What is the Jones Act and how does it impact our energy markets?

In January 2018 a cold snap descended across the Northeast. And in Boston Harbor, a liquified natural gas (LNG) tanker appeared on the horizon, ready to unload its cargo at the only port terminal in the lower 48 states equipped to process imported gas. The massive ship flew a red, white, and blue flag, but not that of the United States. Instead, it was the flag of the Russian Federation. The ship is called the “Gaselys” which, in the Russian language, translates to “extinguished” and it carried natural gas sourced from the Yamal Peninsula in Siberia. The owner of the LNG export terminal in Russia from where this ship set sail is Novatek, Russia's largest independent producer of natural gas. This is the same company that was put under sanctions by the US Treasury Department in 2014 after Russia invaded and seized Crimea from Ukraine. And while the company was sanctioned, the natural gas that it sold to New Englanders was not.

How did this odd set of circumstances occur? How is it that the world’s largest producer of natural gas cannot supply one of the most important cities on its eastern shore even though Boston is located 600 miles from a massive domestic natural gas field? And how is it that a ship flagged, owned, and operated by a geopolitical rival under a broad set of sanctions was able to deliver gas 4,500 miles from its source to Boston Harbor?

Figure 1: Russian-flagged LNG tanker “The Gaselys” unloading her cargo at Boston Harbor on January 28, 2018, from Scott Eisen/Bloomberg

To be sure, this was a rare event. Yet it caused many energy market participants to pause and scratch their heads. The answers to these questions are not straightforward. Certainly, the fact that no new natural gas pipelines have been built to the Atlantic Coast in many years is part of the problem. This is a notable concern because the Marcellus Shale production region (located in West Virginia, as well as in parts of Ohio, Pennsylvania, and New York) is located only a few hundred miles away from major East Coast cities where energy affordability has been a long-standing issue.1 The resulting supply-demand gap that exists in New England is what keeps the Everett LNG import facility at Boston Harbor (owned by French energy company Engie) in business. In fact, that facility is called on to supply about 20 percent of the market demand for natural gas in the US Northeast.2

Yet there was another factor in play in January 2018 that continues to be an issue today. And it is called the Jones Act. Passed in 1920, this federal law requires the transfer of waterborne cargoes between US ports to be carried out by ships that are US-owned, US-crewed, US-registered, and US-built. The original purpose of the law was to secure the nation’s ports at a sensitive time in world history between the two World Wars. Its goal was to support the US maritime industry, including US shipbuilders, the US shipyards that built these vessels, and the largely unionized workforce that supported the industry.

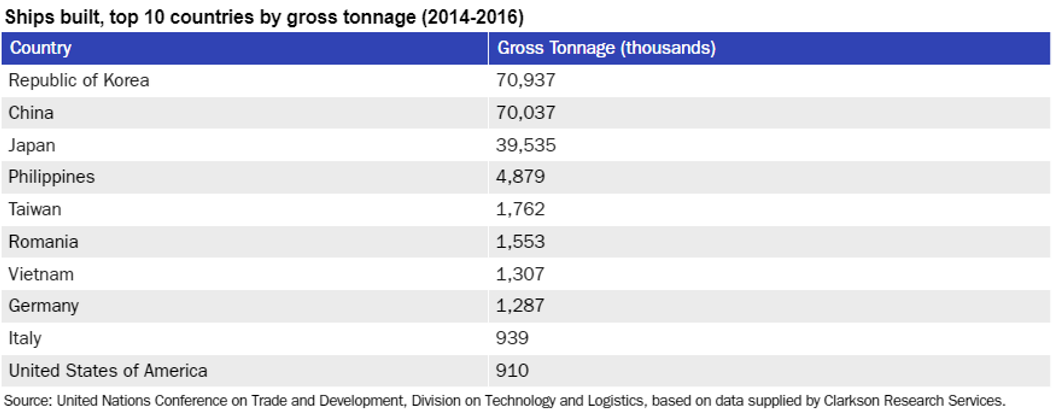

No one (especially those who were not alive in 1920) could argue with the good intentions behind the act when it was signed. And supporters of the act contend that the law continues to serve its original purpose: that the US maritime industry is stronger than it otherwise would be without the law. However, there are only three shipyards in the entire US that make Jones Act-compliant ships for commercial use.3 Contrast that with countries like Japan and China which have thousands of shipyards. Figure 2 below shows how the US shipbuilding industry compares with other countries.

Figure 2: Ships Built, Top 10 Countries by Gross Tonnage from Cato Institute

Most US shipbuilders produce ships for military service. Data from 2014 shows that nearly 66 percent of new large, deep‐draft vessel orders in the US came from the military, which accounted for 70 percent of the shipbuilding and ship‐repair industries’ revenues in 2014.4 Outside the military, though, there is not a significant US shipbuilding industry to support any more. At the same time, Jones Act-compliant vessels are approximately 31 years old, which is well beyond international standards of 15 years. Talk about some rust buckets! Ironically, part of the reason for the decline in US shipbuilding prowess is because American ship owners must shoulder higher insurance premiums and pay heftier salaries for US sailors compared with operators that use foreign crews.5 Some would claim, the Jones Act has contributed to the relative decline of the commercial US maritime industry, even though the law was designed to support it.

Figure 3: "Don't Send me Back on that Rust Bucket" from Cato Institute

Now back to Boston. The Jones Act distorts natural gas markets because there are zero Jones Act-compliant LNG tankers in the world. That is because it is prohibitively expensive to build an LNG tanker in the US. Data from the Congressional Research Service shows that American‐built ships cost between $190 and $250 million, whereas the cost to build a similar vessel in a foreign shipyard is about $30 million. The result is that Everett, MA cannot receive LNG imports from Cameron, LA, or Corpus Christi, TX because there simply are not any domestic ships equipped to carry such cargo while staying within the bounds of federal law.

Therefore, it is always foreign-flagged LNG tankers that offload supplies in Boston Harbor. It is also why cattle ranchers in Hawaii sometimes import cows via Canada, or will even fly cows by air, to reach their ranches on the islands. As ridiculous as that sounds, these ranchers do this because it is more economical for them to do so. It is also why we import rock salt from Chile rather than source it from Maryland or Virginia even though the US is the largest producer of that commodity in the world. These are some examples of the economic factors that are a consequence of the Jones Act.

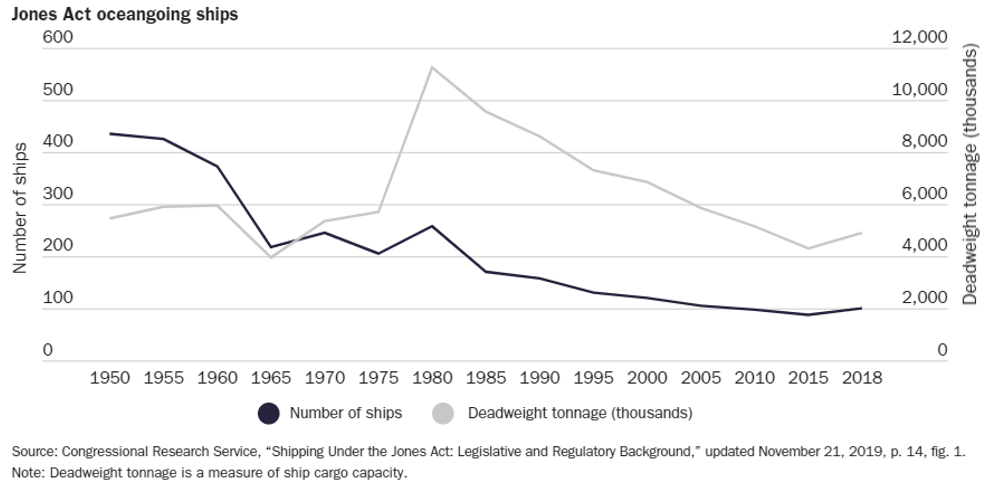

With over 100 years' worth of data, it is clear that the Jones Act distorts markets (not only energy markets) in various ways, which ultimately increases costs for US consumers. In an analysis published in 2019, the Organization for Economic Cooperation and Development (OECD) estimated that repealing the Jones Act would increase US economic output by up to $135 billion. The purported benefits to the US shipbuilding industry are simply unproven. Figure 4 shows the decline in the fleet of Jones Act-compliant ships despite the existence of the law.

Figure 4: Jones Act Oceangoing Ships from Congressional Research Service

At a time of escalating costs across the US economy (with inflation running 7% year-over-year), now is a good time to consider repealing or reforming this law. Granting certain exemptions for Hawaii, Puerto Rico, Alaska, and Guam is especially appropriate since the cost of goods in these distant states and territories are most affected by seaborne transportation costs. Furthermore, at a time of geopolitical turmoil and volatile energy markets, repealing or revising the Jones Act would enhance our national security interests by increasing domestic gas supplies in New England. The fact that an outdated federal law effectively subjects New Englanders to being islanders is nonsensical to both energy independence hawks and free-market enthusiasts across the nation.

[1] https://www.reuters.com/business/energy/penneast-end-development-pennsylvania-new-jersey-natgas-pipe-2021-09-27/

[2] https://www.washingtonpost.com/business/economy/tanker-carrying-liquefied-natural-gas-from-russias-arctic-arrives-in-boston/2018/01/28/08d3894c-0497-11e8-8777-2a059f168dd2_story.html

[3] https://www.cato.org/publications/policy-analysis/jones-act-burden-america-can-no-longer-bear#tallying-costs

[4] U.S. Department of Transportation Maritime Administration, “The Economic Importance of the U.S. Shipbuilding and Repairing Industry.”

[5] https://www.wsj.com/articles/philadelphia-shipyard-struggles-to-survive-on-order-drought-1527779834