On behalf of the team at 5, I am pleased to forward our market letter for the fourth quarter of 2019. Today energy deregulation is a tale of two markets. The Mid-Atlantic states (PJM), New England (NEISO) and New York (NYISO) are caught in a struggle between state regulators who seek to subsidize carbon-free generation and opponents who argue (for economic, policy, or political reasons) that these subsidies threaten the viability of a competitive market. The debate reached a crescendo last quarter when the Federal Energy Regulatory Commission (FERC) issued an order that effectively undercuts current state subsidies of carbon-free power generators.

While PJM, NYISO and NEISO struggle with the energy market’s structure, Texas

(ERCOT) continues to follow a model that depends more exclusively on the energy market’s ability to address supply and demand. Over the past few years, excellent wind and solar resources, combined with limited regulation have resulted in a rapid expansion of large scale solar and wind projects in Texas. At the same time, across all markets, a growing surplus of natural gas drives significant purchasing opportunities. For a national energy buyer, the situation remains complex and confusing. Add to all of that there is an election in November; it is going to be an interesting year.

Natural Gas

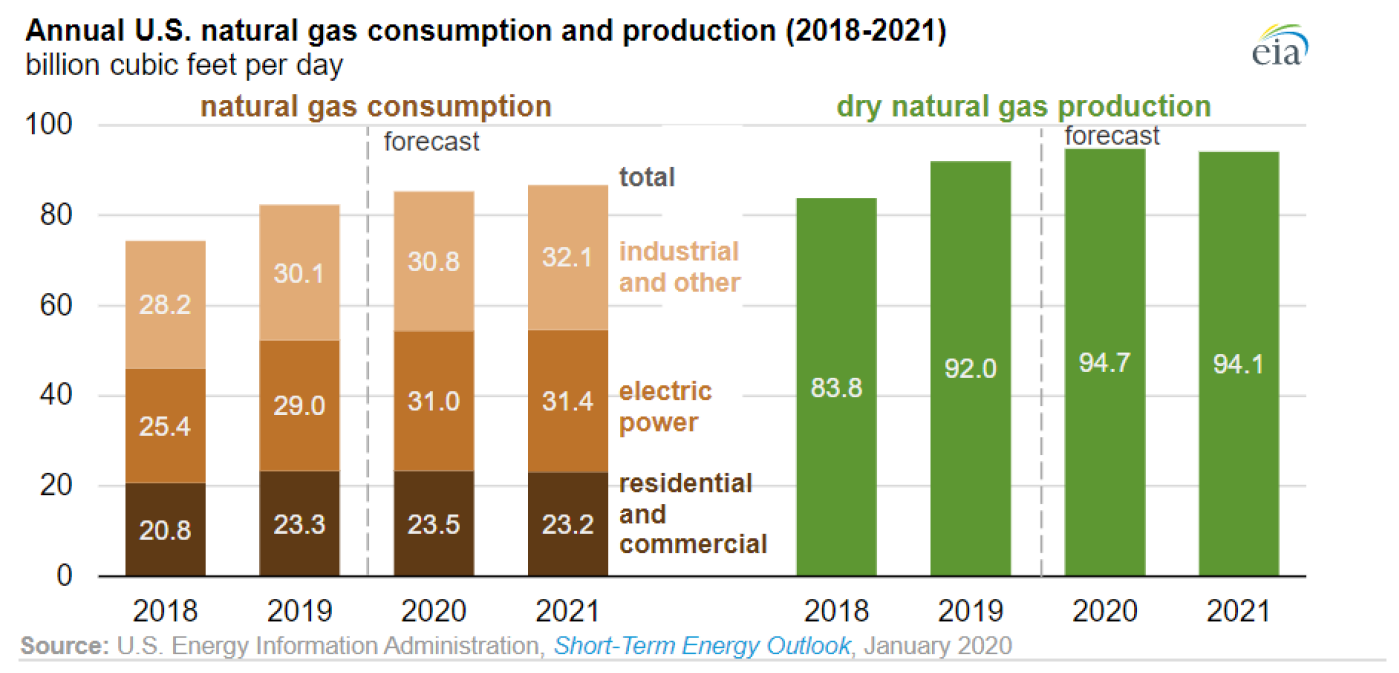

As I was finalizing this letter, the natural gas market continued an impressive sell-off. The U.S. Energy Information Agency (EIA) projects record production levels through 2020, while consumption remains relatively steady. The current production surplus is shown in the chart below.

Figure 1: Annual U. S. Natural Gas Consumption and Production, by eia.gov

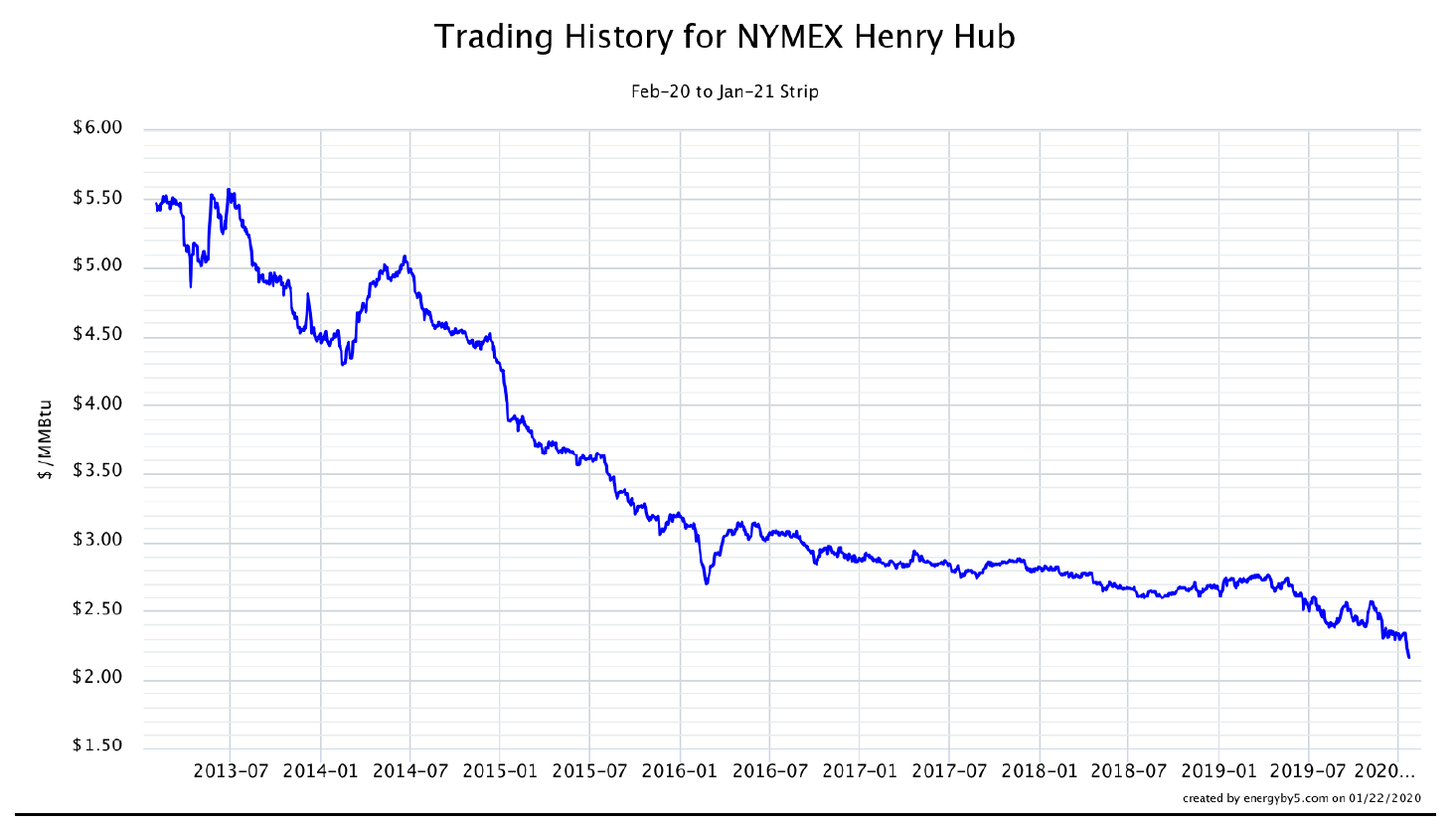

This supply and demand situation allowed the market to brush off recent tensions in the Middle East. Natural gas is trading at or near historic lows. The February contract is trading below $2 MMBtu for the first time since June 2016. The forward market reflects the overall trend. The chart below shows that the 12-month NYMEX contract is trading well below $2.25 MMBtu for the period beginning in February 2020.

Figure 2: Trading History for NYMEX Henry Hub, by 5

This is a strong buying signal for any open power or natural gas positions.

FERC’S MOPR Ruling

Unlike ERCOT, which relies solely on the price of energy to ensure sufficient supply, the PJM market, NEISO and NYISO all rely on capacity payments to ensure that there is enough supply to meet demand. Like energy, the capacity price is set in an auction. Generation units that are awarded capacity payments are guaranteed a fixed revenue stream, even if they do not run. This revenue is designed to ensure that such units are “available” at times of peak energy demand.

States increasingly use out of market payments to subsidize the market revenue received by carbon-free generators.1 These payments allow carbon-free generators to lower their capacity bids since they are already guaranteed revenue by state incentives. Out of market subsidies improve returns and allow the plants to bid lower in capacity and energy auctions. Fossil fuel generators correctly argue that these out of market payments suppress the price of capacity to their detriment.

A December ruling by the FERC upended the current regulatory structure. In December, the FERC commissioners voted 2-1 to apply the Minimum Offer Price Rule (MOPR)2 to almost all generation that receives or could receive a state subsidy. The ruling picks up Renewable Energy Certificates (RECs), Zero-emissions credits (ZECs), carbon tax revenue, cap and trade programs, and many other clean energy standards. It also applies retroactively to nuclear plants that receive ZEC revenues. If this rule is imposed, the independent system operator will determine the minimum capacity price that can be bid by these units.

The new rule does not apply to federal subsidies (for example tax credits for fossil or renewable generation) or to units already in operation or advanced development. The FERC ruling challenges state efforts to support carbon-free generation. PJM, which has delayed the next capacity auction pending the FERC’s ruling, has 90 days to come up with a new set of rules to govern capacity auctions. While the ruling was directed at PJM, it will have a similar impact on NEISO and NYISO.

The ruling has created a whole host of questions and casts a shadow over the market. These questions include:

- When will the next capacity auction take place?

- Is a carbon tax considered a state subsidy?

- Are voluntary REC payments picked up by the rule?

- Will states opt out of the capacity auction all together (something being considered by Illinois)?

We will be monitoring developments closely and working with our clients to make sure retail contracts adequately address the uncertainty caused by this ruling.

The Ruling’s Impact on Capacity Prices:

The only Democratic FERC commissioner, Commissioner Glick, strongly opposed the ruling. He argued that it was a political effort to halt state support for carbon-free generation and would increase capacity prices by $2.4 billion per year. It is too early to tell if Commissioner Glick’s prediction is accurate. The future price of capacity will vary depending on many factors including load growth, the cost of new generation units, and the retirement of fossil and nuclear generators. When the ruling was first issued, one investment bank suggested it would increase capacity prices by $30 MW/day. More recently, the same bank predicts it will have little to no impact on capacity prices. We will not know the true impact until we see the results of the next capacity auction, and at this point, we cannot even estimate when that auction will take place.

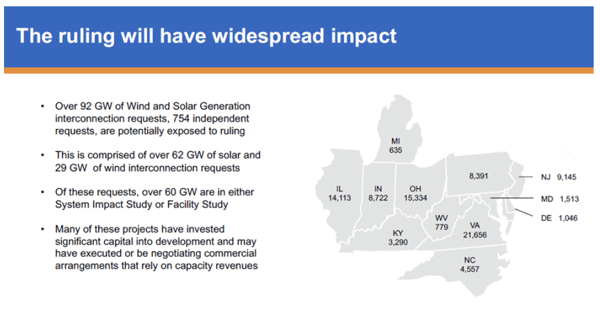

One thing is clear, the FERC rule will decrease the revenue paid to renewable projects in development. As the chart below demonstrates, the FERC ruling will impact some 92 GWs of wind and solar assets (754 projects) in development in PJM (projects that have executed interconnection agreements are grandfathered and not impacted by the new MOPR rule).

Figure 3: Potential Impact of Expanded MOPR on Advanced Energy Participation in PJM, by aee.net

According to Eamon Perrel of Apex Wind, the price of wind PPAs in PJM will increase by $3-$7 per MWh, and the price of solar Power Purchase Agreements (PPAs) will increase by $5-$9 per MWh to address the risk posed by the MOPR ruling. This amounts to a 10-20% increase in the cost of wind generation and a 15-25% increase in the cost of solar. If the current situation is not complex enough, the composition of the FERC is determined by the President of the United States. A Democratic President focused on climate change is likely to change the composition of the FERC, and a new set of FERC commissioners may well side with Commissioner Glick and reverse the recent ruling.

ERCOT: Continued Improvements in Summer Supply

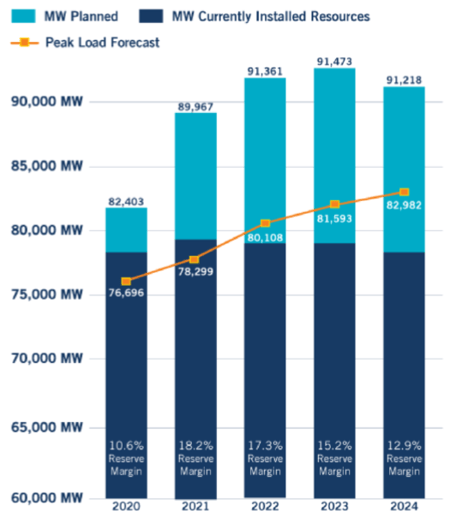

While the capacity markets struggle to address the recent FERC ruling, ERCOT’s energy-only market continues to shine.3 In December, ERCOT issued its report on capacity, demand, and reserves for the 5-year period through 2024. While there continues to be some concern with capacity for the summer of 2020, the expected reserve margin (amount of excess generation) has increased by 2% since the pre-summer analysis. The projected surplus is greater in 2021 and beyond. The following chart issued by ERCOT in December paints a pretty rosy supply picture.

Figure 4: ERCOT: Continued Improvements in Summer Supply, by ercot.com

Figure 4: ERCOT: Continued Improvements in Summer Supply, by ercot.com

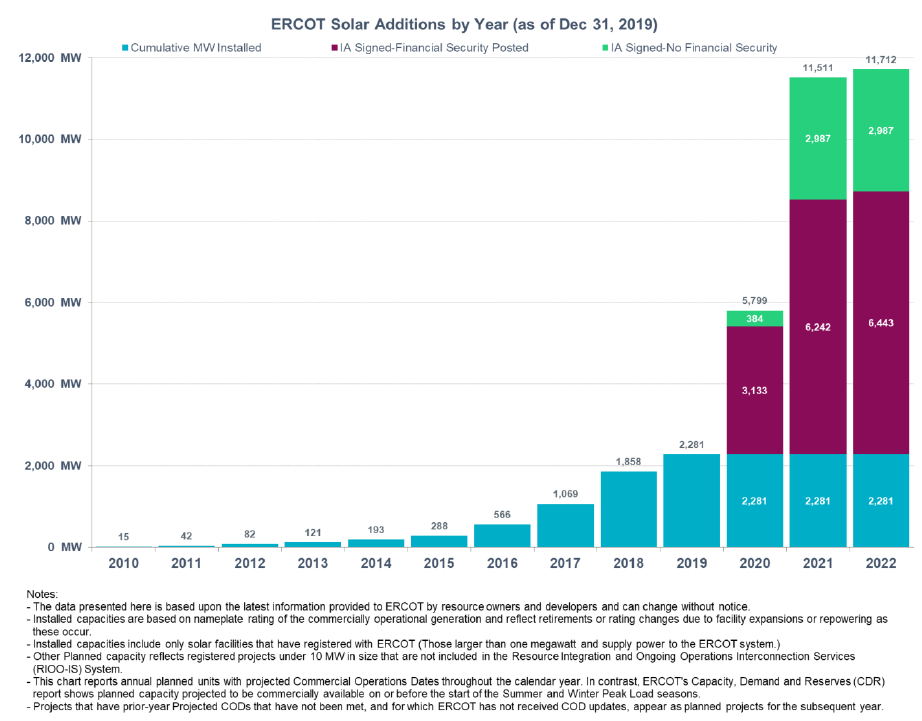

This surplus is driven by a simply amazing quantity of new solar and wind generation. The chart below shows the growth of solar generation in Texas.

Figure 5: ERCOT Solar Additions by Year (as of Dec 31, 2019), by ercot.com

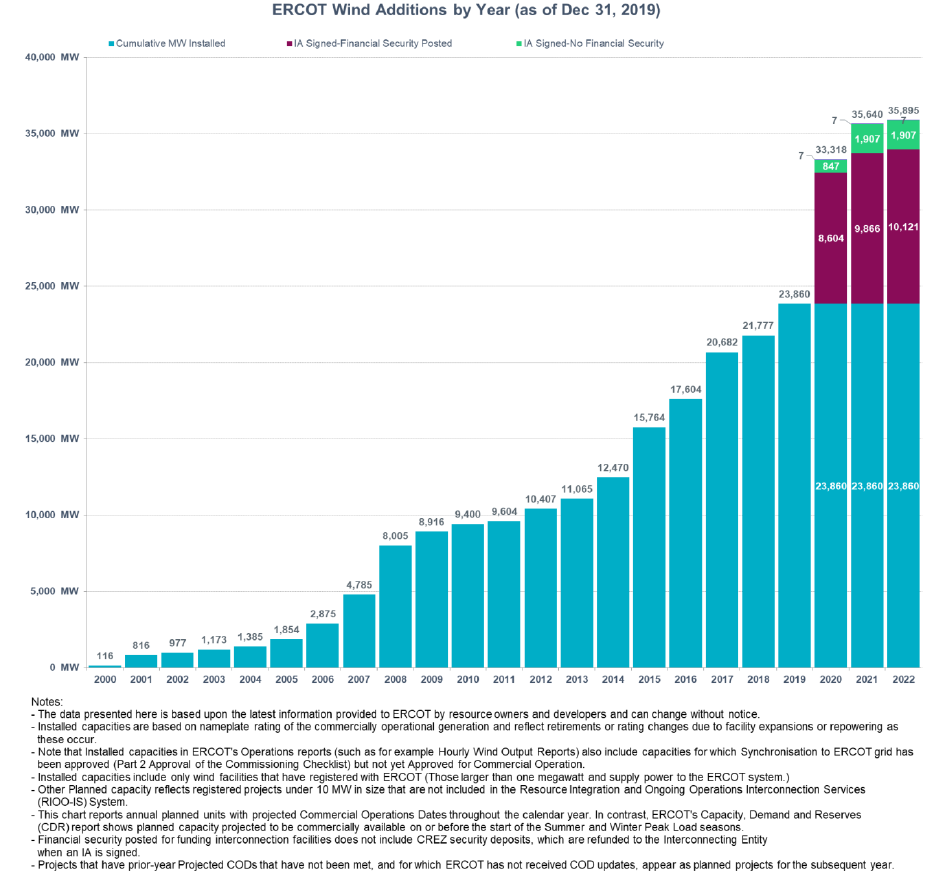

The wind chart is equally impressive.

Figure 6: ERCOT Wind Additions by Year (as of Dec 31, 2019) by ercot.com

Current projections are for around 6 GWs of new solar by 2021, 7 GWs of new solar by 2022, 3 GWs of new wind by 2021 and 3.5 GWs by 2022. The large project queue creates an immediate buying opportunity for large energy consumers in Texas.

Conclusion

In summary, 2020 looks to be another year of both opportunity and uncertainty. We continue to urge our clients in ERCOT to aggressively consider making electricity supply purchases. In PJM, NYISO, and NEISO, the situation is much more complex. While low natural gas prices create buying opportunities, the regulatory situation in each state needs to be carefully considered when structuring retail contracts. And on the west coast, the issues faced by consumers in California would fill an entire letter themselves. We look forward to working with you in 2020 and of course, please do not hesitate to contact me or other members of the 5 team if you would like to discuss the issues covered in this letter in more detail.