On behalf of the team at 5, I am pleased to forward our market letter for the first quarter of 2021. This letter focuses on the latest Black Swan event, Uri, the winter storm that hit Texas in mid-February. The storm caused a catastrophic loss of generation and triggered an extended period of extremely high energy prices. This letter provides: (i) a summary and chronology of the legal and regulatory proceedings that Uri has spawned; (ii) a snapshot of how the storm has impacted a variety of market participants including municipal utilities, wind farms, renewable purchasers, commercial and industrial buyers, and the natural gas market; and (iii) an overview of legislative efforts to address electric reliability in ERCOT.

WINTER STORM URI

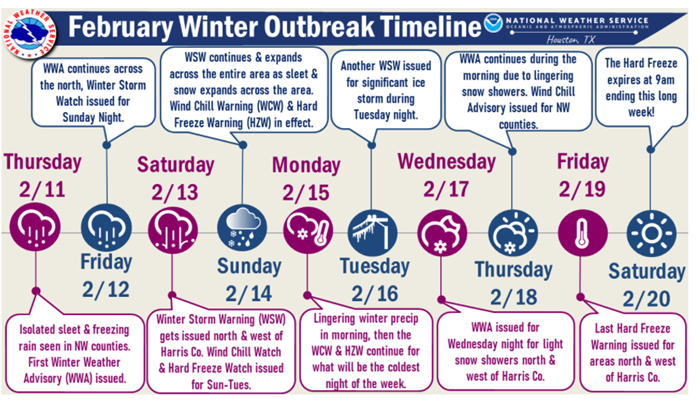

The winter storm that rocked Texas in mid-February was unprecedented. The storm began on February 11 and ended on February 19/20. A high-level overview of the events from that week is shown in Figure 1.

Figure 1: February Winter Outbreak Timeline from weather.gov

Figure 1: February Winter Outbreak Timeline from weather.gov

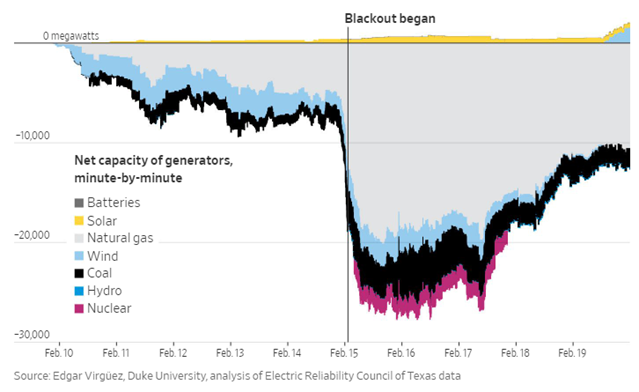

As Figure 2 shows, the coldest days of the storm were the period from late on February 14 to the early morning of February 16.

.png?width=627&name=Cold%20Review%20-%20Houston%20(Bush%20Int.).png) Figure 2: Cold Review - Houston (Bush Int.) from weather.gov

Figure 2: Cold Review - Houston (Bush Int.) from weather.gov

Figure 3 shows the vast amount and type of generation that was taken off-line by the storm’s cold weather:

Figure 3: Off-line Generation by Uri from wsj.com

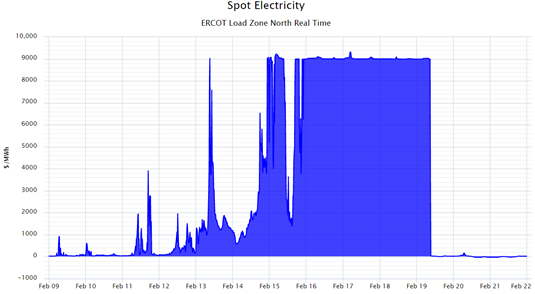

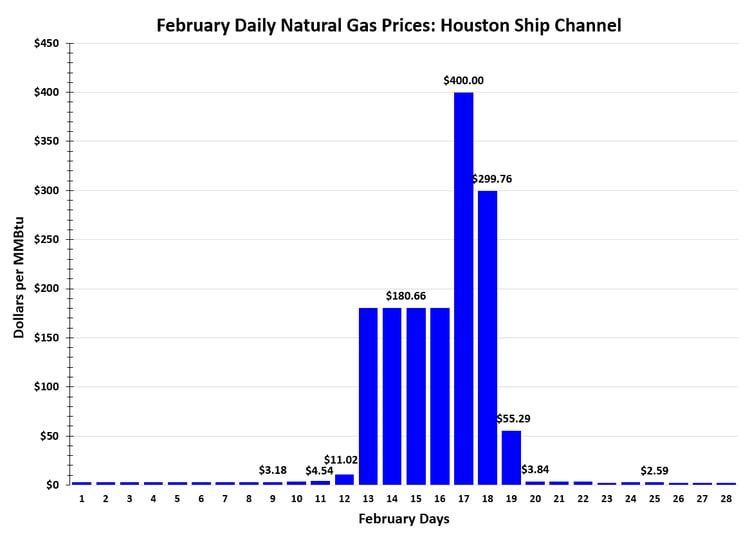

Naturally, electricity and natural gas prices in Texas reacted to the weather and the outages. Please note that storm-related electricity prices reflect the unilateral decision made by the Texas PUC to set energy prices to $9,000 per MWh on February 15.

Figures 4 and 5 show how the spot price of electricity in North Texas remained at that $9,000 cap for nearly the entire week and how Houston Ship Channel natural gas prices spiked during that same period.

Figure 4: Spot Electricity ERCOT Load Zone North from 5

Figure 5: February Daily Natural Gas Prices: Houston Ship Channel from 5

Storm Chronology

The following chronology gives a sense of the legal and regulatory uncertainty created by Uri and its aftermath. Events listed in italics refer to actions taken by ERCOT or the Texas PUC.

• February 12 – Governor Abbott declares a state of emergency.

• February 15 – Rolling blackouts begin, 10,000 MW of load curtailed.

• February 15 – Texas PUC orders prices to be set at $9,000 per MWh even though market prices are clearing at $1,200 per MWh due to curtailments.

• February 16 – Texas PUC confirms its order from February 15.

• February 17 – Rolling blackouts end at 23:55 on February 17.

• February 19 – ERCOT maintains $9,000 per MWh pricing through the morning.

• February 24 – Numerous members of ERCOT’s board resign.

• February/March – Numerous filings in favor and against repricing, many focused on the PUC’s decisions of February 15 and 16.

• March 1 – Texas PUC Chair DeAnn Walker resigns.

• March 1 – Brazos Electricity Power Cooperative files for bankruptcy, citing $1.9B in liability to ERCOT.

• March 4 – Independent Market Monitor (IMM) recommends revising and updating market pricing for the period from when load shedding ended (midnight on February 17) to 9 am on February 19.

• March 5 – Texas PUC refuses to reprice, but does not issue a final order on repricing. Filings for and against repricing continue.

• March 6 – Commissioner D’Andrea meets with out-of-state investors and promises to put weight of commission against repricing.

• March 8 – Texas PUC commissioner Shelly Boykin resigns.

• March 12 – CPS Energy, San Antonio’s Municipal utility, files a lawsuit against ERCOT for various actions taken during the storm.

• March 15 – Texas Senate passes Bill 2142 that would require the PUC to reprice from 11:55 pm on February 17 to 9:00 a.m. on February 19.

• March 16 – Texas PUC commissioner Arthur D’Andrea resigns, effective upon appointment of successor.

• March 17 – Texas AG issues opinion at request of Lieutenant Governor that PUC has the authority to reprice.

• March 19 – Luminant files in Court of Appeals for 3rd Judicial District in Texas against Texas PUC claiming Texas PUC has prejudged repricing (Exelon joins in April, Calpine opposes).

• March 19-26 – CPS Energy sues 17 major gas suppliers over high natural gas pricing during the winter storm.

• March 20 – Senate Bill 2142 fails to get support in Texas House and dies.

• March 30 – Texas PUC and Luminant file motion stipulating that PUC has not made a final decision on repricing.

• April 1 – Governor Abbot nominates Will McAdams to the board of Texas PUC, pending approval of Senate.

• April 6 – ERCOT issues a letter to Citigroup stating, among other things, that ERCOT is undertaking a review of the process used to calculate how ERCOT will address various payment failures.

• April 12 – Governor Abbot nominates Peter Lake as Commissioner. McAdams testifies in the Senate hearing that rulings on March 5 and 6 were probably wrong, but may be too late to reverse.

• April 15 – ERCOT files at the Texas PUC, a plan to invoice market participants at a rate of $2.5M/month to recover the $2.9 billion shortfall created when certain market participants failed to pay their ERCOT invoices.

• April 15 – Commissioner McAdams confirmed by Texas Senate.

Looking back at this timeline, the Texas PUC’s decision to replace the market price with an administratively determined price is the basis for many of the current legal and regulatory disputes. More than two months after the storm, prices set by the PUC’s actions are still not final. This uncertainty, together with the billions of dollars in dispute, guarantees an extended period of legal and regulatory disputes.

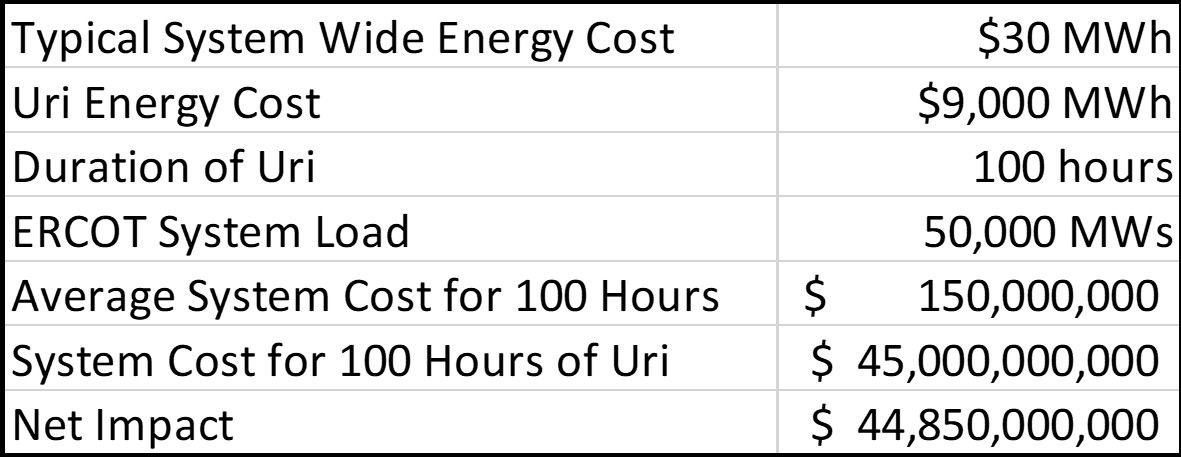

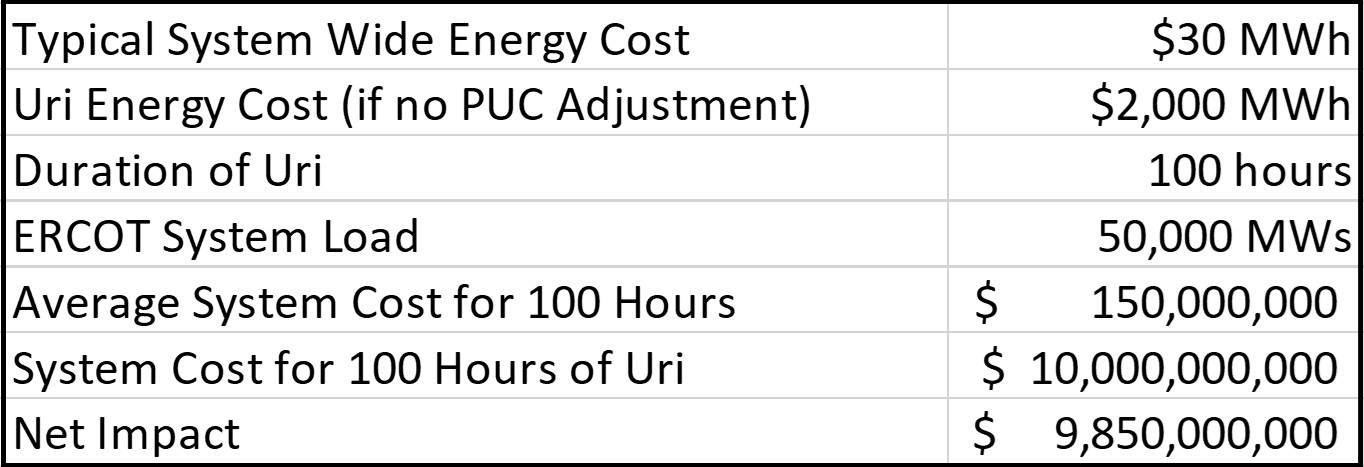

The Cost of Uri

In terms of dollars, the cost of Uri is staggering. The simple comparison of average system energy costs in Texas against average costs during the 100 hours of Uri in Figure 6 tells the story.

Figure 6: Average Energy Costs during 100 Hours of Uri from 5

For comparison, Figure 7 shows 5’s estimate of the cost of Uri without the intervention of the Texas PUC.

Figure 7: Estimate of Energy Cost of Uri without Texas PUC intervention from 5

The difference in Net Impact between Figures 6 and 7 forms the basis for many of the legal and regulatory disputes that are currently playing out.

Who Bears the Cost?

While it is relatively easy to calculate the theoretical cost of Uri, it is more difficult to understand who won and who lost. For example, an integrated energy company that owns power generation and serves customer load in Texas is on both sides of the market. The high prices received for selling electricity output should offset the high cost of buying power to supply its retail customers. While there is no way to get a breakdown of the storm’s cost, the snapshot below, based on public information, highlights the impact that Uri has had on a wide range of different market participants.[1]

• Municipal Utility: Brazos Electric Power Cooperative

Brazos Electric Power Cooperative, Inc, Texas’ oldest electric co-op, had significant load-serving obligations and insufficient energy supply. Given the size of Brazos’ load obligation, the market pricing during Uri was catastrophic. Brazos filed for Chapter 11 bankruptcy on March 1, 2021 and owes ERCOT over $1.8 billion for the cost of power supplied during the storm.

• Renewable Generator: Stephens Ranch Wind Farm

Stephens Ranch (Stephens) is a 376MW wind farm located on 47,000 acres between Lubbock and Odessa. The project was developed by Starwood Energy, a leading renewable developer, and 40MWs of the power generated by the wind farm is sold to a large retail store to offset consumption at its stores in Texas.

To finance the wind farm, Stephens entered into two Power Purchase Agreements (PPAs) with Citibank (Citi) that obligate Stephens to deliver energy to Citi based on expected wind production. Stephens sold Citi energy at $23.55 per MWh, the first PPA price and $31.05 per MWh, the second PPA price. During Uri, the wind turbines at Stephens Ranch were encased in ice and forced out of use until February 19. When Stephens failed to deliver power to Citi, Citi had to go into the market and purchase power to meet its other power delivery commitments. The cost of this replacement power was approximately $113 million. Citi promptly invoiced Stephens for some $113 million in damages. When Stephens refused to pay the invoices (citing Force Majeure), Citi sought to take over ownership of the wind farm. This case is being litigated in New York State court.

Outages at wind farms like Stephens Ranch may also impact corporate purchasers of renewable power. The most significant risk for a corporate VPPA purchaser is that the purchaser was using the fixed price in a VPPA contract to directly offset exposure to other index price contracts. If this retail store was leveraging the 40MWs to offset index price exposure, and the wind farm failed to operate, their exposure to index pricing could be as high as $14 million. This calculation assumes that the wind farm operates at a 40% capacity factor.[2]

• Integrated Energy Supplier: Vistra/Exelon/NRG

Three of the state’s largest integrated energy suppliers have reported estimated storm losses of between $2.44 and $4 billion. Not surprisingly, all of these parties are supporting efforts to reverse the actions taken by the Texas PUC and adjust electricity prices to values less than the $9,000 per MWh cap. Calpine, another integrated energy supplier, has filed papers in favor of leaving ERCOT prices unchanged. Calpine has not reported the financial impact of Uri on its business.

• Pure Retailers: Just Energy, Griddy, Entrust

Retail electricity suppliers who serve load but do not own generation were hit very hard by Uri. Those who failed to meet their ERCOT obligations and closed up shop include Griddy, Entrust, GridPlus, and Volt. One large retail supplier, Just Energy, met its obligations to ERCOT but filed for bankruptcy based on the extent of their Texas energy losses.

• C&I Index Purchasers

C&I customers that purchased power in the spot market during the storm were also hard hit. For a 3 MW customer (for example, a Walmart supercenter) that was on an index during the storm, the cost of power for the 100-hour period is a staggering $1.62 million (1.8 MW [3 MW @60% load factor]* 100 hours *$9,000 per MWh). Based on filings made to date, Boxer Property expects its energy expenses to increase by $18M. Another real estate company, Hartman, expects total charges to be $5-9 million over typical February costs. We are monitoring the market closely to see when/if customers, particularly large industrial buyers like Chevron, take legal action in response to extremely high electricity bills.

• Natural Gas Purchasers

In Texas and other markets in the Midwest, the spot price of natural gas hit levels as high as $1,000 per MMBtu. At this time, we are not aware of any regulatory efforts to reset natural gas prices. Legal proceedings, however, are underway. CPS Energy, San Antonio’s Municipal Energy Company, sought declaratory judgments against 16 natural gas suppliers, including BP, Chevron, EDF, Symmetry and Tenaska, with respect to high spot natural gas prices. CPS’ basic argument is that the astronomical prices set during the disaster were “exorbitant, unlawful and unconscionable”. CPS has taken the position that the maximum price it will pay for natural gas is $38.83 per MMBtu – even if some suppliers based their invoices on prices as high as $500 per MMBtu. A class-action lawsuit was also brought against Symmetry in Federal Court. Plaintiff’s claims include that Symmetry did not substantiate its claims for “Incremental Supply Costs” and illegally price gouged its customers during a disaster.

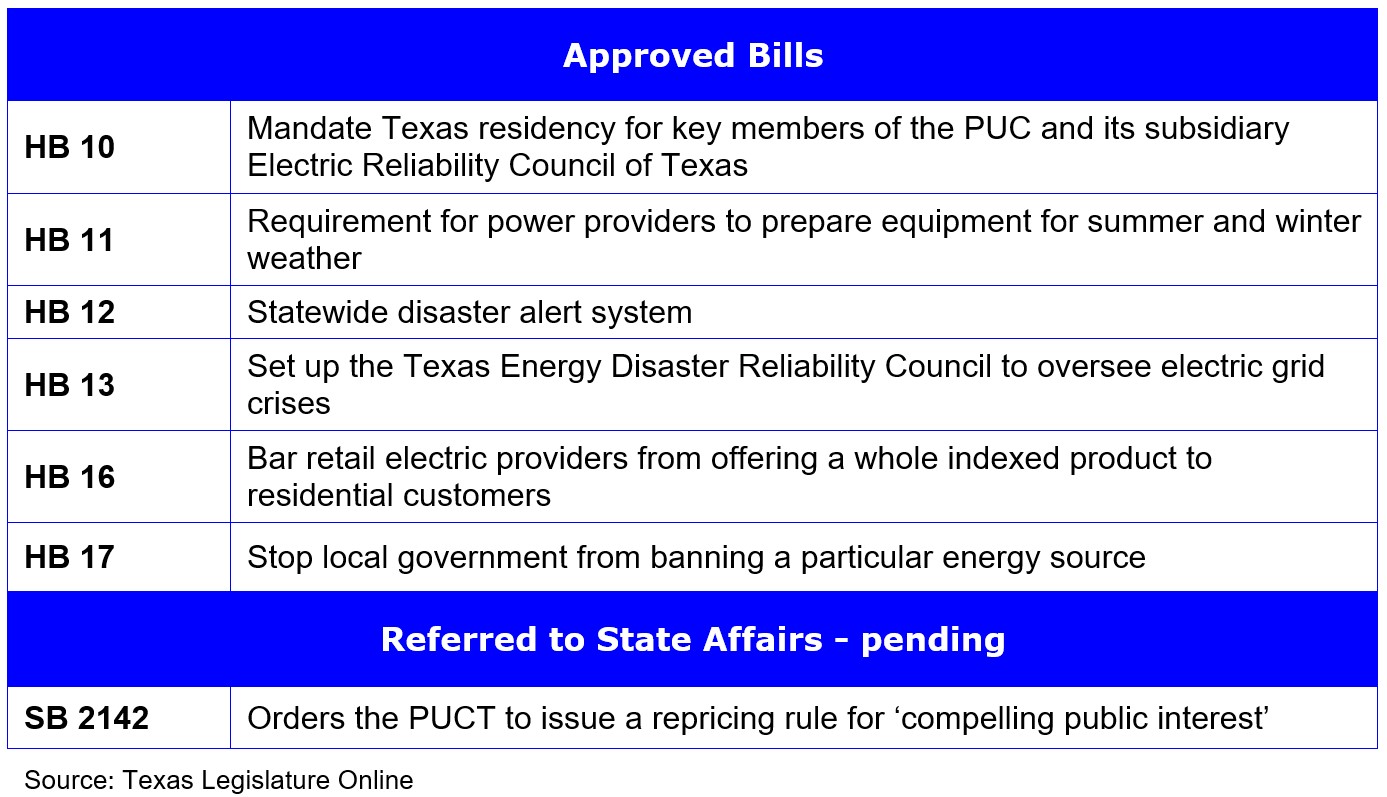

Texas: What Happens To The Market

The grid’s failure to withstand the pressure of Uri puts into question the reliability of the Texas grid and the structure of the ERCOT market. Figure 8 summarizes the bills introduced in the Texas legislature (so far) to address these issues:

Figure 8: House Bills in the Texas Legislature from 5

As this letter goes to print, the situation in Texas continues to evolve. Some of the latest events include the exit from the market of another retailer, Liberty Power and at least one more wind farm lawsuit, Mozart Wind v. Macquarie. As more supplier bills are issued, we expect the number of disputes and lawsuits to increase significantly. We will continue to monitor both the legal and regulatory situation closely.

As always, please do not hesitate to contact me or other members of the 5 team if you have energy-related questions or you would like to discuss the issues covered in this letter in more detail.

[2]40MWs times a 40% capacity equals 16MWs. Assuming 100 hours, the difference in price for the 16 MWs is a contract price of 16*$30/MWh*100 hours or $48,000 contract price vs. 16*$9,000*100 or $14.4 million. This retail store's exposure could be $14.4 million minus $48k.