I am pleased to forward 5’s second quarter overview of the energy market. Weather was our key issue in Q1. This quarter we focus on demand response, another trend which can be linked, in part, to the high short term electricity and natural gas prices we saw in the first quarter.Many markets now have regulated and market driven demand response (or DR) programs. These programs pay customers during periods of peak energy demand when they (i) run on-site generation and/or (ii) take steps to reduce their electricity usage. While Q1’s prices caused immediate pain to consumers and many energy suppliers, this same volatility increased the value and importance of demand response. At 5, we see this trend not just in reported data; we are spending an increasing amount of time working with our clients on new and innovative ways to install and realize the value of on-site generation assets.

The range of new products and creative ways to use demand response solutions reminds us of how little has really changed in the energy markets. Retail markets deregulated over 10 years ago. Although there has been some change, the basic building blocks and structure of electricity systems remain largely unchanged. The radical transformation that competition brought to telecommunications and other industries when deregulated is not yet evident in electricity markets. The lack of comparable change in the energy market helps to create a significant opportunity for creative new products including distributed generation solutions. However, owners of traditional utilities and generation assets will not facilitate this transformation. Instead, they will take significant steps to oppose such changes. We saw the impact of this opposition in the past quarter as well.

Demand Response

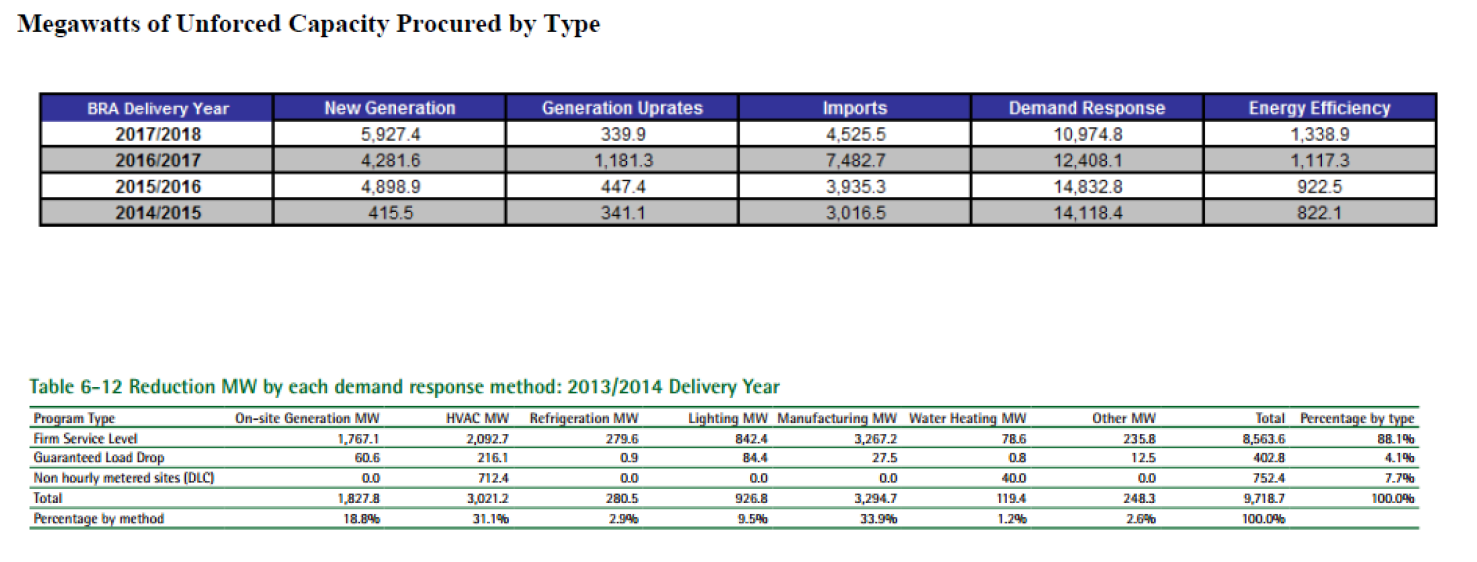

One way to see the increasing importance of demand response is in PJM’s 1 capacity auctions. These auctions are used by the transmission organization to secure contracts with a sufficient amount of generation to meet anticipated electricity demands. In May, PJM published its results from its most recent capacity auction. In this auction, almost 11,000 MWs of demand response resources qualified for capacity payments in 2017/2018. As the following chart shows, over the next four years, demand response will be a far more important source of new electricity than the construction of new power plants.2 PJM relies on a broad range of demand resources to meet the region’s energy needs. This includes both on-site generation and various types of load reduction. In many cases, the load reductions are not reliable resources when there is an emergency event (the example we used in our Q1 letter were air conditioners that could not reduce load during the polar vortex).3 As noted in Table 6-12, only 18.8% of demand response in PJM in the 2013/2014 Delivery Year was from on-site generation.4 We expect that PJM and other market operators will place additional restrictions on demand response resources and such restrictions may create additional demand for on-site generation.

Regardless of the some of the challenges that arise when demand response is used to meet peak power needs, recent steps taken by the State of New York and developments in Texas suggest that there will be more, not less, emphasis on demand response resources. On April 24, 2014, Governor Andrew Cuomo announced New York’s new vision for its electricity future, one under which “the traditional utility business models and cost-of-service regulation could quickly become obsolete, while individual customers are set to become active participants on the grid.” A report issued by the staff of the New York State Department of Public Service (DPS) suggested widespread changes in the structure and regulation of energy assets. Instead of looking at demand response and distributed resources as a last resort, New York DPS staff said such resources should be considered as a “primary tool to manage distribution system flows, shape system load, and enable customers to choose cleaner, more resilient power options.”

Unlike in New York, where changes may be driven by regulators, in Texas, the free market is driving increased interest in demand response, specifically the potential for very high peak electricity prices. ERCOT’s wholesale electricity cap moved up to $7,000 per MWh in June 2014 and goes to $9,000 per MWh in June 2015 (the cap in New York is closer to $1,000 per MWh). This means that if there is a shortage of electricity, hourly prices could go from current levels, around $60 MWh, to $9,000 MWh (i.e., $9/kWh!). At these levels, the economics of running on-site generation are straightforward. The potential to realize very high prices at times when the existing system is strained is incentivizing a wide variety of demand response projects. We see evidence of this with various client projects where the client’s interest in installing on-site generation is met by developers willing to offer very advantageous structures to support such projects.

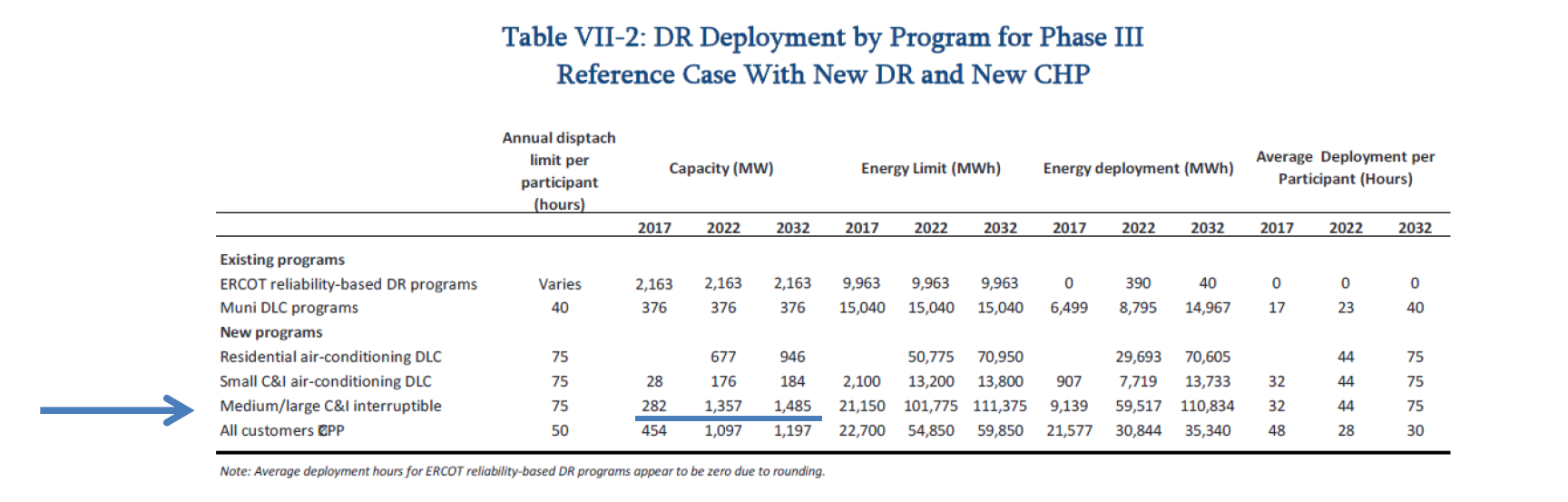

Additional support of demand response came in a May report issued by The Brattle Group.5 Brattle’s report explains the importance of demand response (as well as energy efficiency and combined heat and power projects) in meeting ERCOT’s projected need for new generating capacity. Brattle forecasts that by 2017 various types of demand response resources will grow by 20% to 30%. This amounts to 450-760 MWs. By 2032, this number increases to 2,300 MWs - 3,800 MWs. ERCOT has closely followed this analysis. The Texas grid operator provided data to support Brattle’s research and an ERCOT spokesman, Robbie Searcy commented, “The scenarios in this report are not inconsistent with the possible scenarios we considered in our last 2012 long term system assessment.”

The following table shows Brattle’s projected deployment of each of the various demand response programs within ERCOT. For our clients, the most important section of the table is the fifth row. We highlight this as it reflects projects that are likely to occur at client sites. Based on the level of interest we have already seen among our clients, the 282 MW projection by 2017 is conservative.6

Owners of generation realize that the move to a more distributed generation structure (one that utilizes load reduction programs and a larger number of small generating units in place of a few large centralized power plants) will radically reduce the value of their assets. For this reason, the Electric Power Supply Association (EPSA), together with other associations that represent power producers, is the lead plaintiff in a federal lawsuit that seeks to invalidate a central tenet of many demand response programs, Federal Energy Regulatory Commission (FERC) Order No. 745. This Order insures that demand response resources are paid the same price for reducing electricity demand that generators are paid when they generate electricity 7.

The board members of EPSA include many leading energy businesses, such as BP, Calpine, Exelon, GDF Suez, NRG, PPL, PSEG and Shell. As stated in the plaintiffs’ brief, “EPSA’s members have significant financial investments in electric generation and electricity marketing operations across the country.” In the last quarter, EPSA had a significant legal victory. On May 23, 2014 the US Court of Appeals for the DC Circuit issued a split decision in EPSA v. FERC which invalidates, in large part, FERC’s Order No. 745. The issues being litigated in EPSA v. FERC are complex and beyond the scope of this summary discussion. In brief, however, regulation of the power market is split between the federal government and the states. FERC has authority to regulate the sale of wholesale electricity and to ensure that rules and regulations affecting wholesale rates are “just and reasonable.” Regulation of retail sales are the responsibility of the states. FERC argued that Order No.745 was within its jurisdiction as demand response programs affect wholesale rates. The Court’s ruling was based on its finding that demand response is part of the retail, not wholesale, markets.

The DC Circuit Court’s decision is likely to face extensive review. FERC has moved to have the case reheard by the entire court – an en banc review. Granting en banc review requires the vote of a majority of the active judges on the DC Circuit. Since EPSA’s arguments seek to limit the scope of Federal regulation, votes may break down along party lines with conservative judges supporting the limits to federal powers in the Court’s opinion, and more liberal judges seeking reversal. Regardless of whether an en banc hearing is held, the case is likely to be appealed to the Supreme Court.

Almost before the ink dried on the Court’s opinion, FirstEnergy (a large Ohio based utility with extensive generation assets) filed an emergency complaint at FERC. In its complaint, FirstEnergy requested that FERC order PJM to remove “all portions of the PJM Tariff allowing or requiring PJM to include demand response as suppliers to PJM’s capacity markets.” It also requested that in the most recent capacity auction all demand response resources that were included as capacity resources be “considered void and legally invalid.” If FERC agrees to FirstEnergy’s request, the impact on capacity prices, and therefore consumers’ prices, in PJM would be very significant. In addition, this would be a serious blow to the value of demand response and its associated programs.

Ten years ago, we would have given the established players, companies like FirstEnergy, pretty good odds that they could use the courts and their lobbyists to turn back the growing support for distributed generation and demand response. Today, the playing field is more complex. A wide and diverse group of stakeholders has and will continue to support FERC’s position. Those who have already taken a public position in support of FERC’s Order No. 745 include demand response providers like Enernoc, the Maryland PSC, PJM, the Pennsylvania PUC, various large industry associations like the Steel Producers and American Forest and Paper Association, Walmart, the New York PSC, the Delaware PSC, the New England PUCs (Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont), and National Grid (the utility that owns a large portion of the electricity and gas transportation network in the Northeast). We will follow the litigation at the DC Circuit and FirstEnergy’s actions at FERC closely. Regardless of the DC Circuit’s rulings and potential modifications to FERC Order No. 745, we feel it will be very difficult for companies like FirstEnergy to turn back the groundswell of support for demand response as an efficient way for the market to economically address peak power demands.

EPAs Proposed Regulation of Carbon Emissions from Electricity Generating Units

Although the focus on this quarter’s letter is demand response, we cannot discuss the energy market in Q2 without at least a summary discussion of the EPA’s proposed regulation of carbon. On June 2, 2014, the EPA issued its much awaited rules and proposed a 30% reduction in CO2 emissions from fossil fuel fired generation units by 2030.8 The law firm Sidley & Austin was kind enough to identify “Five Things You Need to Know” about the new regulations. We agree with Sidley’s analysis and like anything with the number “5” in it so we are passing this list on:9

- CO2 reduction targets set for each state and vary depending on the mix of emissions and power generation sources in each state.

- EPA can consider reductions in emissions from sources other than existing power plants, such as demand-side energy efficiency improvements or increased renewable capacity. Expanding the regulation in this way, referred to as “Outside the Fence Line” could subject the regulations to increased risk of legal challenge.

- EPA gives states broad flexibility in deciding how to achieve the emission reduction targets. The range of possible solutions includes market based trading programs, renewable portfolio standards and demand side energy efficiency programs.

- The proposal is referred to as a guideline but it is actually a rulemaking. If the proposed targets are finalized, they are binding on each state.

- Congress will increase its engagement on this issue. Expect significant legislative and legal action on the new rules in the months ahead.

These rules, if finalized, will make coal fired generation less economic and further accelerate the shift to a natural gas based generation infrastructure. Comments on the rules are due by early October 2014. The EPA hopes to issue final rules by June 2015 and to require states to submit compliance plans by June 30, 2016. The road from these proposed regulations to the enforcement of CO2 reductions on existing power plants will be long and winding. Nevertheless, this represents a significant step in the direction of further regulation of carbon emissions and another challenge for coal fired power plants. We will continue to monitor progress as EPA’s regulations move through various legislative and legal challenges.

In conclusion, please note that there is an immediate opportunity for clients, particularly in ERCOT, that have the space and are interested in installing 1MW or more of on-site generation to back up existing energy needs. If you are interested in learning more about these opportunities, please do not hesitate to contact me or other members of the team at 5.

3 Of course, these same risks generally do not apply to customers that qualify for DR revenue by running on-site generation units.

4 Monitoring Analytics, LLC, State of the Market Report for PJM, May 15, 2014.

6 The increasing focus on demand response is not limited to the United States. Recent reports detail how Kansai Electric Power, a utility in western Japan, is working with a large retailer to test offering discount coupons at retail stores that are only valid during the actual hours of a peak event. Faced with generation shortages related to the shutdown of nuclear plants, Kansai has taken the innovative step of paying customers to leave their homes during peak energy usage times.

9 http://www.sidley.com/EPAS-Proposed-Regulation-of-Existing-Utilities-Five-Things-You-Need-to-Know-06-02-2014/