“Few things will impact capital allocation decisions – and thereby the long-term value of your company – more than how effectively you navigate the global energy transition in the years ahead.” - Larry Fink, Blackstone CEO Letter 2022

On behalf of the team at 5, I am pleased to forward our market letter for the fourth quarter of 2021. This letter continues our focus on the conflict between regulations that promote low carbon energy production, and the strain that this energy transition puts on utility systems that must: (i) accommodate intermittent energy sources, and (ii) ensure reliable electric supply at a reasonable cost. California and Europe have taken aggressive regulatory action to reduce carbon emissions. Perhaps because of their early mover status, these markets are also good examples of the challenge faced by regulators overseeing the energy transition.

For our clients, the key takeaway is that energy management is increasingly complex and an energy manager can no longer simply set a procurement or carbon reduction strategy and let it run unattended. Energy regulations are in constant flux, and clients must be ready to adjust procurement and carbon reduction strategies in real-time as regulations change and new technologies are introduced.

California – NEM 3.0

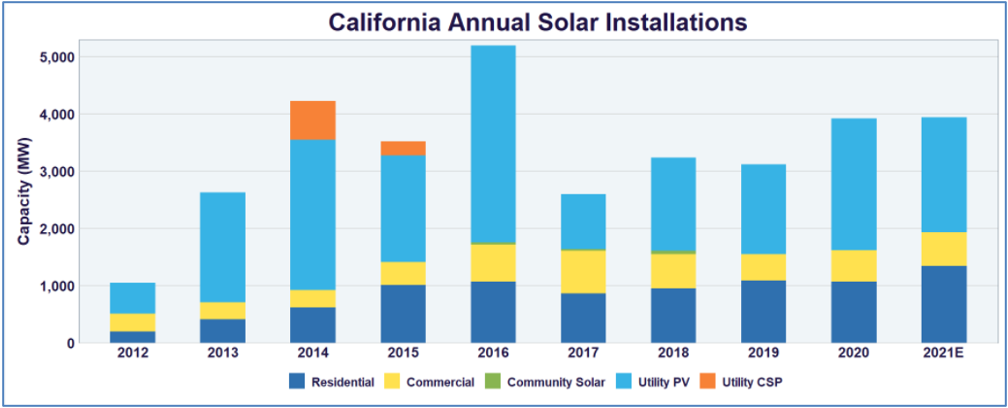

In California, abundant sunlight combined with generous Federal and State incentives, allowed a large number of residential and commercial customers to reduce their energy costs by installing rooftop solar projects. As of 2020, there were almost 10 million homes in California with rooftop solar installations. Overall, California leads the nation in installed solar – some 33,200 MWs of installed solar generation which produces almost 25% of the state’s electricity.

Figure 1: California Annual Solar Installations from seia.org

The state’s net energy metering program is critical to this success. In California, net metering rules permit on-site solar owners to sell excess electricity back to the utility and receive a credit on their electricity bills. This is important because many systems are sized to produce excess electricity when solar production is high (mid-day), and use the credits received from exporting electricity to offset electricity costs when solar production is low, for example, at night.

The current net energy metering (NEM) rules were introduced in 2016 and are referred to as NEM 2.0. Under NEM 2.0, the credit received for selling electricity back to the grid is equivalent to the delivered cost of electricity. This price includes not only the energy portion of the price of electricity but also the cost of transmission and distribution. This is a high rate and is a significant part of the favorable economics of rooftop solar.

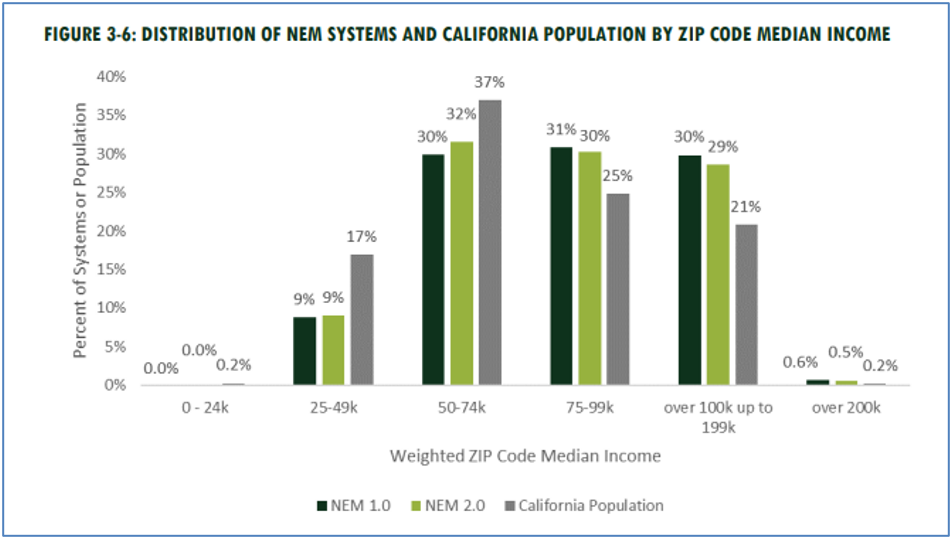

Utilities and consumer advocates argue that solar owners are not paying their fair share of transmission and distribution costs and that rooftop solar owners shift the cost of maintaining the grid to those who cannot afford rooftop projects. Solar owners who receive credits for selling power back to the grid end up paying very low utility bills, and the regulators need to find a way to reallocate the cost of maintaining the grid. This is a common issue with solar incentives; while the incentives are key to promoting solar adoption, they can act as a regressive tax since lower-income people (who may not own homes or have the means to install solar) do not participate. It is unclear how much costs are shifted to non-solar owners – but estimates run from $1b to $3.4b per year.

The California Public Utilities Commission (CPUC) focused on this disparity when examining the current net metering rules. As Figure 2 demonstrates, the smallest share of residential systems was found in areas with the lowest (and highest) median income[1].

Figure 2: Distribution of NEM Systems and California Population cpuc.ca.gov

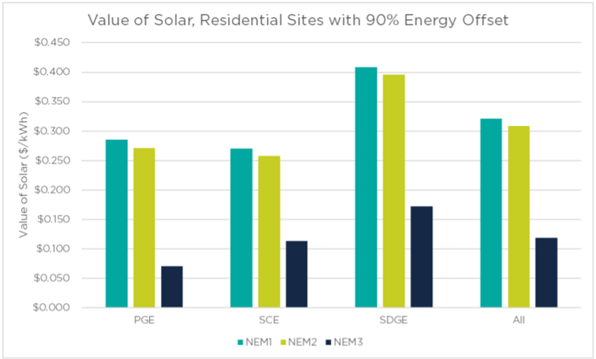

On December 13, 2021, after an extensive review, the CPUC issued a proposed decision that called for far-reaching revisions to the solar net metering rules. The CPUC found that the current net metering “tariff negatively impacts non-participating customers; is not cost-effective; and disproportionately harms low-income ratepayers.” In the proposed rules, NEM 3.0, the CPUC changed the amount paid for electricity exported from rooftop solar projects and set it at a level more closely tied to the market value of electricity. This re-sale rate removed the cost of transmission and distribution from the standard retail rate. The impact would be dramatic, reducing the price paid for excess energy from 17 to 44 cents per kWh in NEM 2.0 to 3 to 4 cents per kWh in NEM 3.0.

The proposed rates also introduced a monthly charge, aptly labeled a “grid benefit charge”, that all solar PV customers must pay the utility. This is a fixed charge and it does not vary based on generation or consumption. The CPUC proposed a monthly charge for residential customers based on installed system size (not production). This charge is set at $8 per installed kW of solar panels; a typical residential customer with a 6 kW system would need to pay $48/month. Like the change in the net metering tariff, this change further erodes the economics of rooftop solar.

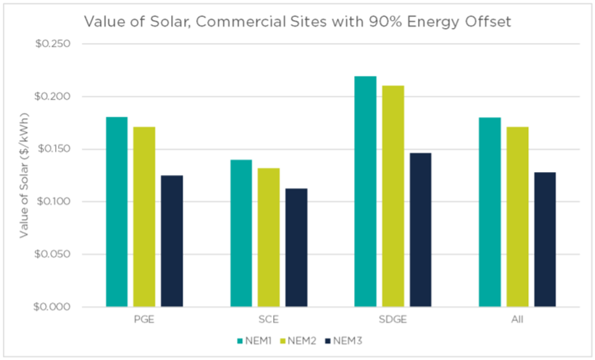

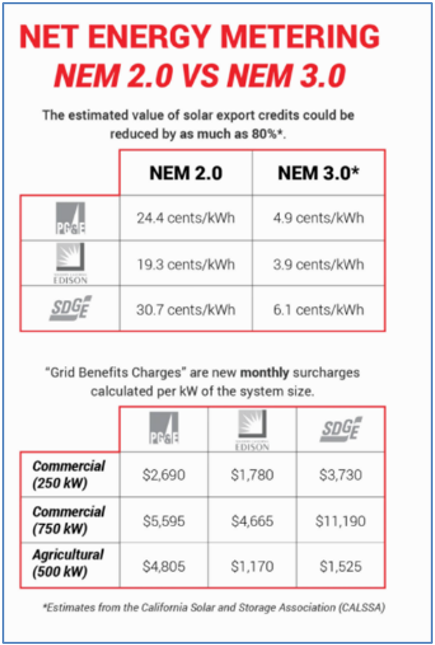

Figures 3 and 4 show the approximate impact of NEM 3.0 on the economics of rooftop solar in the three different utility territories (PG&E, SCE, and SDG&E).

Figure 3: Value of Solar, Residential Site with 90% Energy Offset from sagerenew.com

Figure 4: Value of Solar, Commercial Site with 90% Energy Offset from sagerenew.com

Commercial customers with rooftop solar installations also face significant cost increases under proposed NEM 3.0 rules. While there is some variation between the different utilities, a commercial account with rooftop solar loses approximately 80% of the credit for sending power back to the grid and faces a monthly grid benefit charge that ranges (depending on utility and project size) from ~$1,500 to over $11,000 as shown in Figure 5.

Figure 5: Net Energy Metering NEM 2.0 vs NEM 3.0 from revel-energy.com

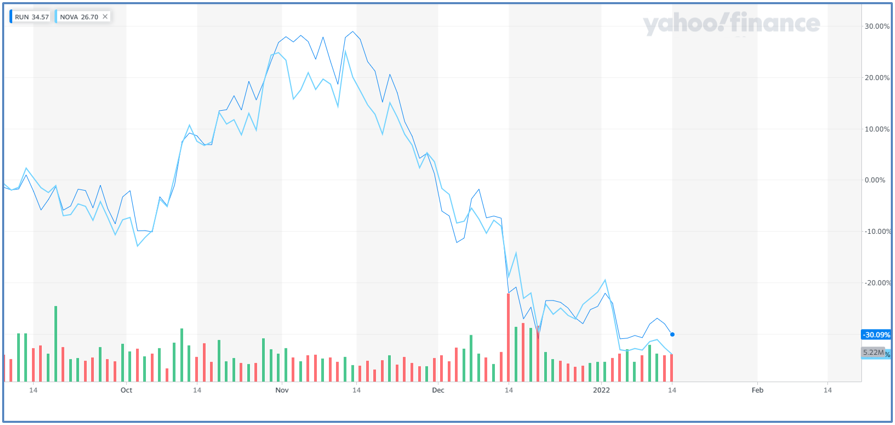

The proposed ruling sent shockwaves through the solar market in California. To add insult to injury, in late December, Senator Manchin made it clear that he would not support Biden’s Build Back Better bill, calling into question some $320 billion in federal tax incentives for wind, solar and nuclear energy. The combination crushed the stock price of solar developers. Figure 6 shows the impact of these developments on the stock price of two large pure-play solar developers – Sunrun and Sunnova.

Figure 6: Chart of Stock Price of Sunrun and Sunnova from finance.yahoo.com

The CPUC’s proposed decision has become a political issue in California. Influencers like Elon Musk, Bill Walton, Mark Ruffalo, and Ed Norton have all taken to Twitter in an effort to reject the changes proposed by NEM 3.0. Norton stated that :

Image 1: @EdwardNorton from twitter.com

In an early January news conference, Governor Newsom, who originally stayed out of the net metering debate, said, “That draft plan that was recently released, I just had a chance to review, and I’ll say this about the plan: We still have some work to do.”

The CPUC was scheduled to hold oral arguments on the proposed rules on January 12, 2022, and a vote on the new rules on January 27, 2022. At the last minute, the CPUC canceled the oral arguments purportedly to allow them to pick a date when all five commissioners could participate. It is unclear when the CPUC will vote on the proposed rules, but given the statement by the Governor and the level of opposition, more delays are inevitable. And while the status of NEM 3.0 remains in flux, it is important to note that projects developed under NEM and NEM 2.0 are grandfathered on those tariffs for 20 years from the date that their solar PV system or other form of on-site generation first went into operation.

While the conflict between utilities and solar regulations in California is significant, the debates in Europe over renewable regulations have an added dimension: geopolitical risk.

Revisiting The Energy Crisis In Europe

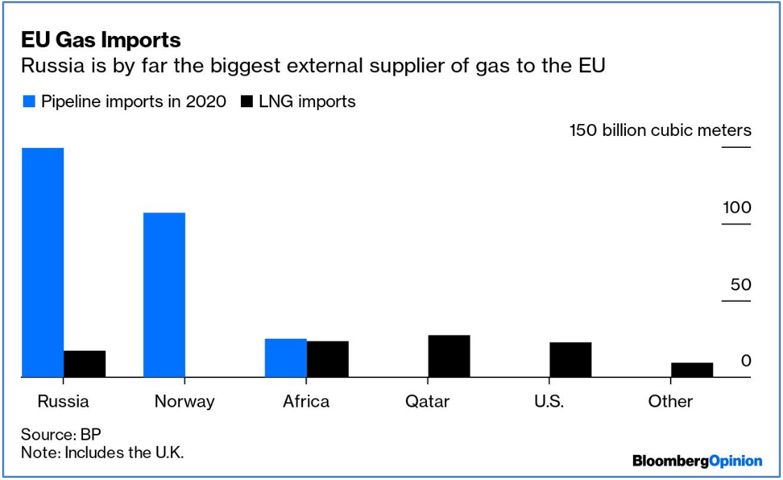

The challenge created by the energy transition is even clearer in Europe. Regulators failed to appreciate the risks of concurrently (i) restructuring the energy market around renewables, (ii) reducing natural gas production, and (iii) closing coal and nuclear plants. Further aggravating an already difficult situation; the EU imports about one-third of its natural gas from Russia as shown in Figure 7.

Figure 7: EU Gas Imports from bloomberg.com

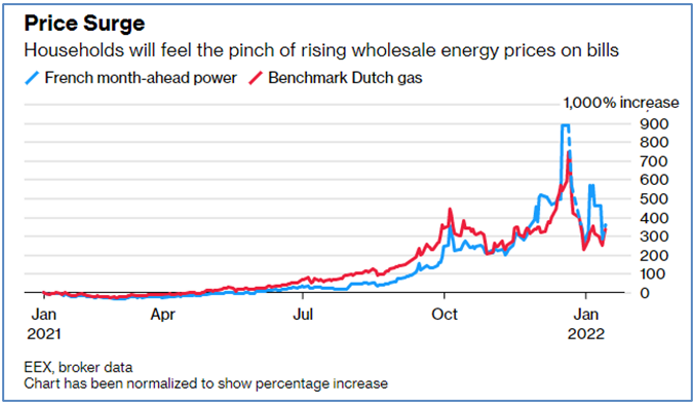

The price of electricity and natural gas remains at historically high levels throughout Europe, and the risk of supply shortages caused by adverse weather or conflicts with Russia is significant. For example, when recent security talks between the US and Russia broke down, the news pushed the European benchmark price of natural gas up by almost 25%. Traders fear that a conflict in Ukraine will result in additional constraints to natural gas. Figure 8 shows how prices have changed in Europe over the past few years.

Figure 8: Households Feel the Pinch of Rising Wholesale Energy Prices from bloomberg.com

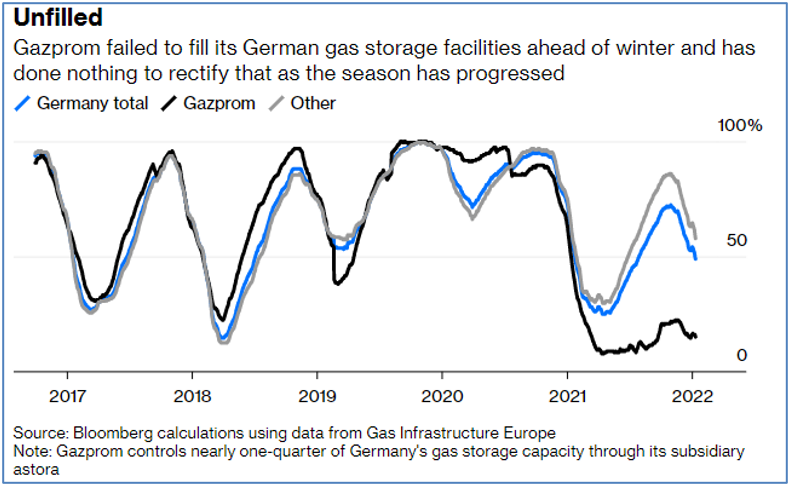

To make matters worse, EU natural gas in storage is at historically low levels. European energy regulators made another key mistake, they allowed Russian-controlled Gazprom to purchase European storage facilities. This made sense in theory since Russia has been the largest supplier of gas to the EU for many years. European utilities relied on Gazprom to buy gas and store it, and when gas prices were low, there was little value in storage. This year, however, when storage is critically needed, Gazprom chose not to fill up its storage facilities. As Figure 9 shows, Europe is nearly out of natural gas.

Figure 9: Gazprom Failed to Fill its German Gas Storage Facilities from bloomberg.com

In our last letter I wrote, “Political risk is another reason that European countries may now reconsider their decision to retire coal and nuclear generation.” On New Year’s Eve, the European Commission confirmed this prediction, introducing draft regulations that designated natural gas and nuclear as “green” fuels for electricity generation. This controversial draft ruling kicked off a policy debate between France, a large proponent of nuclear power, and Germany, which committed in 2011 to close all of its nuclear power plants. Austria and several other European nations support Germany. Finland and the Czech Republic side with France. Not surprisingly, Germany supports the inclusion of natural gas as “sustainable,” since they will need to rely on natural gas as they move to shut down coal and nuclear generation. Christian Lindner, head of the Liberal Party coalition in Germany explained, “Germany realistically needs modern gas-fired power plants as a transitional technology because we are giving up coal and nuclear power.”

Even with nuclear generation, France is struggling to adjust to high natural gas and electricity prices. On January 13, 2022, the French government announced that it would limit the amount that EDF, a state-controlled energy giant, can charge for energy. The move caused EDF to take an 8.4B Euro hit, and the market responded by knocking 20% off of the share price of EDF. France is not alone. Spain introduced a windfall tax on electricity and natural gas producers that have profited from higher energy prices, and Germany cut a surcharge on bills used to support renewable energy. I expect other regulatory changes as the UK and Europe try to address the challenges faced by the energy transition.

Conclusion

Please do not misunderstand what you are seeing in Europe and California. These growing pains do not indicate that the momentum toward a low carbon energy system is slowing. Even Exxon, a long-term opponent to climate change regulation, is beginning to capitulate to the realities of climate change. On January 18, 2022, Exxon pledged to reduce or offset 100% of its greenhouse gas emissions from operations by 2050.

In fact, the issues we see playing out in California, Europe, and other markets are inevitable as governments and markets try to navigate this significant market transformation. We saw similar dislocations when domestic energy markets deregulated in the late 1990s. Given the extent of this energy transition, this state of flux will last for many years. It is also important to remember that successfully addressing the energy transition is a challenge for all market participants, not just those who seek to reduce their carbon footprints. As Blackstone CEO Larry Fink noted, all companies will be measured on how effectively they navigate the global energy transition.

The team at 5 is uniquely situated to help our clients manage this transition successfully. As always, please do not hesitate to contact me or other members of the 5 team if you have energy-related questions or you would like to discuss the issues covered in this letter in more detail.

Download the PDF version here.

[1] NEM 1.0 refers to the Net Energy Metering rules first established in California in 1995.

Sources:

https://www.ft.com/content/92ab113f-ab17-4492-be65-56c9173cfc53

https://www.theguardian.com/business/2022/jan/14/france-edf-cap-household-energy-bills