On behalf of the team at 5, I am pleased to forward our February market letter. This letter discusses: (i) the recent fall in natural gas prices and increasing natural gas price volatility, (ii) the 188th Congress and the potential impact of the election on Federal and State energy policy in 2023, and (iii) how the electricity grid held up during Winter Storm Elliott and the February cold snap.

The Fall in the Price of Natural Gas and the Rise In Volatility

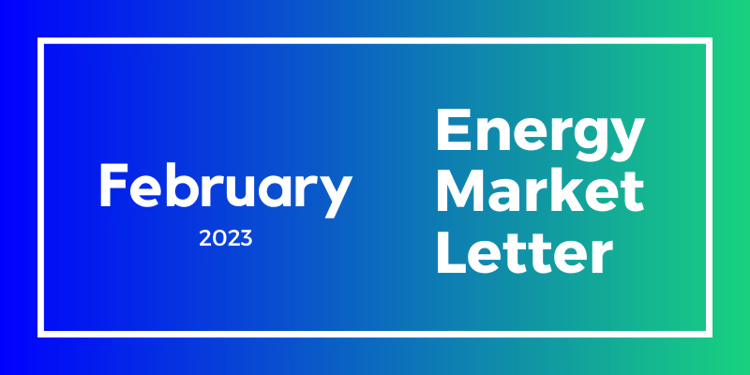

The dramatic fall in the price of natural gas is the most important near-term change in the energy market. The price decline is shown in Figure 1 and was driven by two events that significantly increased the amount of natural gas in storage. First, an explosion and fire at one of the nation’s LNG export facilities, Freeport, shut down the facility and reduced the amount of natural gas being converted to LNG and exported to Europe and Asia. Second, record warmth throughout most of the US reduced the consumption of natural gas. These two events added almost 1,000 Bcf of natural gas to storage. This is around 25% of the available storage capacity in the United States.[1]

Figure 1: By 5

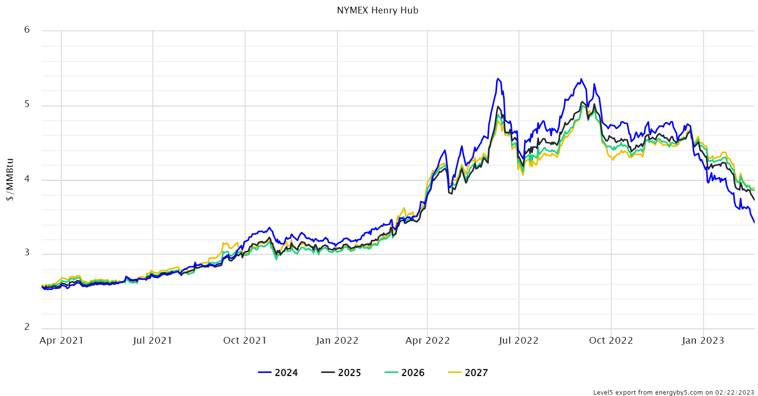

We have also seen unprecedented volatility in natural gas pricing. In 2022, the price of natural gas moved by more than 10% (up or down) over the course of 18 single days as shown in Figure 2.

Figure 2: WSJ, Natural Gas: Fasten Your Seat Belts

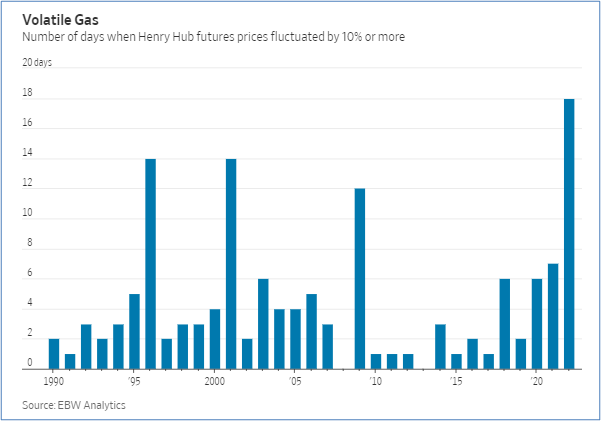

Natural gas storage levels are the likely cause of this volatility. Figure 3 shows the correlation between the amount of natural gas in storage (when compared to the 5 year average) and the frequency with which natural gas prices spike by calendar year. This chart clearly shows that the market in calendar year 2022 was much more sensitive to storage levels than in previous years.

Figure 3: WSJ, Natural Gas: Fasten Your Seat Belts

We expect that this reflects the fact that natural gas use has increased over time (driven by the shift from coal to natural gas fired generation) while the increase in the amount of natural gas that can be stored has increased minimally. Since the amount of natural gas in storage can be consumed quickly, and demand for the fuel can fluctuate much more quickly and dramatically than its production, the price of natural gas reacts more immediately to changes in demand and storage levels, and more slowly to changes in supply.

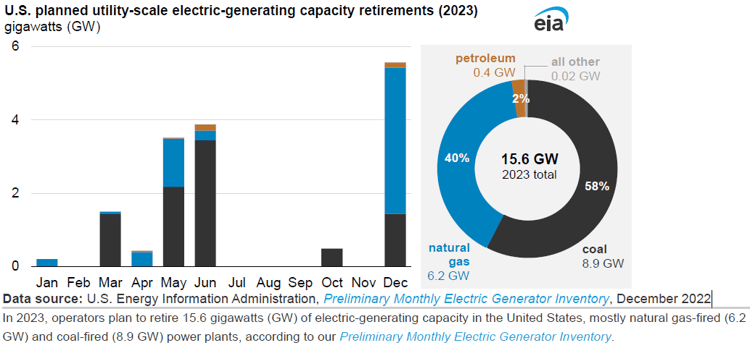

In addition to limits on storage, the electricity market’s increasing reliance on natural gas fired generation also increases volatility. As shown in Figure 4, 11 GWs of coal generation was retired each year between 2015-2020 and this trend is continuing. As the graph below demonstrates, another 9 GWs of coal generation is to retire in 2023.

Figure 4: EIA U.S Energy Information Administration

Coal retirements are expected because: (i) these plants cannot compete with lower cost natural gas plants, and (ii) they are large emitters of greenhouse gases and other pollutants. However, coal plants historically have been a good source of electricity when it is extremely cold and natural gas supply is curtailed by pipeline shortages. Going forward, when gas supplies are constrained, the grid will not be able to depend on coal plants (which typically have large stocks of available fuel on-site) to pick up for the drop in natural gas generation during times of gas constraint. Without an alternative fuel source for generation, the price of natural gas will increase during those periods when electricity demand is high and supplies are limited.

This market volatility further supports our recommendation that clients hedge open natural gas and electricity positions. The factors behind the rapid decline in natural gas prices suggest that the market could easily turn in the other direction and if the trend reverses, the rise in prices could be as dramatic as the recent fall.

The November Elections: Will They Impact Energy Policy at the Federal or State Level?

Changes in Washington DC: The 188th Congress was sworn in on January 3, and the House of Representatives is now controlled by the GOP. The Senate remains in control of the Democrats. This split in power means it is unlikely we will see any significant new Federal energy legislation. One exception is in the area of energy infrastructure. Republican and Democratic members of Congress are focused on the need to improve the nation’s energy infrastructure. While the odds are still slim, bipartisan legislation to expedite permitting and development of new transmission lines and pipelines is possible.

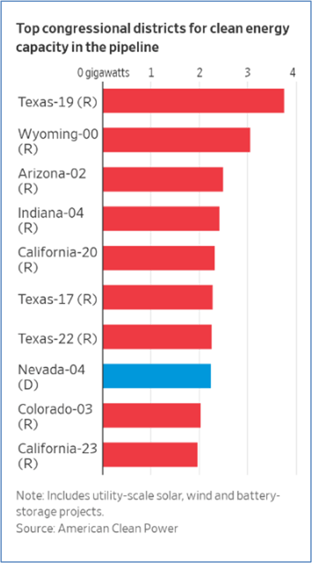

The 188th Congress is unlikely to limit implementation of President Biden’s signature energy legislation, the Inflation Reduction Act (IRA). Legislation to repeal or limit the IRA will not pass in the Senate, and if it does, the President will veto it. In addition, Republican led states are attracting a large portion of the new investments funded by the IRA. Figure 5 shows the top congressional districts for clean energy projects. These projects all benefit from the IRA.

Figure 5: WSJ, Biden's Green Subsidies

The composition of the 188th Congress will impact the Biden Administration’s climate change initiatives.[2] For example, the SEC is rumored to be scaling back its draft Environmental Social and Governance (ESG) reporting requirements, first reported in our April 2022 newsletter. The SEC is expected to drop the requirement that public companies report on Scope 3 emissions.[3] Politico reports that the SEC’s change is in part due to concerns that its rules will be held up in endless litigation. This shift in position is understandable, given the strong opposition to ESG reporting in many states, the change in Congress, and the Supreme Court’s ruling in West Virginia v. EPA (discussed in our July 2022 newsletter). Efforts by the Department of Labor (DOL) to require certain investment funds to consider ESG principles when making investments may also be impacted by the growing backlash against ESG policies. In January 2023, 25 states sued the DOL arguing that ESG rules are arbitrary and capricious. The lawsuit maintains that the Supreme Court’s decision in West Virginia v. EPA precludes the DOL from taking such broad action absent explicit authorization from Congress.

The challenges faced by the administration in pushing ESG principles at agencies like the DOL and SEC demonstrate how the political tide in Washington has shifted after the November elections.

Energy Policy at the State Level: A Nation Divided. Following the elections, power is now divided in DC. At the state level, it is a different story. Only two states, Virginia and Pennsylvania, have legislatures where each party controls one of the two chambers of government. After the November elections, Republicans hold both the governor’s office and the legislature in 22 states. Democrats hold both the governor’s office and the legislature in 17 others.

Republican controlled states are looking to limit climate change-related legislation while Democratic controlled states are aggressively pursuing carbon emission targets. In 2023, anti-ESG bills were filed in Arkansas, Missouri, Oklahoma and South Carolina. In Texas, there are three anti-ESG bills, and one pro-ESG bill pending. Pro-ESG bills that require state investments to consider ESG objections were recently introduced in Washington, New Jersey, Vermont and Hawaii. Bills to limit investments in fossil fuel producers, weapon manufacturers and other businesses that a state considers harmful to the environment were introduced in Vermont, Hawaii, New York, New Jersey, Rhode Island, California, and Indiana.

Anti-boycott rules are the most popular weapon for or against ESG policies at the state level. An anti-boycott rule directs state entities not to enter into contracts with companies based on their industries or policies. For example, we recently responded to a state agency RFP that required our firm to confirm that: (i) we did not boycott Israel, (ii) we do not discriminate against firearm companies, and (iii) we do not boycott energy companies. Other bills use anti-discrimination language to fight ESG policies. One example is Pennsylvania House Bill 2799, which says that discrimination against individuals or companies based on their “social credit score or environmental, social or governance score” is a statewide concern and needs to be addressed.[4]

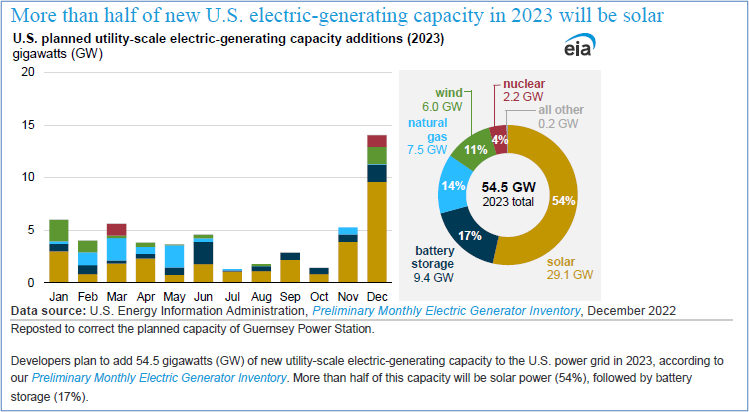

The growing backlash against ESG policies is unlikely to modify the on-going shift towards renewable generation. More than half of the generation that comes online in 2023 will be solar as shown in Figure 6. At the same time, fossil fuel plants to continue to shut down at a significant rate.

Figure 6: EIA U.S Energy Information Administration

The transition to renewable resources continues to put added pressure on reliability, especially during periods of extreme weather.

Winter Storm Elliott and the February Cold Snap: Grid Reliability Revisited

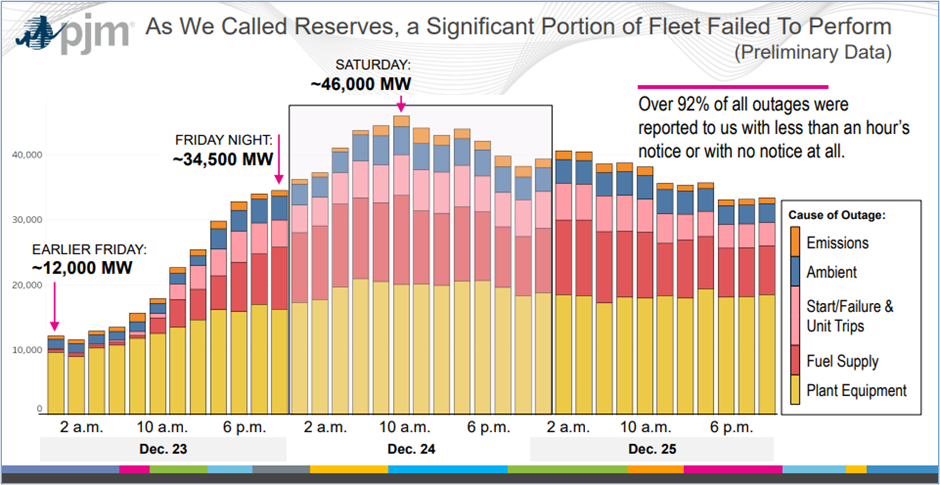

Winter Storm Elliott revealed power reliability issues in both deregulated (PJM) and regulated (Duke/TVA) service territories. In PJM, almost 46,000 MWs, more than 23% of the entire generation fleet, was offline during the historic storm. Figure 7 shows the extend of the outages in PJM during Elliott.

Figure 7: PJM, Winter Storm Elliot

PJM is doing a full analysis of what caused these shortages, and this is expected to be completed in a few months. Most of these outages were unexcused, and the owners of the generation plants that failed to operate could face non-performance penalties of up to $2 billion.

Widespread outages also occurred in Duke Energy’s and TVA’s service territories. Duke experienced widespread outages in North Carolina and South Carolina. These were driven by a combination of factors including generator outages (both generators owned by Duke and those contracted with under PPAs), and demand that was higher than what was forecasted. Utilities that receive power from TVA experienced rotating outages for the first time in almost 100 years. While the TVA is still investigating the cause, initial reports were that demand was 35% higher than expected and several coal and gas generators were offline due to freezing temperatures.

Responding to the widespread power outages, FERC and NERC announced on December 28 that they would open a joint inquiry to understand what happened during Winter Storm Elliott. In announcing the inquiry, NERC CEO and President Jim Robb said “This storm underscores the increasing frequency of significant extreme weather events (the fifth major winter event in the last 11 years) and underscores the need for the electric sector to change is planning scenarios and preparations for extreme events.” On February 16, 2023, FERC approved various changes to generator reliability standards designed avoid the outages and generator failures experienced in Winter Storms Uri and Elliott. Of note, in response to objections raised by generators that deregulated markets did not provide a way for generators in such markets to recover costs incurred to increase reliability, FERC responded that cost recovery was outside the scope of their current proceeding.

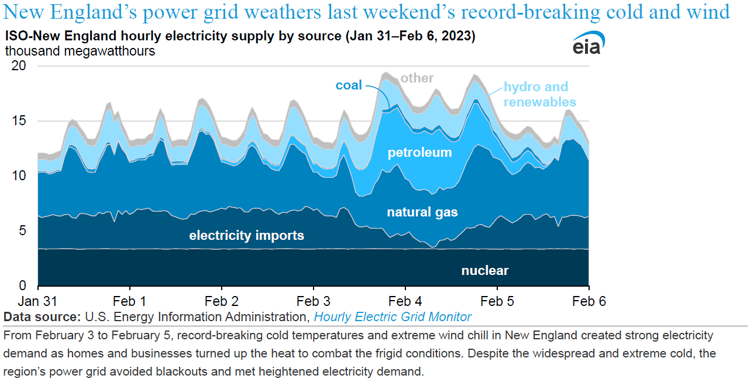

Winter Storm Elliott was followed by another arctic blast that hit the Midwest and New England between February 3 and 5. Cold weather records were set throughout New England with Mount Washington registering a wind chill of -108F. Notwithstanding this historic cold, New England did not see any material outages. As Figure 7 shows, sufficient electricity supply was not due to the availability of renewable or natural gas fired generation - it was the grid’s ability to call on aging oil plants and a coal plant that kept the grid running.

Figure 8: EIA U.S Energy Information Administration

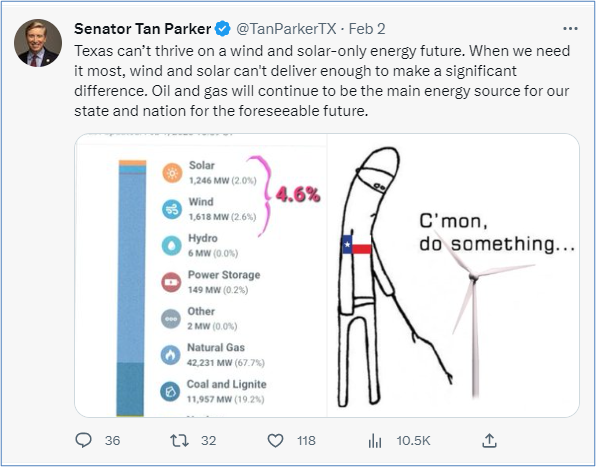

New England was not the only region that saw its energy grid affected by the February storm. Texas, which avoided material outages during Elliott, experienced significant generator outages during this winter storm. According to ERCOT’s fuel mix tracker, only 1,600MWs of wind generation, out of an installed capacity of 37,000 MWs, was available at certain times during the storm. According to a spokesperson for NRG, this was the result of different weather patterns. In the case of Elliott, there was significant wind and little precipitation – allowing wind plants to generate electricity at very high levels while the cold caused gas and coal plants to fail. In the case of the February storm, precipitation caused wind turbines to freeze.

Political opponents of renewable energy used the low generation output of wind and solar plants to argue for more fossil fuel generation. The tweet of Texas Senator Tan Parker is representative of this position:

Figure 9: Twitter, Senator Tan Parker

Renewable energy advocates blamed the outages on ERCOT’s “outdated grid infrastructure” and the fact that ERCOT remained isolated from other energy grids.

One thing is clear, generator outages will force both regulated and deregulated markets to consider new regulations designed to ensure reliable energy supply. A good example of this is the Performance Credit Mechanism (PCM) adopted by the Texas PUC in January. Historically, Texas took pride in being the only electricity market in the United States that relied solely on the market price of electricity to ensure adequate supply.[5] The significant increase in intermittent wind and solar supplies, and the outages during winter storm Uri, proved fatal to the energy-only market design. The details of the PCM are still being worked out, but at its core, it provides a capacity-type payment to generators that operate during times of extreme demand. We expect other energy market regulators to revisit market structures and take new regulatory action to ensure adequate supply.

The challenges posed by the energy transition are not slowing the speed with which the grid is transitioning. Some 82% of all generation additions in 2023 are projected to be solar, wind and battery storage.

At the same time, and as shown in Figure 6, almost all generation plants expected to close in 2023 are coal and natural gas fired.

Conclusion

The clashing goals of reducing carbon emissions and providing reliable and affordable energy will continue the recent trend of: (i) extreme market price volatility, and (ii) changing energy regulations. For our part, we will continue to explore options to ensure our clients can effectively manage energy supply through this difficult transition. Of course, if you have questions about the content in this letter or other energy related matters, please do not hesitate to contact us.

Download the PDF version here.

[1] Warmer than expected temperatures in Europe have reduced demand for Natural Gas and dramatically decreased the price of natural gas at the main trading hub in Europe, the Dutch TTF, where the price of natural gas, which rose to almost €350/MWh after the Russian invasion is now trading under €54/MWh, the price back in September 2021.

[2] For example, in President Biden’s State of the Union address he surprised most commentators by going off script to state that “We’re still going to need oil and gas for a while, at least another decade….and beyond that…”

[3] Scope 3 emissions are those that related to activities upstream and downstream from the company. For example, carbon emissions associated with employee travel to and from work.

[4] The text of the bill states that “a financial institution or business conducting a transaction in this Commonwealth, …may not discriminate against, advocate for or cause adverse treatment of a citizen or business's practices based on subjective or arbitrary standards such as:… an environmental, social or governance score or other similar values.”

[5] ERCOT (Texas)’s market rules assumed that by allowing electricity prices to rise to very high levels ($9,000 MWh), the potential to realize such revenue would be sufficient to insure sufficient generation. Unfortunately, during Winter Storm Uri, prices rose to $9,000 MWh but there was insufficient energy supply.