To say that 2021 was a challenge for energy practitioners in Texas is a serious understatement. Certainly, 2020 was difficult as the market reacted to a global pandemic and energy demand destruction that resulted in negative oil prices. However, 2021 presented even greater challenges with the devastation from Winter Storm Uri coupled with the market uncertainty from the ongoing mutations of the Coronavirus.

There are four commissioners at the Public Utility Commission of Texas (PUCT), all of whom are new to their roles as each of their predecessors resigned after Winter Storm Uri. On Thursday, December 16, 2021, comments by Peter Lake, the current chairman, perfectly captured the mood at the PUCT. "It has been a long six months as well as a long year. ... It has been a helluva six, seven, eight months going through what I would imagine has to be the darkest period in the commission's history, making remarkable progress with our partners in the Legislature and the governor, to then work with our stakeholder groups, ERCOT staff and leadership to bring about even before today's actions an outstanding amount of reform and improvement in enhancing reliability in ERCOT in a staggeringly short amount of time[1]."

Chairman Lake issued these statements at the end of yet another marathon session. Over the past few months, the commissioners, and their respective staff, have debated many energy-related topics, dead-set on the notion that their constituents should never again experience the disastrous spiraling catastrophe that afflicted the state’s infrastructure during the deep freeze of February 2021. Commissioner Lake is correct, the state needs an “outstanding amount of reform” and that is exactly what the PUCT commissioners delivered last week. And while the plan is far from perfect, the announced reforms signal the first steps necessary to safeguard the Texas power grid. After the trauma of Uri and the tragic loss of life, you can bet that more reforms will continue to come from the PUCT moving forward.

There are two phases of market reform coming to ERCOT. Phase 1 deals with items set to change in the calendar year 2022, while Phase 2 deals with items to change from 2023 and beyond. Here are the details you need to know for Phase 1.

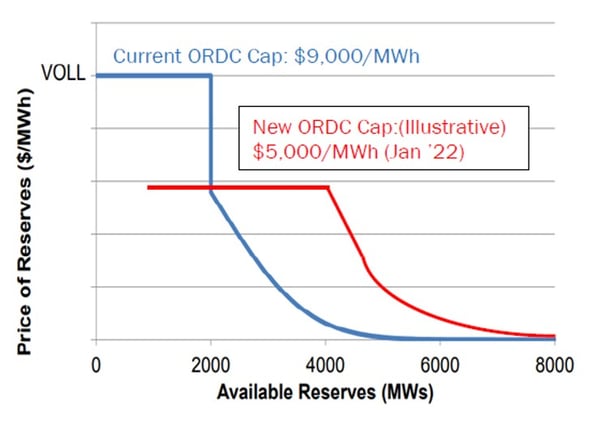

On January 1, 2022, the System-Wide Offer Cap (SWOC) will revert to $5,000/MWh from $9,000/MWh. This change lowers the administrative price cap for energy prices to reduce volatility for both energy producers and consumers and has been a top-of-mind issue for the commissioners all year. At the same time, the Operating Reserve Demand Curve (ORDC) will shift outward so that spot electricity prices will begin to rise sooner and faster as power generation supplies diminish. Figure 1 shows a high-level representation of how these reforms will change the ORDC.

Figure 1: ORDC Changes from Constellation New Energy/Exelon

Major reforms are also coming to ERCOT’s ancillary services (A/S) markets. A/S, or “ancillaries”, have historically consisted of four products that ERCOT calls upon to maintain frequency on the grid and, from time to time, to preserve the reserve margin. The four legacy A/S products include regulation up, regulation down, responsive (spinning) reserve, and non-spinning reserve. The PUCT is now ordering ERCOT to design and implement the following three new A/S products in 2022 - fast frequency response, firm fuel-based reliability service, and contingency reserve service.

These A/S products have strict technical definitions that determine which power generation resources are eligible to provide them. These definitions will be determined in the relevant ERCOT committees over the coming months. What’s important for our clients to know is that these new products are not yet available in the ERCOT market since they are entirely new concepts. These A/S components are being designed to incentivize more power plant capacity to be on-line, operating, and delivering power during periods of grid stress, like extreme weather events. The services will be provided by certain power plants, whose costs will ultimately be borne by end-users, as invoiced by their selected retail electricity provider. There is no way to avoid these increased costs in the short term, although we do expect some optionality to develop over time.

Last, but not least, are reforms on the demand side. Some market participants are hailing these reforms as the dawn of a new era for energy efficiency and demand response in Texas. The Emergency Response Services (ERS) is ERCOT’s flagship demand response program, which delivered over 1,000 MWs of demand reduction in the middle of Winter Storm Uri. The PUCT recognized the sizable contribution to grid stability brought about by demand response, and is thus expanding the program by taking several critical actions:

1) ERCOT will deploy ERS before an Emergency Energy Alert (EEA) is called, expecting that demand response will play an important role in grid-balancing long before operating reserves drop below 2,300 MW

2) The annual budget of $50M for ERS resources will be scrapped and ERCOT will instead opt for a procurement process based on physical capacity (e.g., megawatts per hour). In addition, loads will now be eligible to participate in a non-spinning reserve, one of the four traditional A/S products in ERCOT. This is a major change because historically only supply-side resources (e.g., power plants) were able to sell non-spinning reserves.

Combined, these reforms open exciting new opportunities for demand-side resources to monetize their energy reduction activities.

The team at 5 will continue to keep our stakeholders updated as Texas continues to define and implement Phase 1 reforms throughout 2022. Stay tuned for future ERCOT articles detailing Phase 2 reforms and additional insights into future reform topics.