NYISO Power Market Update for May 2022

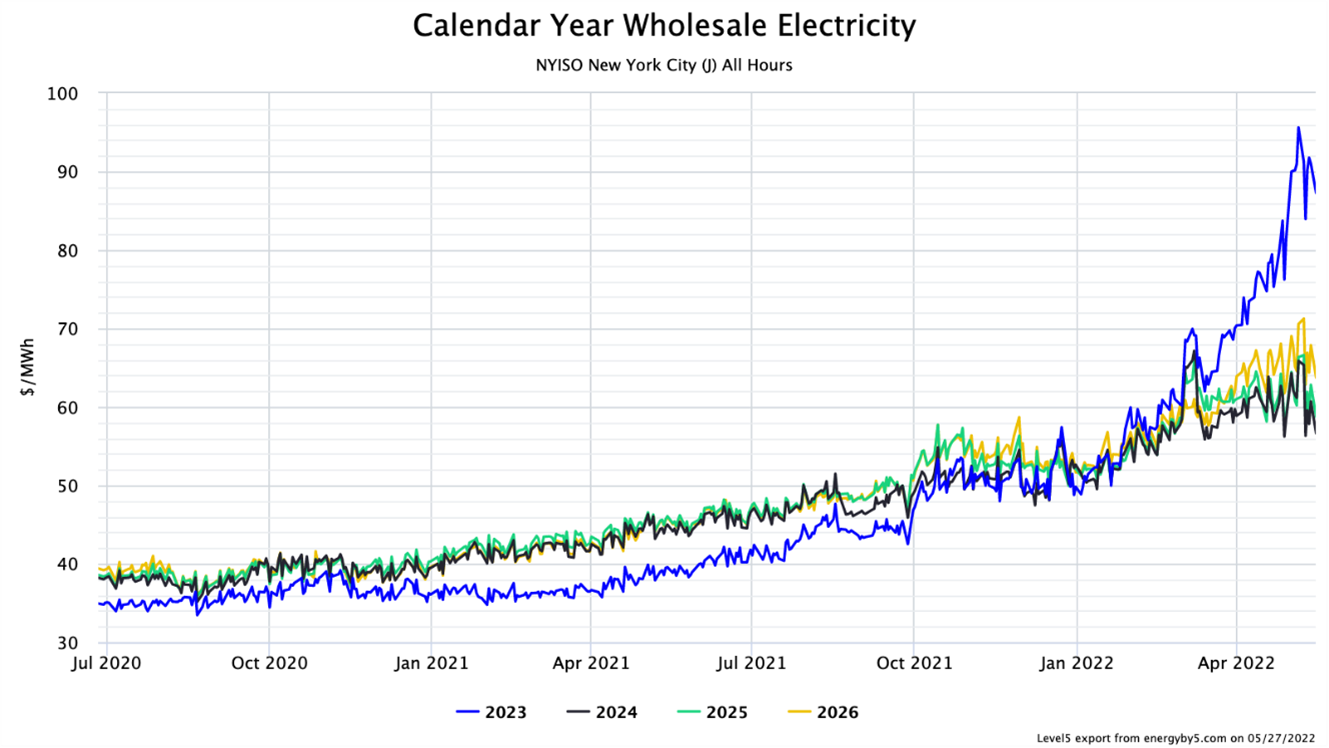

Near-term electricity prices in New York City continue to climb like an Aaron Judge home run that has not reached the apex of its arc. Figure 1 shows calendar year strip prices for 2023 (blue line) through 2026 (yellow line). Despite a short-lived correction in the middle of May, price movements have mostly been in one direction over the last year.

An interesting phenomenon has happened over the last six months. Before October 2021, prices for calendar year 2023 were less expensive than 2024 through 2026 (called a contango market). That dramatically changed this year and as shown in Figure 1. Today, there is a significant price separation between calendar year 2023 and 2024 through 2026. And while there is little question that near-term prices are at record highs, prices in 2024, 2025, and 2026 are trading at a significant discount. This means that the near-term run-up in electricity prices in 2023 can be mitigated by adding lower-priced outer years to a contract to reduce the overall weighted average price.

Figure 1: Calendar Year Wholesale Electricity NYISO Zone J All Hours from 5

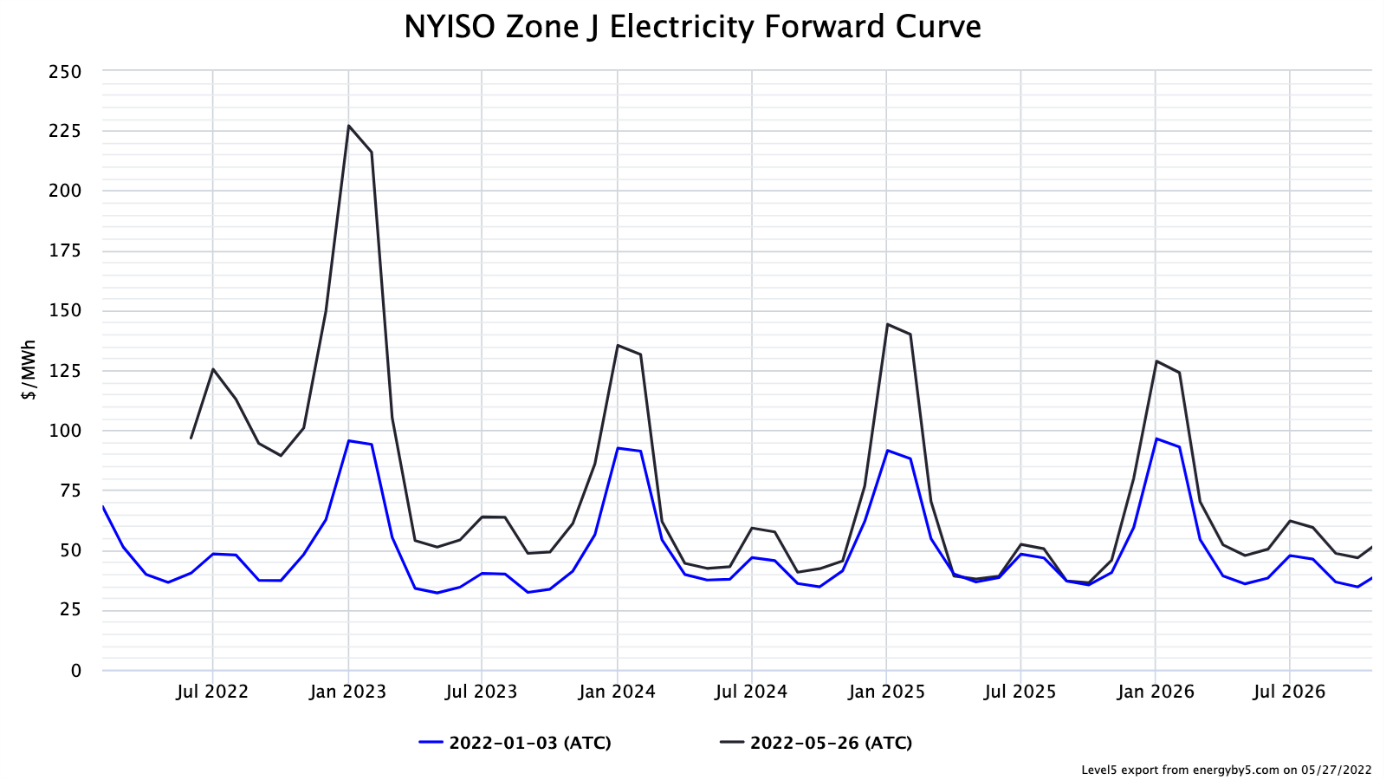

The most significant driver of elevated prices in New York (and in most other electricity markets) is the cost of power for the winter of 2022/23. Figure 2 shows the monthly price for electricity in New York City through October 2026. The blue line shows the forward price curve on January 3, 2022; the black line shows those same monthly prices on May 26, 2022. This chart shows that the most significant increases are in the months of December 2022, January 2023, and February 2023. Even in 2024, 2025, and 2026, it is clear that prices in the three winter months are materially more expensive than prices in the other nine months of the year, including summer.

Figure 2: NYISO Zone J Electricity Forward Curve from 5

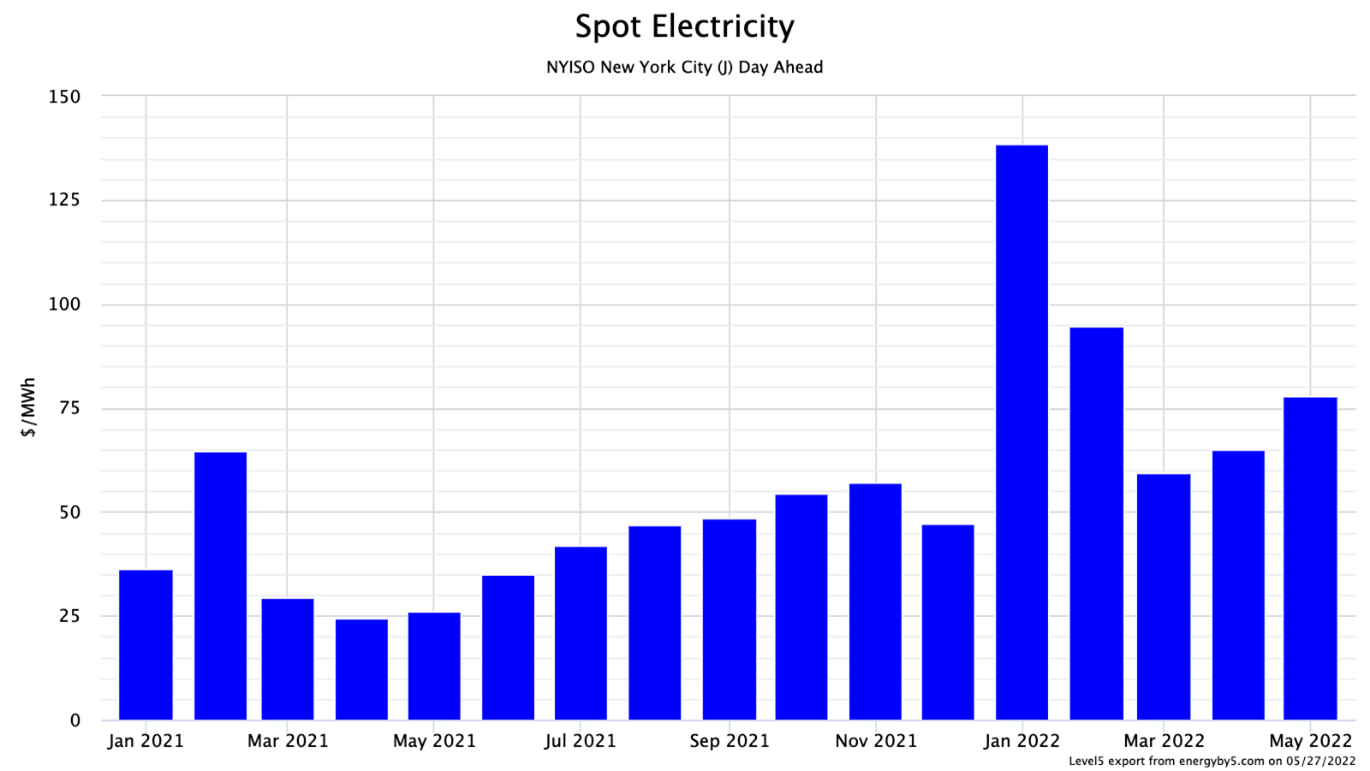

The temptation now is to think that default electricity service from Con Edison will offer protection from rising rates; that is simply not the case. Figure 3 shows how spot electricity prices have settled since January 2021. This is important to know because Con Edison’s default service closely follows these spot prices. This chart shows that, like the forward market, spot prices have been steadily rising over the last 18 months with the most dramatic price spikes occurring in the winter. Many Con Edison customers and those on variable rates were shocked this winter with record-high electricity bills in January and February. Wholesale spot settlement prices this January and February were $138/MWh (13.8¢/kWh) and $94.6/MWh (9.46¢/kWh) respectively. Overall, spot prices have more than doubled from last year. The average spot price through the first five months of 2021 was $36.23/MWh; the average spot price this year is $87.02/MWh.

Figure 3: Spot Electricity NYISO Zone J Day-Ahead from 5

While all of this may seem like bad news, there is a bit of a silver lining that can be found in longer-term contracts. No one knows how much higher prices may continue to rise in 2023. However, there is strong agreement among analysts that there is a higher probability that prices beyond 2024 will increase rather than decrease, mostly due to rising natural gas prices. In addition to longer-term contracts, a completely different purchasing strategy is required in bull markets. In today’s elevated markets, electricity customers should consider purchasing percentages of their electricity requirements and make measured purchases over time rather than buying 100% at one point in time. Bull markets, like the one we are in, demand a paradigm shift and a focus on price risk management. Contact us to learn more about better purchasing strategies in today’s market.