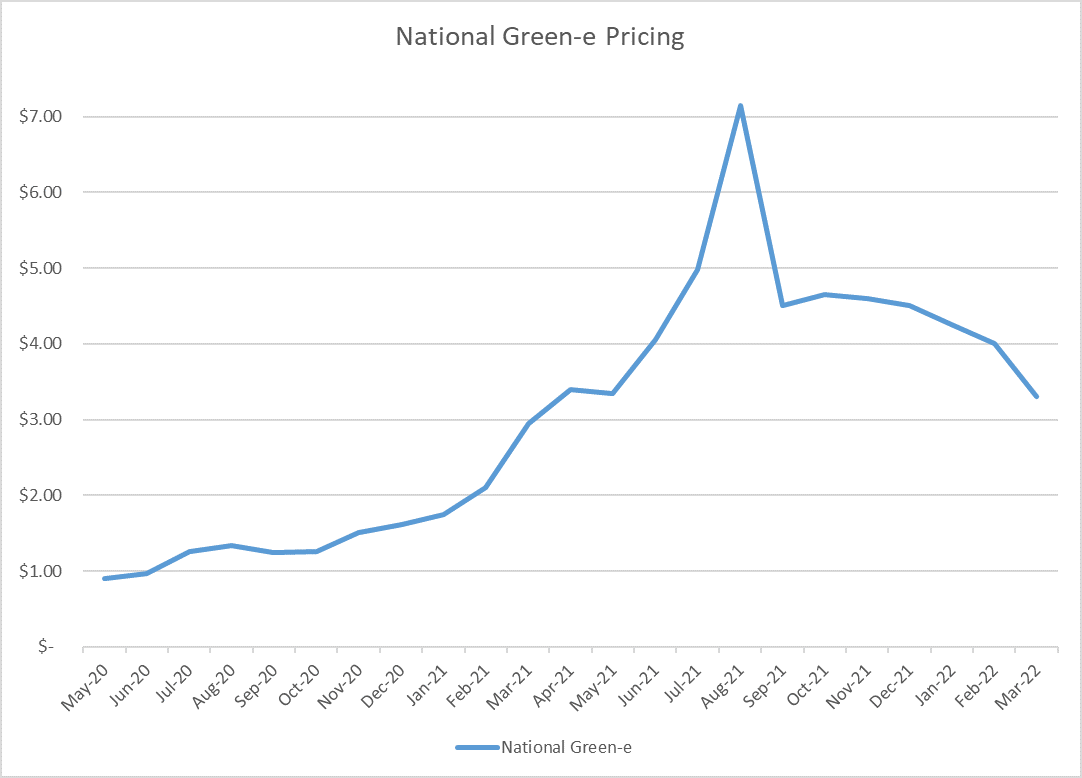

The combination of increased demand for renewable energy and delays and/or failures of renewable projects is causing a rapid increase in both the price of renewable energy credits (RECs) and renewable PPA prices. The chart below shows the dramatic increase in REC pricing over the past two years.

Figure 6: National Green-e Pricing

PPA pricing is following the same general curve. LevelTen Energy reports that renewable PPA prices have risen by almost 10% since the beginning of 2022 and almost 30% since the beginning of 2021. As REC and renewable PPA prices continue to rise, companies with renewable commitments are forced to look at other alternatives for meeting such commitments. One alternative attracting significant interest is carbon offsets.

Carbon offsets are still relatively new to most corporate buyers and are often confused with carbon credits. A carbon credit constitutes the right to emit one metric ton of carbon. Carbon credits exist in markets that cap the amount of emissions that can be generated by specific energy users. In such markets, industrial users have the right to generate a certain amount of carbon. An industrial user that is able to operate at a level below such cap can sell the excess credits to other regulated energy consumers who can use the credits to meet their carbon obligations or to increase their carbon emissions. Carbon credits are actively traded in markets that regulate carbon. The largest market for carbon credits is in Europe. In the United States, the only active carbon credit market is in California, which is regulated by the California Air Resources Board.

A carbon offset represents one metric ton of carbon dioxide (or equivalent greenhouse gases) that has been removed from the atmosphere. There are two general types of carbon offset projects – those that remove carbon from the atmosphere and those that avoid the emission of carbon into the atmosphere. A renewable energy project is a good example of an avoidance project. A forest maintenance or reforestation project is a good example of a project that removes carbon.

Since the carbon offset market is voluntary, various organizations register and validate carbon offset projects. Examples include the American Carbon Registry (ACR), the Climate Action Reserve, Markit and Verra. Carbon offsets trade based on how the market perceives the value of the underlying carbon reduction efforts. The factors that affect the value of a carbon offset include “its vintage, the type of project, the volume of credits traded at the time, the geography of the project, the delivery time, and whether the offset can be certified.” Removal offsets tend to trade at a premium to avoidance offsets.

Below are some indicative prices for carbon offsets:

Figure 7: Indicative Prices for Carbon Offsets from 5

Current carbon offset pricing reflects this increased demand. For example, tree planting project offsets increased in price from $4.65/ton in June 2021 to more than $14/ton in April according to S&P. We are currently seeing forest offsets trading close to $20/ton, and many holders of such offsets are so bullish about the future price that they are simply unwilling to even sell vintage 2022 and 2023 offsets.

The carbon offset market has its own unique risks. Buyers should research carefully the type and source of the carbon offset before purchasing. A recent FT article highlights how a number of well-known companies bought carbon offsets that were created by injecting CO2 into oil wells to increase oil extraction. The offset rules used by these projects somehow provided offset credits because carbon was captured and injected in the ground, but they neglected to account for the emissions caused by the oil extracted in the process. Three US-based enhanced oil recovery projects generated some 12.4 million offsets, which were sold by leading carbon brokers including Terrapass and Blue Source. Although these “carbon offsets” are no longer permitted, the existing offsets are grandfathered.

Notwithstanding these risks, we expect this market to continue to mature. For example, several banks recently launched a plan to create a carbon market settlement platform called Carbonplace by the end of 2022. Once the market rules are clarified and formal trading systems established, the price of carbon offsets are likely to increase even further.

5 continues to expand its sustainability and resiliency teams to address all of the risks associated with the energy transition. Of course, please do not hesitate to contact me or other members of our team if you have questions about carbon offsets or any of the other matters covered in this quarterly letter.

Download the PDF version here.

[1] On prior days, electricity generated by wind turbines exceeded generation from coal power plants and generation from nuclear plants. March 29th marked the first day that wind generation exceeded both nuclear and coal generation on the same day.

Resources:

https://www.washingtonpost.com/world/2022/04/22/china-coal-climate-change-xi-energy/

https://www.sec.gov/comments/s7-10-22/s71022-20122544-278541.pdf