On June 21, 2022, PJM posted the results of its capacity auction, also known as the Reliability Pricing Model (RPM), for the planning year June 2023 to May 2024. The execution of this auction has been postponed multiple times over the last few years due to FERC rulings on the validity of the PJM auction’s design. Differences between FERC and PJM seem to have finally been resolved to the extent to allow the auction to proceed. This is important because these latest auction results give the market some much-needed clarity into future capacity costs, which are a major cost component of next year’s overall electricity costs for all retail customers in PJM states.

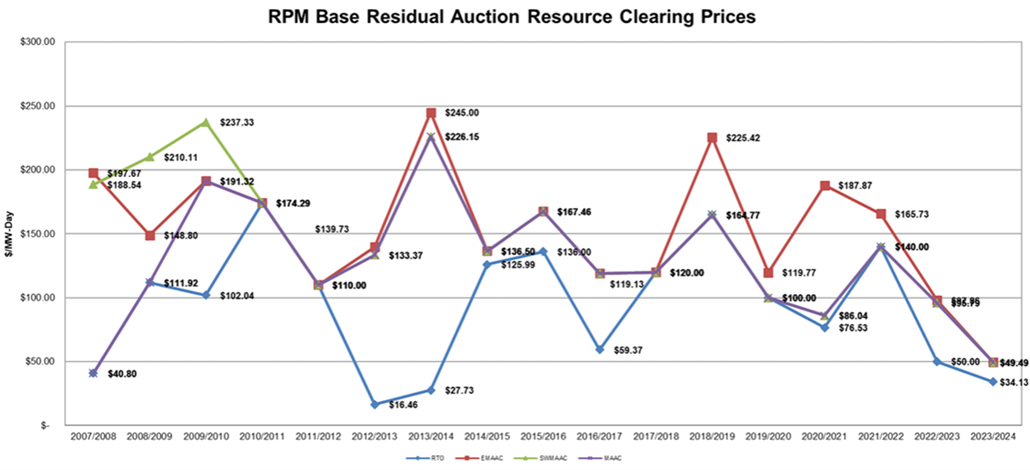

It seems the delay may have been helpful for capacity prices as this year’s auction results are record lows as shown in Figure 1. Each line in Figure 1, shows capacity prices in a particular part of PJM going back to 2007/2008. This chart clearly shows that prices in this most recent auction were down and trading between $34 to $59 per MW-day.

Figure 1: RPM Base Residual Auction Resource Clearing Prices from pjm.com

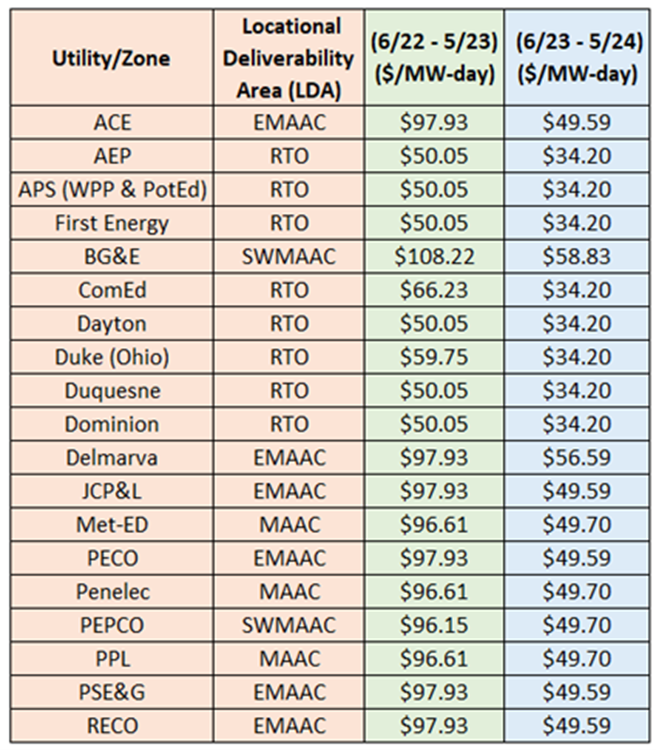

The groupings of utilities/zones in the auction are not very intuitive. A table showing capacity prices for June 2023 to May 2024 compared to prices for June 2022 to May 2023 is shown by utility zone in Figure 2.

Figure 2: Capacity Prices for June 2023 to May 2024 from pjm.com

The different assigned Locational Delivery Areas (LDAs) are grouped based on PJM’s study of transmission grid constraints along with excess and insufficient capacity reserves by utility/zone. The Mid-Atlantic Area Council (MAAC) is the LDA that typically sees price separation. The MAAC is further divided into three sub-regions: Eastern, Western, and Southwestern (EMAAC, WMAAC & SWMAAC) and summarized below.

-

Eastern MAAC: PSEG (PS), JCPL, PECO, ACE (AE), Delmarva (DPL) and RECO

-

Southwestern MAAC: PEPCO and BG&E

-

Western MAAC: Penelec (PENLC), Met-Ed and PPL (PPL)

Typically, capacity prices for these utilities are similarly close to one another. This year, the exception was in BG&E and Delmarva which cleared slightly higher than their assigned LDA. All other utilities/zones cleared at the RTO price (the lowest price point of the auction).

Overall, the targeted reserve margin of 14.8% was only slightly higher than last year’s 14.5%, and the total MWs procured, 144,396 MWs, was very close to last year’s 143,790.5 MWs. The biggest difference from last year was the change in price. Note that in many instances, prices fell 50% or more. It might seem odd that while PJM’s forward wholesale energy prices for next year are trading near all-time highs, capacity prices clear at all-time lows. However, this is exactly how the market is designed to perform.

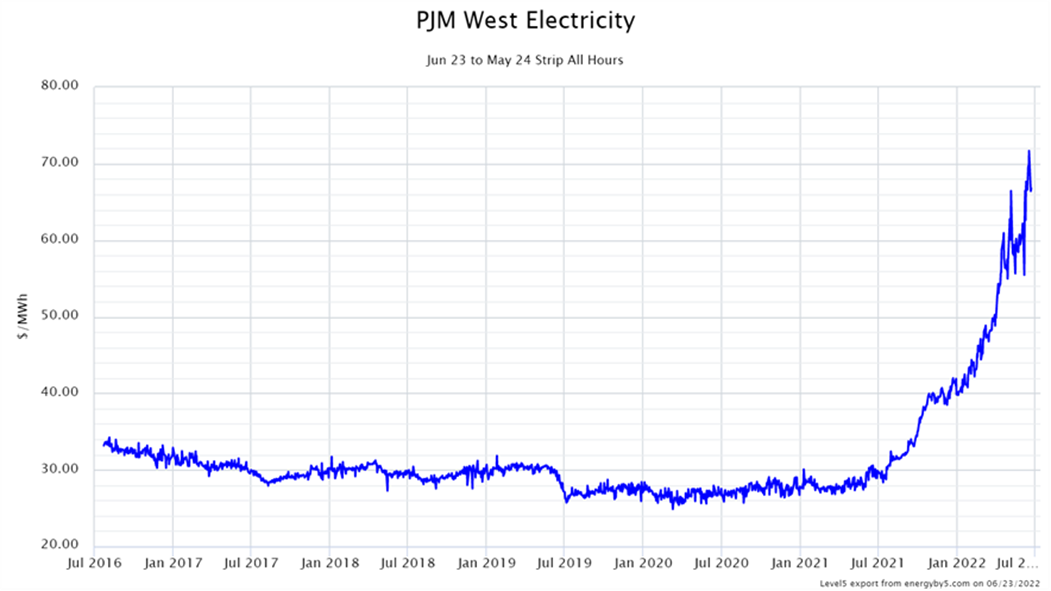

Capacity prices, by nature, are a supplemental revenue source for power plants, that pay them for their ability to be available to produce power when it is needed most. If the revenue power plant owners can get from selling the power is high, the marginal revenue needed to also provide capacity is lower. Therefore, if the forward power price for June 2023 to May 2024 is trading near all-time highs as shown in Figure 3, it is reasonable for capacity prices for that same time period to clear at all-time lows.

Figure 3: PJM West Electricity June 2023 to May 2024 Calendar Strip from 5

These lower capacity prices will provide some relief to PJM customers that have either chosen to pass-through capacity costs or those who still need to procure capacity through “all-in fixed price” agreements for this coming capacity year.