Higher Delivery Rates on the Way with Con Edison's 2022 Rate Case

ConEdison, the largest investor-owned utility (IOU) in the state of New York, has an obligation to its investors to operate profitably year-over-year. Doing so can be a challenge due to changing operating conditions like the COVID-19 pandemic, prolonged cold snaps like the Polar Vortex of 2014, or new climate-driven policy mandates for large-scale electrification powered by renewable sources that have yet to be developed. To ensure profitability, a formal process known as a Rate Case is undertaken annually to evaluate if the utility is adequately charging electricity and natural gas customers for its services.

The act of filing Rate Cases with the New York Public Service Commission (NYPSC) is a common event for utilities across the state, with most occurring every one to three years. The 800+ page letter filed last month by ConEdison was less common, however, due to the shocking rate increases requested.

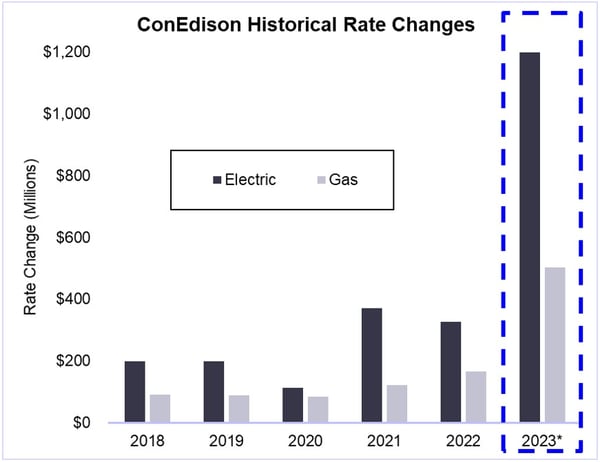

ConEdison’s total request is to increase electric delivery rates by 17.6% and gas delivery rates by 28.1%, resulting in a system-wide cost increase of $1.2 billion and $500 million respectively. Figure 1 compares this latest rate case and the cost increases to take effect in 2023 to those filed in previous years.

Figure 1: Historical Rate Change Filings from conedison.com

Costs Are Expected to Keep Rising After This Rate Case

The company cited several predictable drivers for the increases in the 2022 rate case including the need to make up for a lower sales forecast due to the pandemic, higher property taxes assessed by the state, deferred costs, expiring credits, and higher discounts for low-income customers.

Notably, ConEdison detailed new obligations including the need to make significant investments to upgrade overhead and underground electric delivery systems in preparation for large-scale electrification that the grid will need to meet the goals of the Climate Leadership and Community Protection Act (CLCPA) and Climate Mobilization Act (CMA). Other new investments included those needed to accommodate significant amounts of solar and wind power, energy storage, thermal-electric heating for new buildings, and new infrastructure to handle the anticipated increases in electricity volumes from the growing level of electric vehicle adoptions.

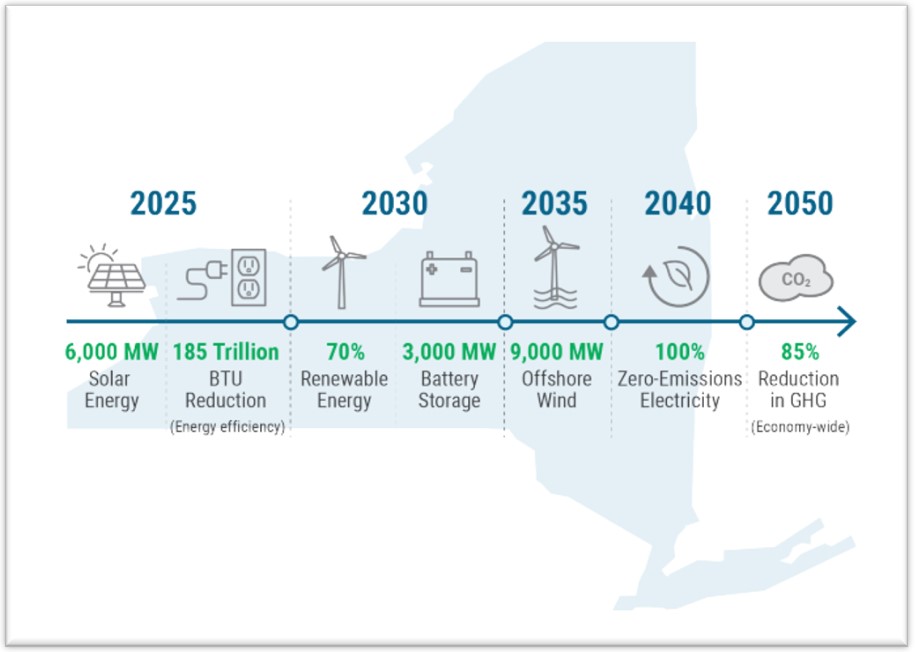

ConEdison's requested increases will likely only cover one to three years’ costs. When considering the limited number of distributed energy resources (DERs) currently deployed across the company’s network compared to what will be required to reach the state and the city’s climate targets, analysts suspect that more infrastructure upgrades will be necessary. This would suggest that ConEdison may request additional rate increases for many years to come. The timeline from the NYISO in Figure 2 shows the 25+ year planning phases of investments required for the energy transition throughout the state.

Figure 2: Estimated Timeline for CLCPA Targets from nyiso.com

What Comes Next

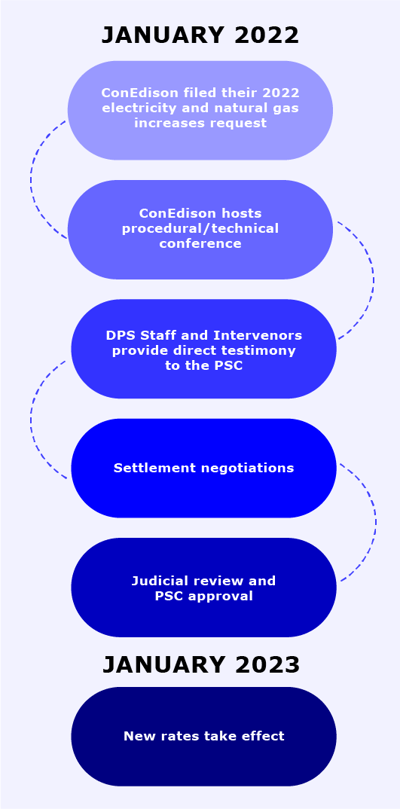

Staff from the New York Department of Public Service, along with other interested parties, will participate in a hearing process to review ConEdison’s filing and submit testimony to either support or oppose their proposal. The complete process has several steps, outlined in Figure 3, before final approval, which will take most of 2022 to complete. The new delivery rates once settled on, are scheduled to be effective January 1, 2023.

Figure 3: Approximate Anticipated Timeline for the 2022 Rate Case from 5

This 2022 rate case for ConEdison will likely be a harbinger for future rate cases filed by other utilities, given New York’s aggressive sustainability goals and the demands placed on the state’s electricity infrastructure.

Please reach out to your Energy Advisor at 5 with any questions about how these proposed rate increases could affect your energy budgets and other advice for managing these potentially higher delivery charges. We are here to help with updated budgets and strategies for your organization.