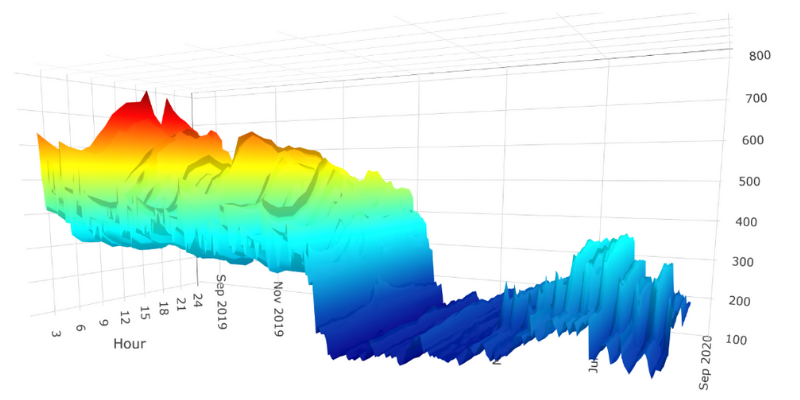

The coronavirus has not only significantly reduced electricity usage and peak demand across the NYISO and PJM regions, it has also dramatically changed how retail electricity suppliers approach fixed price electricity offers to clients. In order for suppliers to generate fixed price offers, they first gather and review the previous 12 months of historic usage data, including the volume of electricity consumed (MWhs) and the peak demand (MWs).

For many businesses there are significant differences in their current consumption and peak demand when compared to historic usage data. A business that has scaled-back operations over the last 6 months has obviously used less electricity, which presents a forecasting challenge. Suppliers must now determine if the current electricity usage for a business is more representative of on-going operations or if the client’s electricity usage will return to values closer to what was observed before the onset of COVID-19. Many businesses leaders are unsure when, or if, their operations will return to “normal.”

The other significant unknown is how to assess the peak demand for a business. This value is critical in determining a client’s cost for capacity. For clients in both the NYISO and in PJM regions, capacity is often the 2nd largest cost component in a retail electricity price. In PJM, a client’s capacity obligation (the “cap tag”) is set by the five highest system-wide electricity demand days; while in New York, it is set by the single highest demand day on the grid.

This year’s capacity obligations in New York were set last summer on a Saturday in July. The unique timing of a Saturday peak, when most businesses are not in operation, lowered the capacity obligation for many businesses across the state but was also not representative of typical operations. The same forecasting questions a supplier has around usage also applies to capacity. What peak demand values should a supplier use in determining a client’s future capacity obligations?

As with any other market, uncertainty equates to risk. Many suppliers are applying risk premiums to fixed price electricity products to account for these uncertainties and irregularities in historic usage data.

There are a few ways for a supplier to mitigate these risks and unknowns around a client’s electricity usage and peak demand. One way is to apply a risk premium to both usage and capacity values. With an appropriate risk premium, a supplier can account for variations in both usage and capacity into the future. However, these risk premiums translate into higher fixed prices for clients.

Another way a supplier can reduce its risk is to incorporate language into the retail contract that either passes through some cost components or allows the supplier to charge additional fees for variances in usage or capacity. Unfortunately, these risk mitigation mechanisms, while completely legitimate, make it very difficult for clients to compare offers from multiple suppliers. The best approach is to consult with your energy advisor to determine the most appropriate electricity product for your business.

In today’s electricity market, there is no one-size-fits-all electricity product. Some clients know what their operations and electricity usage will look like into the future. For many others there is still a lot of uncertainty. Working with an energy advisor to determine the right cost components to fix and which ones to pass through are important elements of an effective electricity purchasing strategy.

We are helping our clients to avoid excessive risk premiums and providing an accurate comparison of supplier offers in the process. Contact us to learn more.