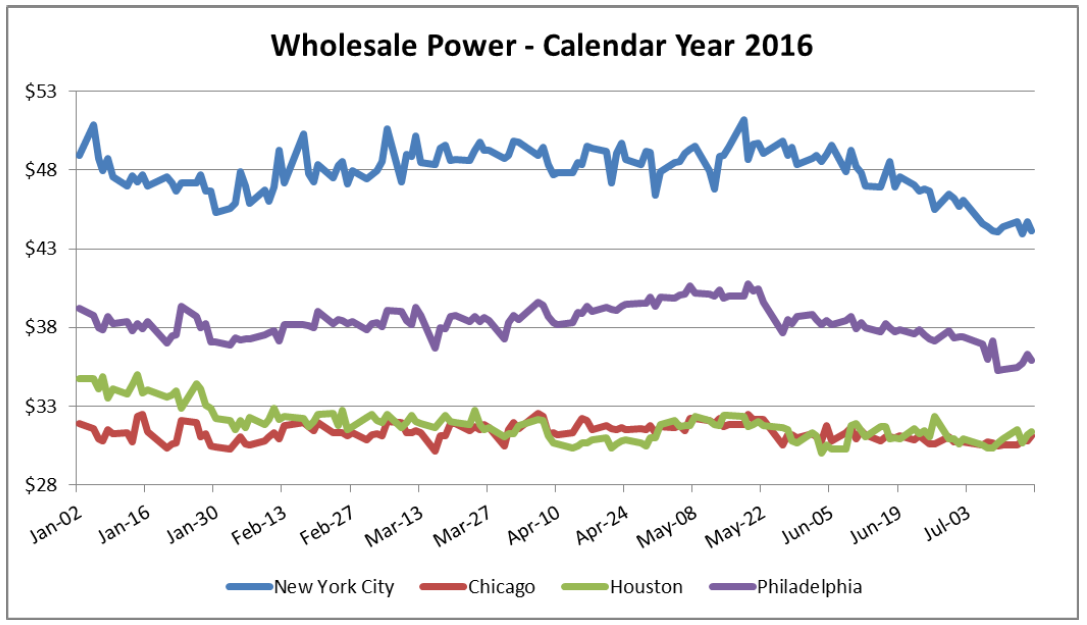

I am pleased to forward 5’s second quarter overview of the energy market. In this quarter, energy markets continued the stable trend that characterized Q1. The relative calm is unusual and presents an excellent opportunity for customers to mitigate the risk of future periods of higher volatility and take advantage of historically low prices. The energy market’s price movement during the first 2 quarters of 2015 is reflected in the following chart:

Source: energyby5.com

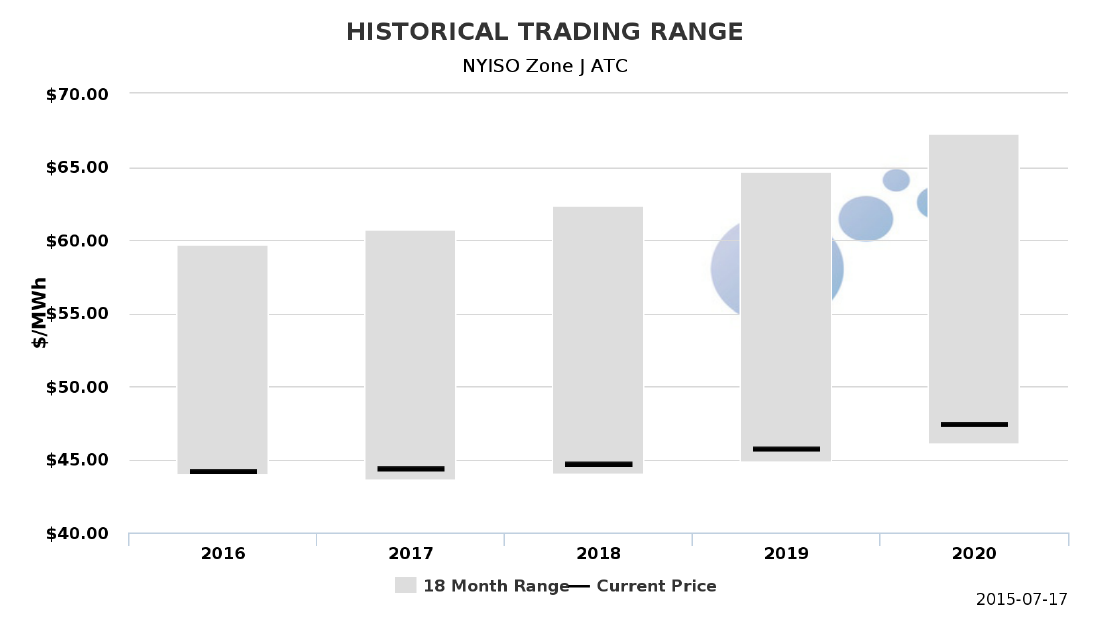

In many markets calendar year power is trading at or near historic lows. This trend is reflected in New York City’s power prices. The following chart summarizes New York City’s trading range over the past 18 months for a variety of different delivery years and provides a good example of this trend. As the chart shows, if you want to fix your power price for 2016-2020 (or for just one of those years), you can do it today at an energy price that is $15-20 MWh lower than the peak price at which power for this year has traded over the past 18 months 1.

Source: energyby5.com

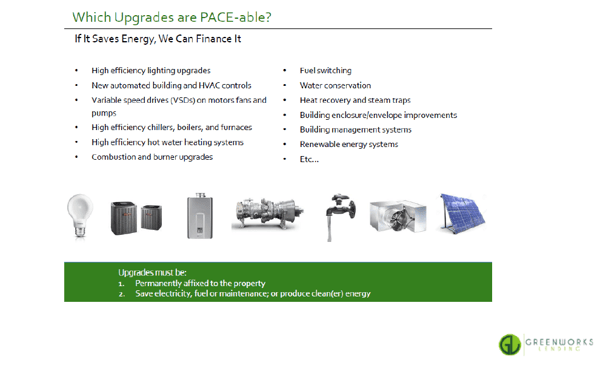

While the price of electricity and natural gas remained flat, we are following other energy market developments that present significant risk and opportunity to our clients. One important development is PACE financing. This offers a new way for clients to finance a wide range of renewable and energy efficiency projects. While the majority of this quarterly letter is focused on PACE, we will also highlight several other significant legal and regulatory developments which took place in Q2.

PACE Financing

PACE stands for Property Assessed Clean Energy Financing. PACE is driven by state

legislation which clarifies that clean energy and energy efficiency projects are a “public benefit,” no different than a road or a sewer. Lenders to a PACE project are secured by the property tax assessed on the property on which the energy efficiency or renewable project (e.g., solar panels on the roof or a new high efficiency HVAC system) is located. The property owner repays the project lenders through an increase in the property tax bill. From a lender’s perspective, PACE does several important things. First, PACE allows the lender that is financing the improvement

to leap frog over the mortgage on the property. The PACE lender is secured directly by the property tax payment stream. This significantly reduces repayment risk and results in a lower interest rate. Second, since the improvement becomes a part of the building, it legally transfers with the building. If the current owner sells the building, the new owner automatically assumes any remaining payments (as well as the benefit of lower energy costs). This avoids the potential conflict that can exist if the purchaser of a property decides it does not want to assume the building owner’s payment obligation for capital improvements. As long as someone acquires

the property and pays taxes, the PACE loan will be repaid.

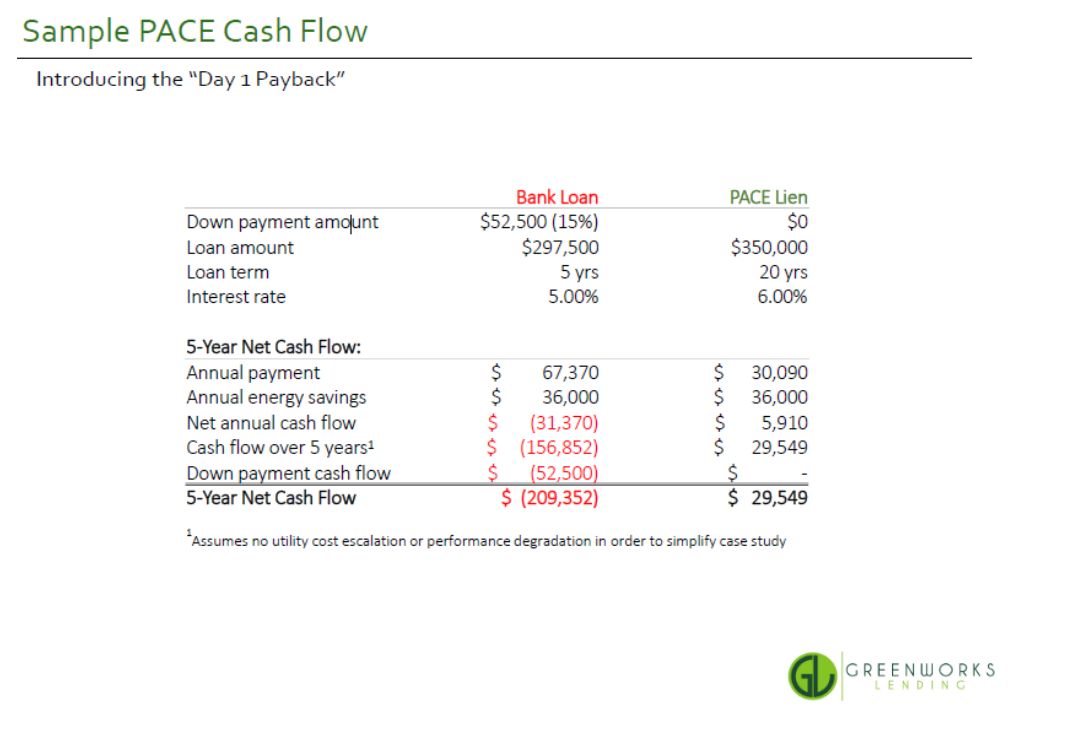

PACE not only creates an attractive loan for lenders, it is a great way for property owners to realize significantly lower energy costs without any out of pocket expenditure. The property owner repays the cost of the energy improvement through the property tax payment. Most importantly, projects are cash flow positive from day 1, as the value of the annual energy savings must exceed the annual property tax payments. The chart below demonstrates the difference between an energy efficiency project that generates $36,000 per year in energy savings financed with a traditional $297,500 bank loan with a 5 year term and one financed with a $350,000 PACE loan with a 20 year term. As you can see from the example below, in the case of the PACE loan, the building owner realizes almost $6,000 in yearly savings and is not required to make any capital investment to realize these savings.

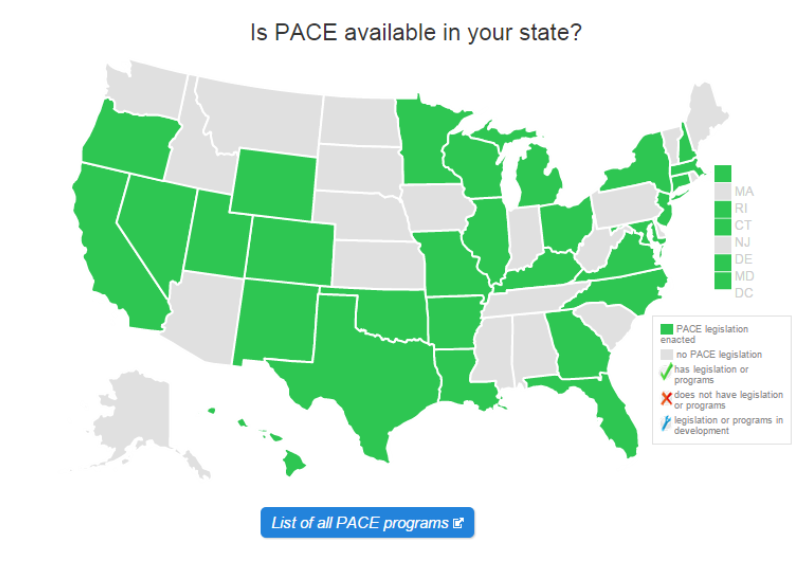

38 states have adopted PACE legislation, and programs have already been implemented in 14 states. A very strong coalition of groups is working to implement PACE. This includes renewable energy companies and the lenders interested in financing renewable and energy efficiency projects. PACE is already available in Travis County, Texas and we expect it to be rolled out in Houston by late fall, and in many other Texas jurisdictions including Dallas by the end of the year. PACE is also available in the District of Columbia, California and Montgomery County, Maryland. We expect PACE to grow quickly with many other states and jurisdictions expected to open up for PACE financing in the next 12 months.

Depending on the state in which the PACE project is located, there are some restrictions on which buildings qualify for PACE. Most commercial and industrial projects in PACE areas qualify for PACE financing. Generally, the cost of the project cannot exceed 35% of the building’s value and the debt on the property cannot exceed 100% of the property’s value. Not surprisingly, properties in bankruptcy do not qualify for PACE.

PACE works well for a wide variety of property owners, ranging from small restaurants to large hotels. One of the largest PACE projects is the Hilton Universal Hotel in Los Angeles. This 23 story hotel undertook a $7 million PACE project that targeted a wide range of energy improvements including new HVAC motors, chillers, lighting upgrades and new shower heads. The project had an ROI of 78%.

PACE is also appropriate for small commercial property owners, such as Salut Bar Americain, a neighborhood restaurant in Edina, Minnesota. The restaurant used PACE financing to fund only two projects, the installation of LED lights and kitchen hood controls. The $40,000 project resulted in initial savings of $5,500 per year (which ramps up to $15,000/yr once the PACE loan is repaid). We are currently working with a number of vendors and financing parties to roll out PACE programs in multiple markets. Please do not hesitate to contact our team if you have further interest in this program.

PJM Capacity Program

The relative quiet in the energy markets is in stark contrast to recent legal and regulatory activity. On June 9, FERC approved a very significant change to the capacity market in PJM. The changes to capacity are designed to avoid the reliability issues faced by the PJM market in the cold winter of 2013/2014. PJM’s capacity performance plan is designed to achieve greater reliability by increasing the penalties assessed against capacity resources that fail to meet PJM’s performance standards. Aspects of the new capacity model will be introduced in the next capacity auction scheduled for August 10. PJM is currently working on additional filings needed

to implement the new program. The new capacity rules are expected to increase capacity prices in PJM and significantly change the way in which renewable energy and demand response resources participate in the market. While it is too early to say for sure how these changes will impact our clients, one thing is sure: we will see higher capacity prices and increased uncertainty which will add to volatility in capacity and energy pricing. Unfortunately, there is very little that a retail customer can do to protect against this kind of regulatory change.

Supreme Court Invalidates MATS (Mercury and Air Toxics Standards)

On June 29, the Supreme Court held that the EPA violated the Clean Air Act when it decided in 2002 and 2012 that it was “appropriate and necessary” to regulate mercury emissions from power plants. The Supreme Court found that the EPA failed to consider the cost at the initial point of the rule making process. This decision will require lower courts to figure out what happens next. It is unclear if this ruling will have a material impact on coal plant retirements. The EPA required plants to meet the MATS standard by April 2015 and many plants have made the necessary investments to meet the EPA’s MATS standards. A relatively large number of plants were granted a one year extension until April 2016 to meet these MATS standards. It is too early to tell how the ruling will impact these plants. Texas tops the list of states with generation plants operating under the MATS extension, some 16,500 MWs. The possible relief offered to coal plant owners may not be enough to save them in the face of the continued low price of natural gas. In April, for the first time, the US generated more of its electricity from gas than from coal. Coal generation declined by 3,300 GWs in 2014 and the EIA expects this decline to increase to 22,900 GWs in 2015.

Federal Energy Legislation

A wide variety of energy legislation was recently introduced in the House and in the Senate. Commentators suggest that in spite of partisan politics we might actually see this result in comprehensive energy legislation. This optimism is driven by the general consensus that we need to make significant investments in our natural gas and electricity infrastructure. The new legislation addresses many energy related categories including energy efficiency, infrastructure, and supply. We will continue to monitor the House Energy and Commerce Committee and the Senate Energy and Natural Resources Committee as these various bills work their way through the legislative process.

As noted earlier, all of these legal and regulatory developments create market uncertainty. We have experienced times of market uncertainty and there is no doubt that when market rules are not clear and/or are subject to change, volatility increases. While it is too early to predict how these various changes will impact the market, the uncertainty that is driven by these proposed changes is another reason for clients to take a close look at ways to take advantage of the current low energy prices and limit their exposure to future energy price volatility.