A Review of ERCOT's Seasonal Assessment of Resource Adequacy report for Summer 2022

The Seasonal Assessment of Resource Adequacy report, otherwise known as SARA, is a quarterly publication from ERCOT that gives its assessment of the short-term risk of Energy Emergency Alerts. This assessment looks at both load growth and peak demand forecasts, along with generation capacity and probability of availability to determine the potential for the state’s power grid to run out of power when it is needed the most. In May, ERCOT published the SARA report for this summer, with the following highlights.

First, the report opens with a statement that is most often quoted, “The ERCOT region is expected to have sufficient installed generating capacity to serve peak demands in the upcoming summer season, June - September 2022, under normal system conditions and most of the reserve capacity risk scenarios examined.” What this says and does not say is where the real risk assessment is done. The “top-line” evaluation contemplates the “normal system conditions”, but it is the Moderate and Extreme Risk scenarios that one needs to truly evaluate to contemplate potential risk. It stands to reason that if there is a significant risk of system failure given normal conditions, then the SARA report would be getting more news coverage, but grids rarely rarely fail under normal conditions; the moderate to extreme situations are what need to be planned for when discussing the risk of emergency situations.

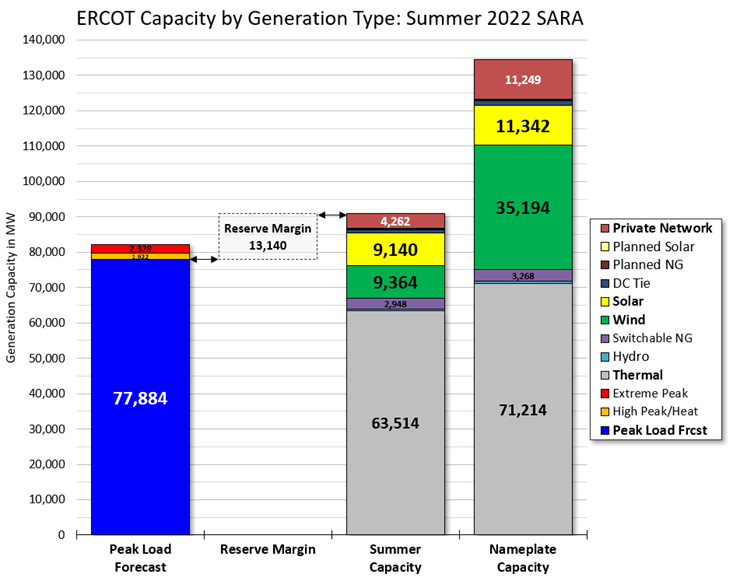

For the first time, ERCOT has included all generation resource details in this season’s SARA report, including nameplate and summer deration capacity quantities by generation type. This allows us to dive into the data to see exactly how the reserve margin of 13,140 MW is derived, and discuss the details of the moderate and extreme risk scenarios published by ERCOT.

Figure 1: ERCOT Capacity by Generation Type Summer 2022 SARA from 5

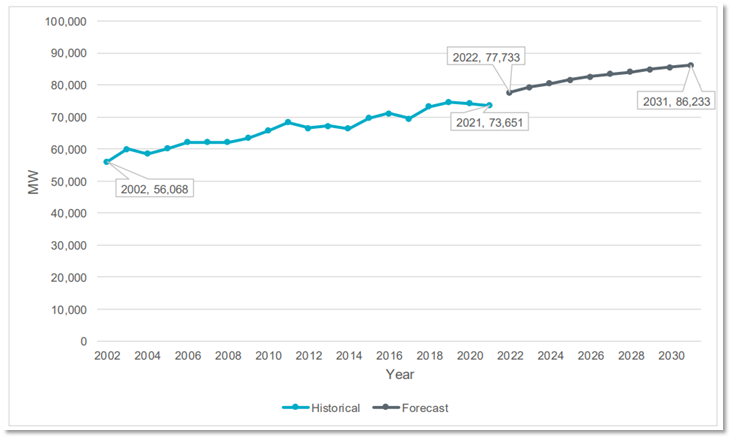

The first thing that we should discuss is the Peak Load Forecast of 77,884 MW, which is 4,233 MW higher than last summer’s actual peak (Figure 2), and about 3,000 MW higher than the all-time peak set in August of 2019.

Figure 2: ERCOT’s 2022 Long-term Peak Demand Forecast from ercot.com

The second thing that might be surprising to most is how reliant we now are on wind and solar generation. The gray thermal section is inclusive of all nuclear, coal, and natural gas plants based solely in ERCOT, and their combined summer capacity is only 63,514 MW. That number increases slightly when you include the switchable natural gas plants that are on the ERCOT border that can generate into either ERCOT or SPP (the region just to the North of ERCOT), and the Private Use Network generation assets (aka microgrids).

The difference between the Nameplate Capacity (the total summation of the theoretical maximum capacity of each generation asset) and the anticipated output from each generation asset at the time of the peak demand is what has become more complex as the grid has evolved. Determining the derated summer capacity of thermal generation is a fairly straightforward physics equation. First, ERCOT models the output which considers air temperatures, humidity levels, and more to determine how much power each asset can produce. Second, ERCOT determines the probability of forced outages in thermal generation types based on history. Lastly, ERCOT studies the probability of wind and solar availability based on multiple factors like geography, historical and forecasted wind and solar availability to determine a statistically probable discount factor to apply to the total wind and solar nameplate capacity. These all combine to develop a probable reserve margin of about 13,000 MW.

The real risk assessments are not completed in the base scenario; instead, they are performed in the Moderate and Extreme Risk Scenarios. In these scenarios, ERCOT takes the above assumptions and tests how increased load or decreased generation, or both, ultimately impacts the reserve margins.

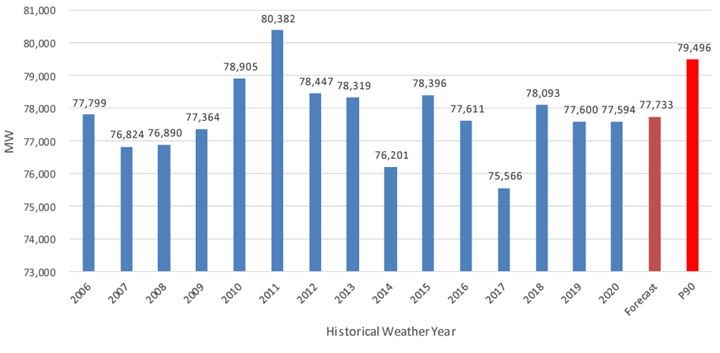

The easiest assumption is to only assume warmer weather and its impact on total peak load. This study is not done directly in the SARA report, but instead in the annual Long-Term Hourly Peak Demand and Energy Forecast, using recent historical weather and today’s grid to determine possible peak demands given different weather scenarios (see Figure 3).

Figure 3: Long-Term Hourly Peak Demand and Energy Forecast from ercot.com

On the generation side of the equation, ERCOT models additional unplanned outages in thermal generation, low wind, and low solar scenarios. The result is that in the Moderate Risk Scenarios, if all risky outcomes align in a single afternoon, the reserve margin falls below the 2,300 MW emergency threshold that triggers controlled outages (rolling blackouts). In the Extreme Risk Scenarios, which essentially moves wind generation down to zero and models thermal outages to the maximum historical summer outages, generation falls short of forecasted load by over 10,000 MW.

While these scenarios are not probable, specifically the Extreme Risk Scenarios, the Moderate Risk Scenarios are not too far out, the risk of scarcity pricing is growing faster than the risk of running out of capacity.