Early this month, ERCOT released the Seasonal Assessment of Resource Adequacy (SARA) report detailing market conditions as they exist going into the summer of 2023. This report takes into consideration the power output from all current, new, and planned generation that will be available comparing it to the forecasted peak load.

On the same day that ERCOT released the SARA report, the Chairman of the Public Utility Commission of Texas (PUCT), Peter Lake, released the following statement “Data shows, for the first time, that the peak demand for electricity this summer will exceed the amount we can generate from on-demand, dispatchable power." While the initial shock of these words is quite alarming and was quickly picked up by regional news agencies, we believe ERCOT is still better off this summer than last, and that the evolution of the grid to larger and larger percentages of renewable generation is not a new story. And while the statement of the Chairman is not technically false, it is somewhat misleading. Here is more of the whole story.

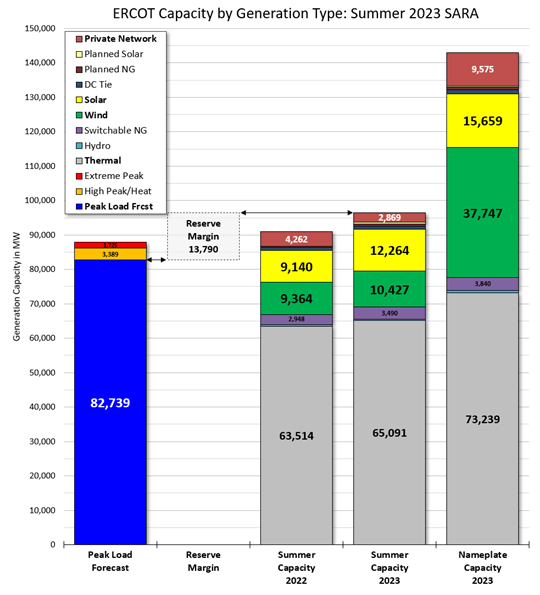

Figure 1 below is a summary of the report’s findings, demonstrating the load forecast scenarios on the left and a breakdown of the generation by type on the right, rated for this and last year’s summer capacity (the expected generation capacity during peak hours) as well as the current nameplate capacity (theoretical maximum output). Lastly, the reserve margin is a measure of the difference between the summer capacity and the maximum forecasted peak in the summer season.

Figure 1: ERCOT Capacity by Generation Type: Summer 2023 SARA by 5

The reserve margin (RM) is an indication of how adequately supplied the ERCOT market is compared to this coming summer’s anticipated demand, and this year’s RM has increased by over 600 MW compared to last summer’s. The thermal resources that Chairman Lake is speaking of (plants fueled by nuclear, coal or natural gas) have also grown this year from 63,514 MW to 65,091 MW. This makes up more than 68% of the summer capacity.

The largest difference this year on the generation side of the equation is the 37% increase in summer capacity coming from solar generation. As Texas’ solar generation has a higher ratio of projected output during peak hours compared to its total nameplate quantity (≈78%) than the total wind generation fleet (which is around ≈27%) it is better equipped to help improve the reserve margin during those hot summer afternoon hours.

Another notable increase in generation type this year came in the form of battery storage, which has increased its nameplate capacity by over 74%. Due to the physical constraints of the typical 2 to 4-hour dispatch capacity of battery storage, it doesn’t make a sizable appearance in the SARA report, but it should have a fairly significant impact on the ancillary service market. This 3,300 MWs of quick-ramping generation displacing gas-fired generation in the ancillary service market and can help free up other deployable resources to help with resiliency on the days and hours of low wind output or cloudy skies.

The last noteworthy call out in this year’s SARA report was on the demand side with the addition of Large Flexible Loads (LFLs) coming from crypto mining. These loads are classified differently because they are typically larger than traditional commercial entities and sometimes are connected directly to individual generating units. While the addition of load is typically a strain on total generation resources, the propensity of LFLs to curtail load during high-priced intervals will encourage this group of consumers to be more flexible and curtail during peak hours. ERCOT anticipates there is about 1,100 MW of curtailable load from these LFLs when Real-Time power prices climb above $100 per MWh.

The Chairman’s statement that load could exceed dispatchable power capacity is true. Yet while thermal generation’s share of the capacity picture continues to decrease, ERCOT should have sufficient installed generating capacity to serve system-wide forecasted peak load this summer, and at least based on the statistics utilized at ERCOT, the overall picture looks slightly better this summer compared to last summer. Ironically, this exact scenario, increasing amounts of carbon free generation, is what is desired, planned for, and sometimes even mandated by state or local legislation across many of the other large load centers in the US and overseas. Texas just happens to be one of the first states that is wrestling with the problem of how to deal with the complexities of a grid comprised of diverse types of generation.