The big news story this summer in PJM has been the auction that set the price for capacity for the period of June 2022 through May 2023. This is newsworthy because there has not been a PJM capacity auction in three years. The delay had been caused by disagreements between the Federal Energy Regulatory Commission (FERC) and PJM, which were at odds over the mechanism by which the price for capacity is set. This three-year delay created uncertainty in how capacity was valued in any forward electricity contract. And like any other security or commodity, uncertainty creates risk premiums and higher costs. Before examining the details of the most recent auction results, it is important to review capacity and why it is important to electricity buyers.

What is Capacity?

The PJM Interconnection (PJM) is an independent entity that is responsible for ensuring that there is enough electricity supply to meet the demand that is placed on the electricity grid. On hot summer and cold winter days when demand is high, PJM calls upon electricity generators that are on stand-by to produce the electricity that is needed to keep up with demand. A commitment by an electricity generator to provide energy when it is needed for a specific period of time is called capacity. The price for capacity in PJM is set through a competitive auction process.

In many ways, capacity is like an insurance payment that is paid in advance to ensure that electricity supply and demand are in balance. When electricity is offered to a client from either the utility or an Energy Supply Company (ESCO), approximately 20-40% of a client’s price for electricity supply is related to the cost of capacity, which is highly dependent on the specific utility territory. For example, the cost of capacity is much higher in PSE&G (NJ) than FirstEnergy (OH). In the case of a client who pays 10¢/kWh for electricity, between 2.0 to 4.0¢/kWh of that cost is related to capacity payments that the utility or the ESCO must make to PJM.

The Auction Results

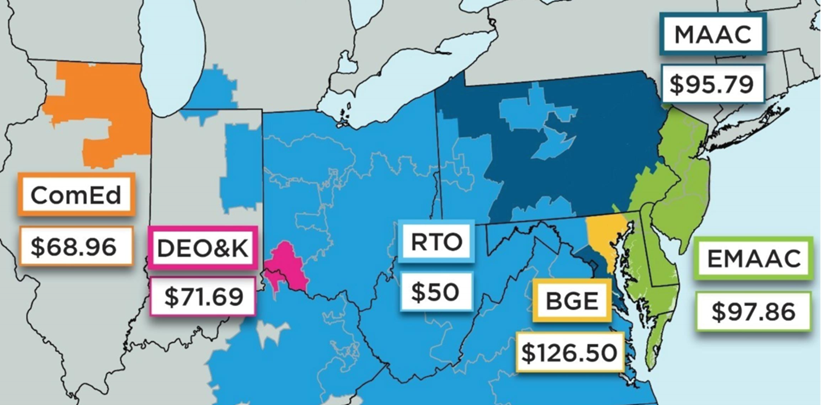

Overall, the price of capacity for June 2022 – May 2023 decreased dramatically across most of PJM. Specifically, the average price of capacity fell 64% from $140 per MW-day to $50 per MW-day. Nuclear power plants, natural gas-fired units and renewable power sources saw the highest increases in cleared capacity. Conversely, fewer coal plants managed to clear this most recent auction. Analysts point to several factors that contributed to the drop in capacity prices.

-

A lower load forecast, suggesting that electricity supplies exceed expected demand over the next couple of years

-

A decrease in the Cost of New Entry, which means that it costs less to build and place new generating assets into service

-

Lower offer prices from generation owners bidding into the auction

And while all parts of PJM saw the price for capacity decrease, there are a few locations where prices cleared above $50 per MW-day. These areas are shown below in Figure 1.

Figure 1: PJM Areas that Cleared Above $50 per MW/day from pjm.com

Lower capacity prices should lead to lower retail electricity prices. However, bullish gas and power prices have offset bearish capacity sentiments. It is important to note that this most recent capacity auction established prices through May 2023. Given the three-year delay in capacity auctions, an accelerated auction schedule was created to make up for the auctions that were not held. The upcoming auction schedule is shown below:

| Auction | Delivery Year |

| December 2021 | June 2023 to May 2024 |

| June 2022 | June 2024 to May 2025 |

| January 2023 | June 2025 to May 2026 |

| June 2023 | June 2025 to June 2026 |

The results of this past auction, and those coming up in the next two years, will provide clarity into future capacity prices that has been lacking for the last three years. Additionally, the forces that are driving capacity prices today are very different from what they were three years ago. The state of the economy, the presidential administration, and the balance of electricity supply and demand are not the same as it was in May 2018. Join our webinar on Friday, July 23rd at 9:00 AM ET to learn more about the outcome of this recent capacity auction and what it means for electricity customers in PJM.