On behalf of the team at 5, I am pleased to forward our market letter for the first quarter of 2018. This letter focuses on a change taking place in the energy market and its impact on our clients. Historically, energy procurement was separated from facility operations. A procurement team and/or an advisor worked with competitive retail suppliers to manage commodity prices. In parallel, engineers worked with an operations team to reduce energy consumption. Today, large energy users can no longer approach energy procurement and facilities management as separate and distinct tasks – a cost effective energy management strategy must integrate facilities management and procurement. In this letter we discuss some of the factors that have driven this change and the importance of integrating procurement and energy management.

Background

In the early days of deregulation, the wholesale market was illiquid. The only retail market participants were very large users and the products were short term fixed or floating prices. By contrast, the liquidity in today’s market allows for an almost unlimited number of products. And for strong credit consumers, contract terms often can extend 10 or more years in some markets. Products include a wide variety of wholesale structures (e.g. block and index, heat rate hedges) and alternative products including on and off-site solar, storage, and direct power purchase agreements with renewable generators.

A similar transformation occurred in the energy services market. In the 1990s, limited access to usage data and inadequate controls often prevented the micro management of a consumer’s energy usage. Since retail prices were fixed, there was no reason to modify facility operations with changing market prices. Today, prices can vary significantly throughout the year and throughout each day driven by weather and other factors. Real-time data feeds combined with sophisticated control systems allow operators to shift usage to periods with lower commodity prices. Operators may also be able to use controls together with on-site generation to curtail demand during peak hours to reduce demand charges.

The ability to respond to changing real time prices by controlling usage and altering consumption requires coordination between commodity purchases and operational decisions. For example, operators can use low priced energy at night to make ice and then use the ice during peak hours to chill a building, effectively shifting energy purchases from on to off peak periods.

Unfortunately, many asset owners look at commodity decisions in a vacuum. We are often asked how much we can save a client by running an effective procurement process. While there is value that can be realized through a strong procurement and risk management strategy, this question often overlooks the fact that more money can be saved (and in some cases, revenue generated) by synchronizing procurement decisions with the design and operation of a consumer’s energy infrastructure (controls, lighting, heating/cooling, back up generation and process loads). This is especially true when there is volatility in market prices. The current ERCOT (Texas) market is a good example to demonstrate the importance of coordinating procurement with operations.

ERCOT – The Summer of ´18

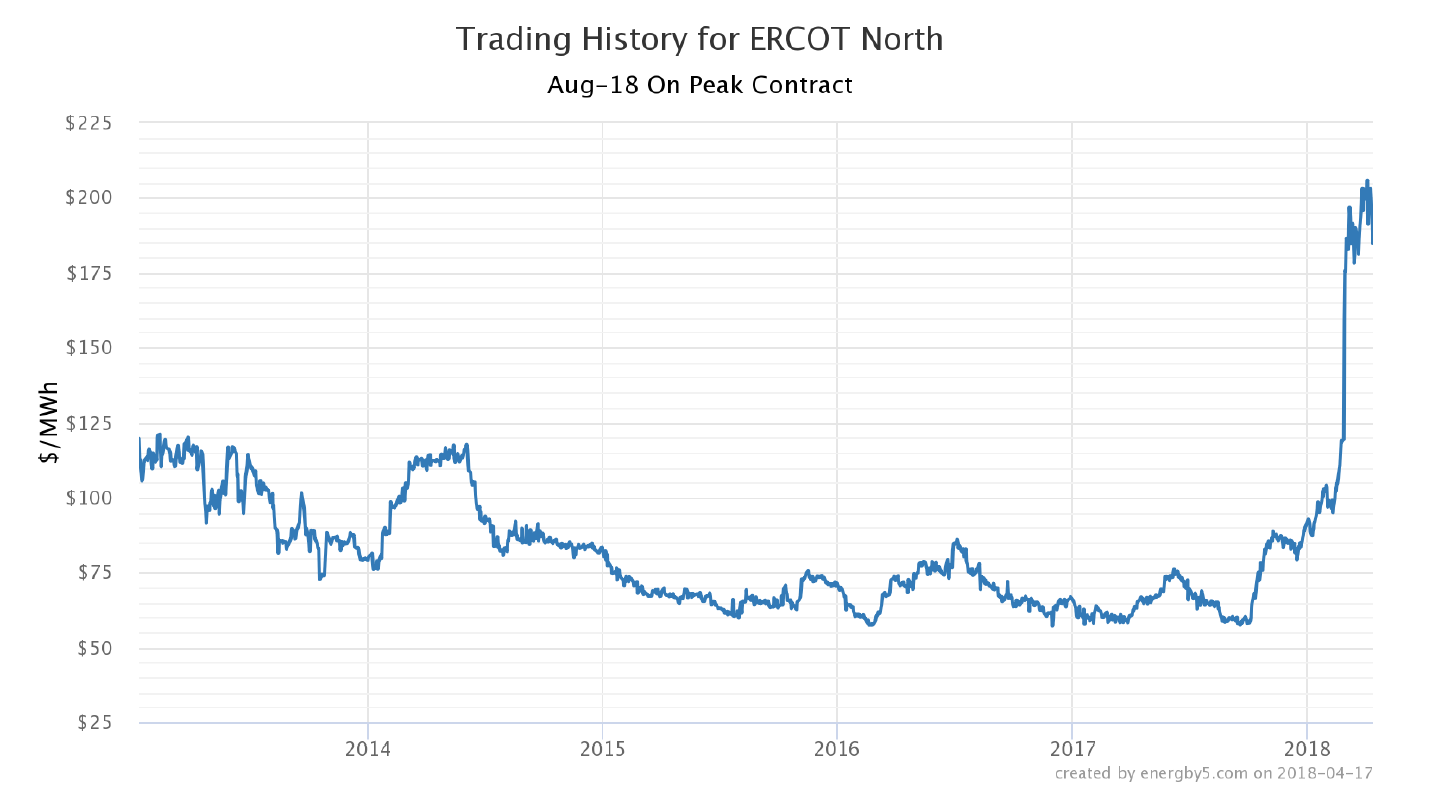

The near-term market in ERCOT is very volatile. As we noted in our last letter, a number of factors are putting significant pressure on ERCOT summer 2018 prices. This trend has accelerated recently. For example, on peak power (hours ending 7am-10pm weekdays) in ERCOT for August 2018 is trading near $200 MWh.

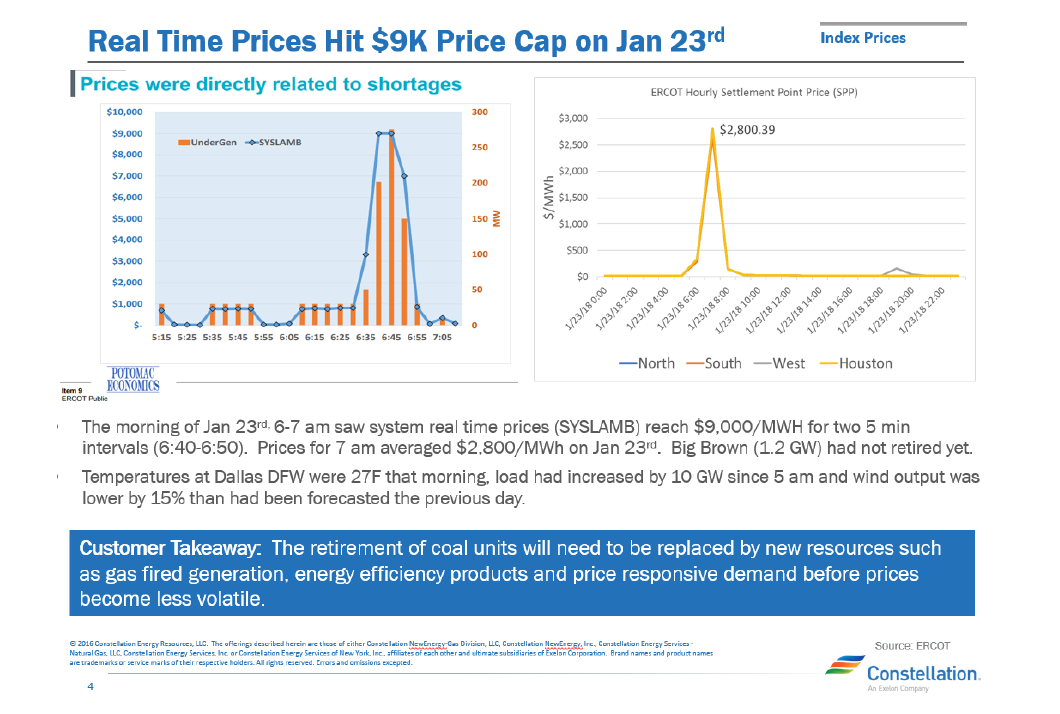

As you can see from the chart above, at this time last year on peak power for August 2018 was trading at $68 MWh. For a 1 MW peak commercial energy user that is floating on an index price, 6 hours at the index maximum price would increase annual energy costs by over $50,000. The retirement of 4,700 MWs of coal generation, the rapid increase in intermittent wind resources and the very high price cap - $9,000MWh 1, all contributed to the recent rally in forward market prices. In fact, ERCOT prices hit the $9,000 MWh cap for the first time on January 23rd – the result of low temperatures and below forecasted levels of wind generation.

The Linkage Between Procurement and Operations: The Example of Backup Generation

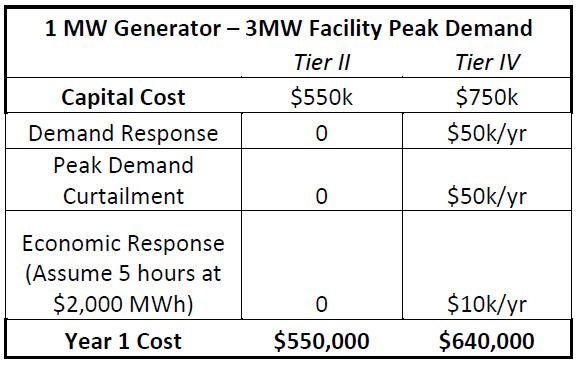

The volatility in the ERCOT market is a good back drop for showing the importance of considering market conditions when making operational decisions, such as selecting a backup generation unit. Historically, an engineer selecting an emergency generator for backup power selects the lowest cost, emergency-only rated equipment to provide a reliable source of backup power during a utility outage. In ERCOT, emission regulations limit operations of emergency-only diesel generators to situations when utility power is not available. Non-emergency rated diesel generators (often referred to as Tier IV), are equipped with better emission controls and can be permitted to operate in non-emergency situations. The Tier IV rated equipment can be significantly more expensive ($100 to $200 per KW).

In many instances, the operational team that makes the procurement decision does not include in its analysis the incremental value that can be created by a generator that can run in non-emergency situations. The Tier IV premium can often be recovered through a combination of incremental revenue and reduced cost. The chart below provides indicative values associated with using a 1 MW machine with Tier IV emissions.

The more expensive 1 MW machine can easily generate $50,000/yr by participating in a variety of demand response or load resource programs. These programs pay consumers that are able to reduce their load in response to certain grid reliability events by simply curtailing load or switching some or all of the load to a Tier IV generator.

In markets like ERCOT, all utilities include a coincident peak (4CP) demand charge for metered loads at or above 700 KW. This charge varies by utility and rate code, but on average this 4CP charge can be $50 per KW or more and comprise up to 50% of the total utility delivery charge. Consumers that can curtail or switch 1 MW of load to a Tier IV generator can reduce their utility delivery charges by up to $50,000 per year.

Finally, the Tier IV generator can be economically dispatched when the real-time or day ahead market prices increase to levels significantly above the cost of on-site generation. In this case, the value is created by using the generator to meet a portion of the facility’s power needs and re-selling the power purchased in the forward market to capture the high market price. For example, if the consumer’s contract price is $40 per MWh and the market price is $2,000 per MWh 2 and the consumer runs the generator for 5 hours when the market price is $2,000 per MWh, the consumer would net the difference between its contract price, $40 per MWh, and the market price, $2,000 per MWh, or $1,960 per MWh times the 5 MWhs. In this example, the Tier IV machine generates an incremental $9,800.3 Please note that to realize this benefit, the consumer must have negotiated this option with its electricity supplier. When one considers the incremental value that can be generated over the many years of the generator’s life, it is clear that in most instances, the correct economic decision is to purchase the more expensive non-emergency rated generator.

The above ERCOT example demonstrates that decisions that are made by the operational team can have a significant impact on both the regulated and unregulated portion of a client’s energy bill, yet in many instances the commodity team does not communicate with the operations team. New backup power systems are often purchased and installed with no consideration for how they might be used to drive revenue and reduce cost. The same applies to decisions made by the commodity team. Supply contracts are often written without consideration for how existing backup power systems might be leveraged. This coordination will become more important as products and solutions proliferate in the energy market. For this reason, our team now spends a significant amount of time working with clients to ensure that procurement and operations are synchronized.

As always, please do not hesitate to contact me or another member of the 5 team if you have energy related questions or you would like to discuss the issues covered in this letter in more detail.