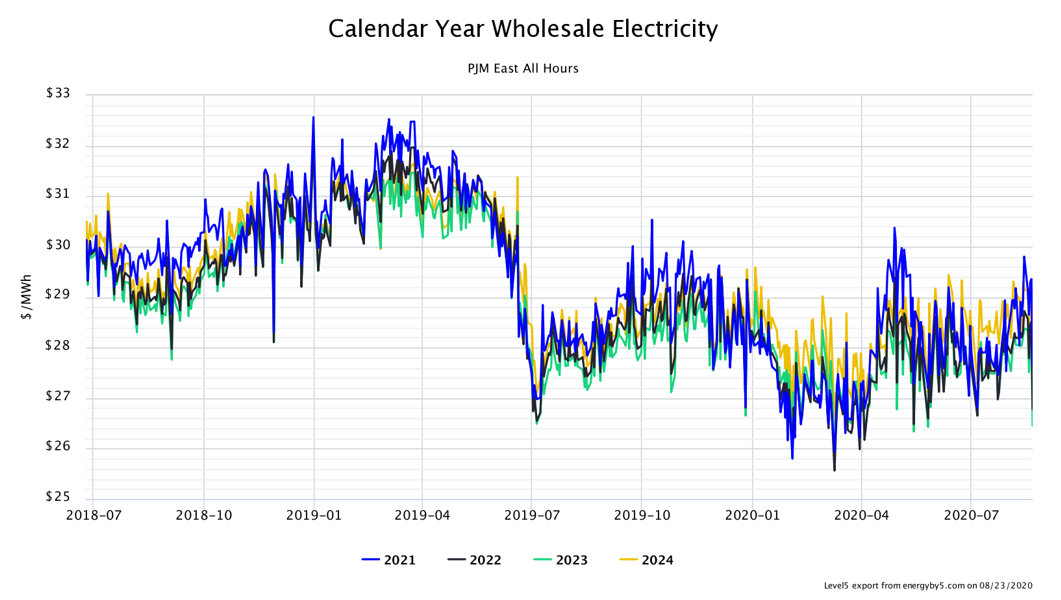

Sometimes, no news is good news. Figure 1 shows how calendar year wholesale electricity has traded for 2021 through 2024 in the eastern part of PJM over the last two years. And while this chart seems to show a significant amount of volatility, consider the scale of the y-axis when assessing market movements.

Two observations stand out. The first is that over the last two years, the wholesale price of electricity has varied from a sustained high of approximately $31.50/MWh in March 2019, to a sustained low of about $26.50/MWh in the spring of 2020. Outside of these peaks and valleys, forward prices have consistently traded between $27 and $30/MWh over the last year. The other notable observation is that there is little price separation in futures prices from 2021 to 2024. This indicates that there is neither a strong premium nor a discount for making futures purchases. You might conclude that there is little incentive to making futures purchases until you view current market prices in a wider context.

Figure 1: Calendar Year Wholesale Electricity PJM East All Hours, from 5

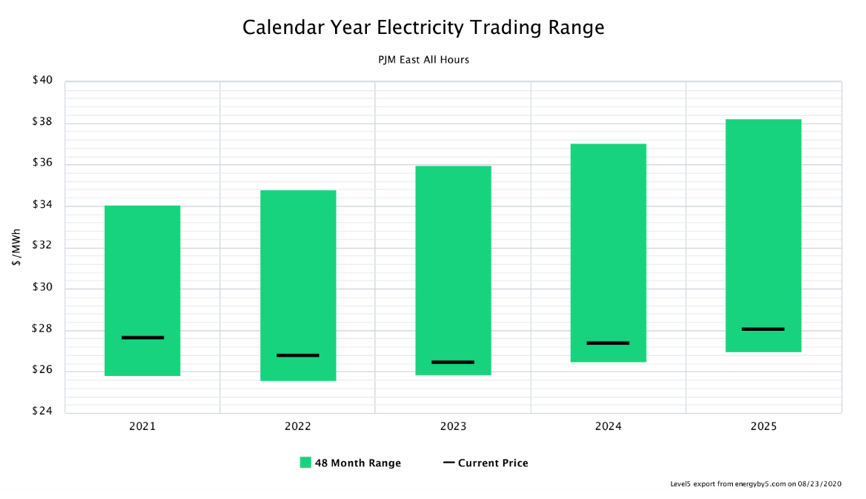

Figure 2 shows the 48-month forward wholesale trading ranges for electricity traded in the eastern part of PJM. The height of the green bar shows the 4-year range of low and high traded prices for electricity in calendar years 2021-2025. The black bar shows where prices closed as of 8/23/20. This chart shows that electricity prices in all calendar years are near the bottom of the four-year trading range. There is also a slight discount in calendars years 2021 to 2023. This phenomenon of lower prices into the future is known as backwardation and is a very good purchasing signal.

Figure 2: Calendar Year Electricity Trading Range PJM East All Hours, from 5

Most traders would look at the data in Figure 1 and say that electricity futures markets have been “flat” over the last twelve months. However, the “flatness” of this market may be changing. Since the onset of the coronavirus pandemic, futures prices have trending higher. After hitting a low at the end of March/beginning of April, futures prices in all calendar years have been rising. This is likely due to near-term bearish natural gas forces and bullish factors that are moving natural gas prices into the future. These bullish and bearish market drivers were discussed in the July 5x5.

Clients with open electricity positions in PJM through 2025 should consider making electricity purchases now, given that the market is “flat” and trading near the bottom of its 4-year trading range. However, traditional fixed-price electricity products may not be the best option for many clients. To generate a fixed-price electricity offer, suppliers will examine historic electricity usage and the peak demand for each electricity account and use that data as the basis for their fixed price. In the wake of the demand destruction that has occurred during the coronavirus pandemic, historic electricity usage and peak demand data are not necessarily indicative of future electricity usage and demand.

With retail electricity offers, uncertainty equates to risk premiums. While it makes sense to capitalize on attractive futures prices and lock-in future energy prices, clients should consider passing through other cost components, such as capacity. These alternative product structures offer ways to take advantage of low futures prices while not paying excessive premiums for other retail electricity cost components. These alternative product structures are discussed in "How Not to Buy in PJM and NYISO".

Now, more than ever, the need for clients in PJM to work with a knowledgeable energy advisory firm is critical. The right approach to risk management can make or break bottom-line expenses during this time of uncertainty. We are here to help.