Find Us

5 Headquarters

4545 Fuller Dr. Suite 412

Irving, TX 75038

Phone: (972) 445-9584

Toll Free: (855) 275-3483

Fax: (855) 329-3493

email5@energyby5.com

Irving, TX 75038

Phone: (972) 445-9584

Toll Free: (855) 275-3483

Fax: (855) 329-3493

email5@energyby5.com

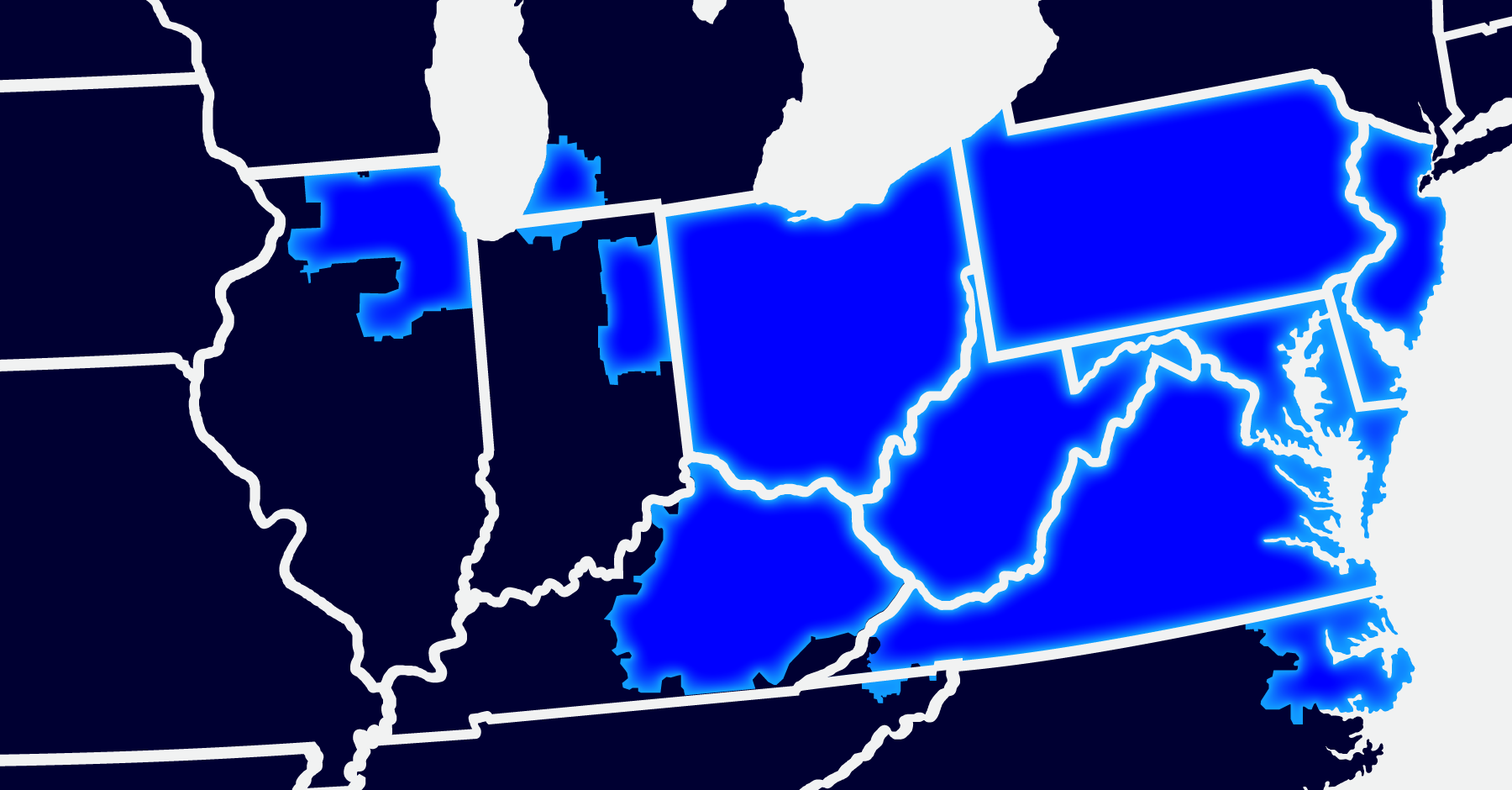

5 - Northeast

865 State Route 33

Ste 3 PMB 1077

Freehold, NJ 07728

Phone: (732) 774-0005

Fax: (855) 329-3483

email5@energyby5.com

Ste 3 PMB 1077

Freehold, NJ 07728

Phone: (732) 774-0005

Fax: (855) 329-3483

email5@energyby5.com