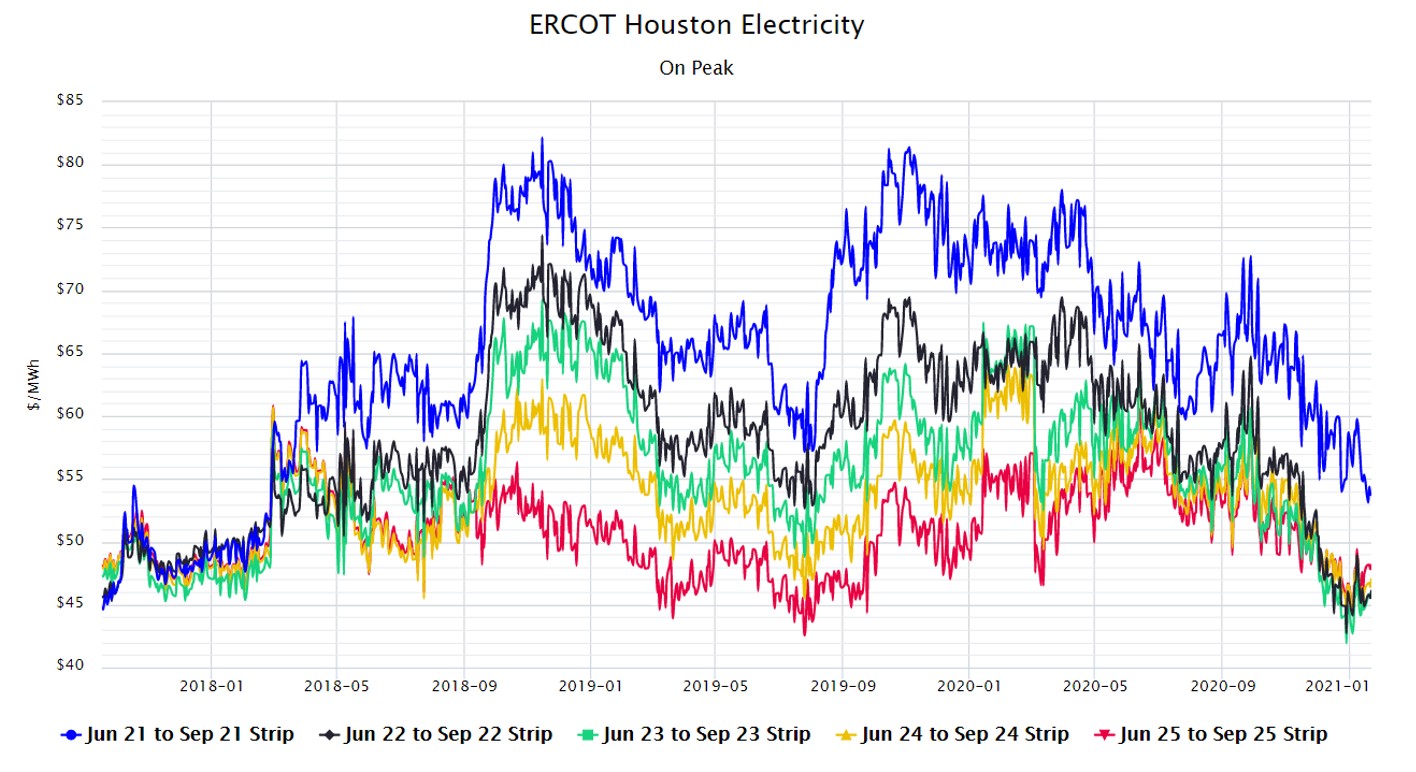

It may have taken almost four years, but the price for summer, on-peak power in Texas has finally returned to levels that were observed prior to the announced retirement of four Luminant power plants during the fall of 2017. With strong growth in both wind and solar generation in various stages of completion, the power market in Texas appears to be back to where it was before the anticipated loss of generating assets, which kicked off multiple years of price volatility. Figure 1 shows the wholesale electricity price for each of the next five summers (2021 – 2025) as they’ve traded from Sep 2017 to the present.

Figure 1: ERCOT Houston Electricity On Peak from 5

Note that in October of 2017, after another summer of low spot market prices, along with record low natural gas prices the previous year, Luminant decided it was time to retire several coal-fired generating plants across the state. The decision was primarily motivated by simple economics, as the wholesale market in Texas had dropped below the operating cost of these old, highly polluting powerplants. This announcement created a bullish market effect as the wholesale summer on-peak prices, shown in Figure 1, increased on this news. In the fall of 2017, the on-peak, wholesale power price for the next summer (June – September of 2018) was trading around $45 per MWh, while today’s average price for the summers of 2022 through 2025 is nearly the same and trading at approximately $46 per MWh. Coincidentally, the average Real-Time spot price in Houston for 2016 was $23.63 per MWh, while 2020 actuals were just slightly lower, at $22.42.

From a pure market price perspective, there are multiple similarities between the Fall of 2017 and the last few months. However, there are also fundamental differences fueled by renewable assets that are shaping todays market. Today’s forward markets are even more detrimental for legacy power plants. In the fall of 2017, market prices had just started to move away from a long-term contango market (where forward prices increase into the future) and started to transition to a flat to slightly backwardated (prices decreased into the future) market. Today, the futures market is becoming less backwardated (higher prices in the short-term, cheaper in the future) and is beginning to flatten. This movement greatly reduces the short-term economic benefit to keep power plants running, but also removes the promise of improving economics in the future due to the flat nature of forward prices.

Most of the new generation in ERCOT’s interconnection queue are from wind, solar, or battery assets. Even if natural gas prices rally in the next few months (or years), the profit margin of natural gas power plants will continue to erode as fuel prices rise and renewable power prices fall. Unless something changes, such as a rally in wholesale prices or additional revenue streams are created, we may be approaching a breaking point that leads to an additional wave of fossil fuel power plant retirements in Texas.

If there is another round of retirements for fossil fuel power plants, this market could react as it did in the fall of 2017 and rebound. The rapid deflation of today’s power market has created good purchasing opportunities for clients in Texas. Clients with open positions over the next few years should consider making purchases now and capitalize on the favorable summer on-peak prices, the dominant driver of retail electricity contract rates throughout ERCOT. Reach out to your energy advisor at 5 to evaluate your options given this current market opportunity.