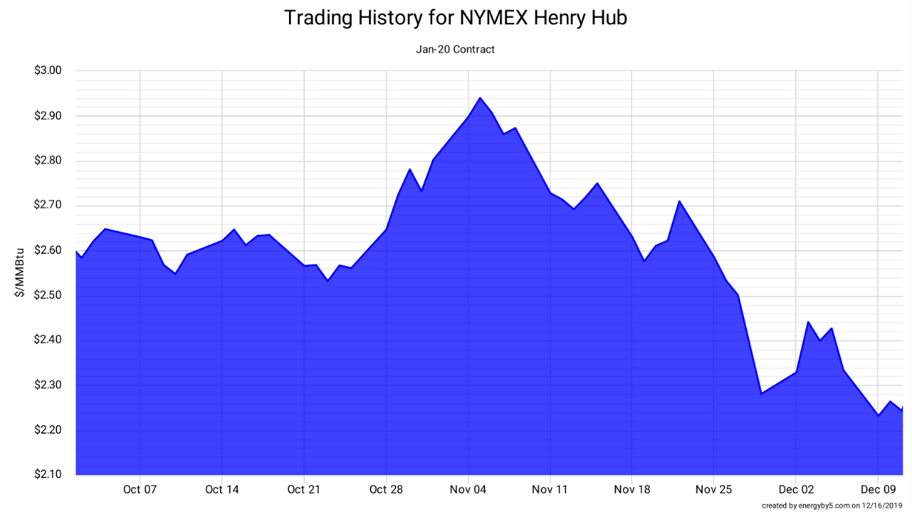

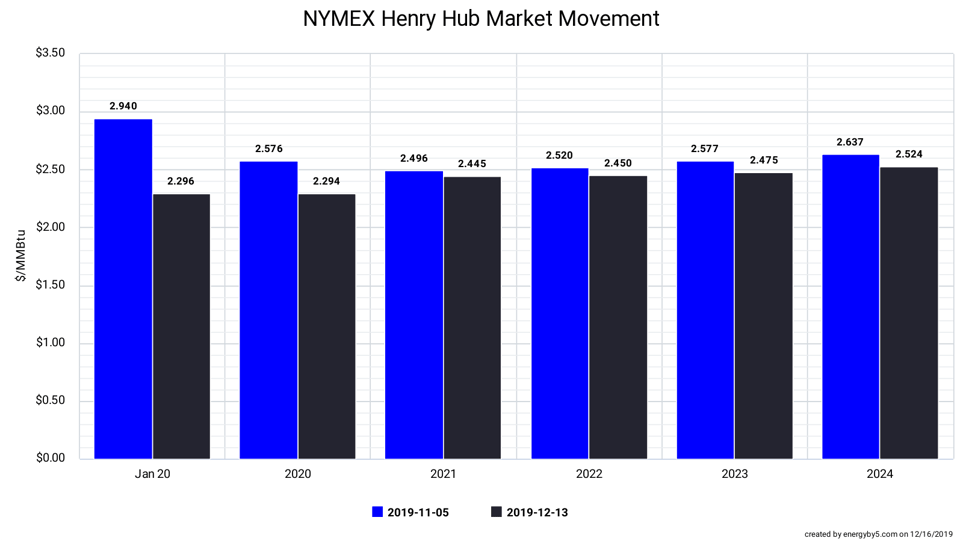

It is hard to believe that natural gas traders and analysts remain bearish given current prices. But the amount of gas being produced is outpacing demand and continues to place downward pressure on prices. This supply and demand imbalance has caused both short and long-term gas prices to tumble. Prices for both the January 2020 contract and winter strip (Jan 2020 – Mar 2020) have dramatically fallen over the last month. Figure 1 shows how gas prices for the January contract rallied through the fall, reaching its peak of $2.94/MMbtu on November 5th and then settled at $2.22/MMBtu on December 9th – a decrease of nearly 25% in four weeks. Prices for the winter strip have followed a similar trend. Figure 2 shows longer-term market movements in gas futures since November. The blue bar in Figure 2 is the price for the January 2020 gas contract and calendar years 2020 through 2024 on November 5th. The black bar shows how those same contracts were trading on December 13th. While the biggest decrease was in the January contract and in calendar year 2020, prices fell across all calendar years to 2024.

Figure 1: Trading History for NYMEX Henry Hub, by 5

Figure 1: Trading History for NYMEX Henry Hub, by 5

Figure 2: NYMEX Henry Hub Market Movement, by 5

Figure 2: NYMEX Henry Hub Market Movement, by 5

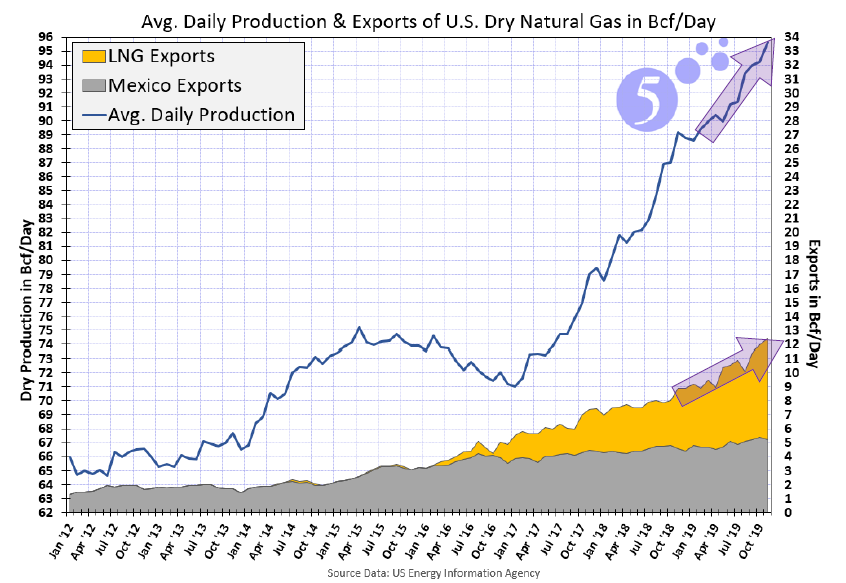

Large amounts of gas in storage, coupled with high levels of production are the two drivers that are fueling bearish sentiments in the market. Figure 3 shows the average daily production rate of natural gas in the United States over the last seven years. Production rates have increased by 36% over the last two years from 71 Bcf/day in January 2017 to its current rate of 95 Bcf/day. While LNG and Mexico export rates have also increased over the same time period, they have not exceeded the amount of natural gas being produced. This is good news for natural gas consumers and bad news for producers. As reported by the New York Times, this oversupply “problem” is a major concern for companies like Chevron that have invested billions of dollars into natural gas exploration and production. Some predict there will be significant financial risks for gas producers if bearish trends and low gas prices persist over the next three years.

Figure 3: Average Daily Production & Exports of U.S. Dry Natural Gas in Bcf/Day, by 5

Figure 3: Average Daily Production & Exports of U.S. Dry Natural Gas in Bcf/Day, by 5

In the meantime, clients with both short and long-term open gas positions should actively consider closing out those positions. A moderate winter will likely place additional downward pressure on gas prices. However, if there is a rally in gas prices, it is likely to be abrupt and substantial as there is more upside risk than downside potential in this market. As with all investments, the goal should not be to “time the market” and only make a purchase when the market hits its floor. The prudent investor will capitalize on “market dips” and make measured purchases with time. Now is the time to make some of those natural gas purchases.