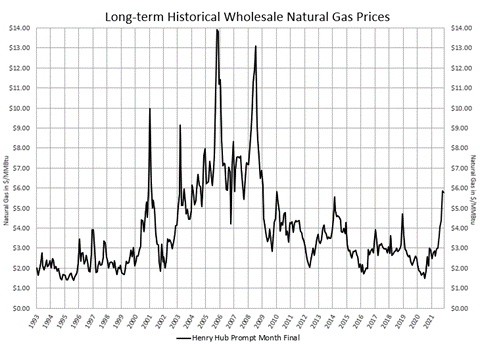

One of the most common questions clients ask when purchasing electricity or natural gas is, “How much money will this save me?” This was a reasonable question and for many years savings could be realized because energy prices had been trending lower. Figure 1 shows how the NYMEX has settled over the last 28 years. This chart shows that natural gas hit its peak in 2006 in the wake of Hurricane Katrina and Rita where gas prices approached $14/Dth.

The expansion of horizontal drilling in the late 2000s provided access to vast quantities of onshore oil and natural gas reserves and resulted in an abundance of low-cost natural gas supplies as well. Domestic natural gas production flooded the market, placing downward pressure on prices and initiating a steady bear market that, with a couple of exceptions, has been in place since 2008.

Similar patterns are observed with electricity prices since there is a strong correlation between natural gas and power prices in many parts of the country. In a bear market, when clients renewed their natural gas or electricity contracts, it was not uncommon for prices to be less expensive than on their existing agreement. This made it relatively easy to experience year-over-year savings. That bear market came to an end last March and energy prices have been steadily rising over the last 18 months without many fundamental or technical factors to suggest it might return to pre-pandemic price ranges in the near future. In this new market dynamic, price risk management and different purchasing strategies are paramount.

Figure 1: Long-term Historical Wholesale Natural Gas Prices from cmegroup.com

Many clients have entered fixed price contracts for both natural gas and electricity because, like interest rates, prudent risk management suggests fixing the price of a commodity when it is relatively low. But what are best practices for smart energy purchasing decisions in a bull market? Look to 401(k) investing for the answer. The growth of a financial portfolio is dependent on how the stock market moves over time. Few investors take all their money and invest it all in one day unless the market is trading at record lows, which was the situation for natural gas and electricity over the last several years. Most personal investors adopt a strategy based on dollar-cost averaging where an amount is invested across periodic purchases, regardless of the market price, to reduce the impact of price volatility on the overall purchase and maximize the return on the investment.

While it is impractical to make energy purchases with the same frequency as 401(k) investments, the same principles apply. The sticker shock that can be experienced when looking at renewal prices in a bull market can be alleviated by making measured and regular purchases over the duration of the contract rather than simply signing another fixed price contract. With this approach, clients can fix a certain percentage of the electricity they need while keeping open or floating positions too. Those open or floating positions are then closed out (purchased) at opportune times when there are corrections or dips in the market.

For many clients, the recent rise in energy prices brings about a necessary perspective change. The best approach to energy purchasing is to focus on price risk management rather than “savings.” Both electricity and natural gas are commodities whose prices are determined by market forces of supply and demand and they are two of the most volatile commodities in the world.

One reason for this volatility is that many buyers are limited in their ability to substitute other fuels in response to price signals and the fact that electricity cannot be stored in significant amounts. Other factors including weather, regulatory issues, storage levels (for natural gas), and transportation and delivery constraints, also have a material effect on energy prices and contribute to its price volatility. Savings can often be a coincidental byproduct of a bear market and often impossible as market prices increase. Consequently, when market prices are low or falling, a simple fixed price purchasing strategy often makes sense. When market conditions change and prices rally, however, a different and more proactive buying strategy is required.

Bull markets, like the current market we are experiencing, demand a paradigm shift and a move to focus on price risk management. But this mindset and strategy also require expert-level help and we highly recommend you talk with your energy advisory firm to create your game plan.