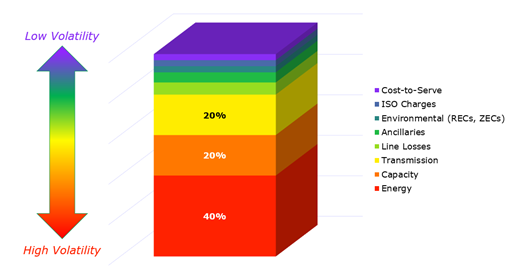

The big energy news in PJM this summer was the completion of the first capacity auction in three years, which was held in late May. This was an important event on several fronts. Most importantly, the price for capacity in all parts of PJM was set for the period of May 2022 through June 2023. As shown in Figure 1, the price of capacity is typically the second-largest cost component of a retail electricity agreement, and like any other commodity or security, uncertainty creates risk and increases cost. This recent capacity auction provides the transparency necessary to reduce risk premiums associated with this important cost component.

Figure 1: Retail Electricity Components from 5

The other important outcome from the auction was that the average price of capacity fell by 64% from $140 per MW-day to $50 per MW-day. Lower capacity prices were likely driven by the market’s assessment that, overall, there is more electricity supply than demand in PJM. And while capacity prices fell across all parts of PJM, the most significant decreases occurred in regions where capacity has been more expensive, including PSEG and JCPL (NJ), PECO (PA) and Com Ed (IL). Notably, capacity prices in BG&E (MD) cleared at the highest price across all of PJM.

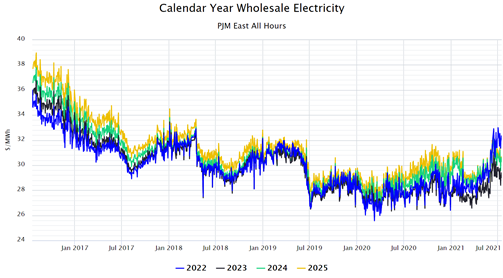

Lower capacity prices have been offset by higher wholesale energy prices in many parts of PJM. Figure 2 shows wholesale electricity prices in the Eastern part of PJM for calendar years 2022 through 2025. The dramatic rally in calendar year 2022 (blue line) is primarily driven by a bullish natural gas market that shows no sign of letting up soon. Since natural gas is often the marginal fuel in many power markets, there is a strong correlation between NYMEX natural gas prices and wholesale electricity prices. While falling capacity prices will help to lower costs, it is the price of wholesale energy that has traditionally been the most volatile and most significant cost component (see Figure 1) in a retail electricity rate.

Figure 2: Calendar Year Wholesale Electricity PJM East All Hours from 5

Prices for capacity after May 2023 will be determined by an accelerated auction schedule. Every six months until June 2023, PJM will host an auction to set the price for capacity in a given capacity year (June to May). The uncertainty of capacity prices beyond May 2023 drives our frequent recommendation to pass through this cost component. And even though near-term power prices have been on the rise, the data in Figure 2 shows that current electricity prices are only $7/MWh (0.7 cents/kWh) above the all-time low. Additionally, Figure 2 shows that overall, power has been trading in a relatively tight $6/MWh range over the last three years. Good buying opportunities remain, despite the recent rally.

There are different strategies to consider when it comes to buying capacity in PJM. There are ways to fix the price of capacity while leaving room for adjustments to a business’ capacity obligation (PLC) in addition to options that fix the PLC while making adjustments for the future price of capacity. Your energy advisor from 5 can help determine the best option for your business. You can also get more details around capacity product options and what is happening in wholesale energy markets by watching our recent PJM Capacity Webinar.