On behalf of the team at 5, I am pleased to forward our market letter for the second quarter of 2021. The unusual weather that caused historic outages and extreme electricity and natural gas prices in Texas in Q1 surfaced in other markets in Q2. Both the Pacific Northwest and the Western US faced extreme weather conditions, namely, heat. In Death Valley, temperatures hit 130 degrees on July 9, a world record for the hottest reliably measured temperature in recorded history.

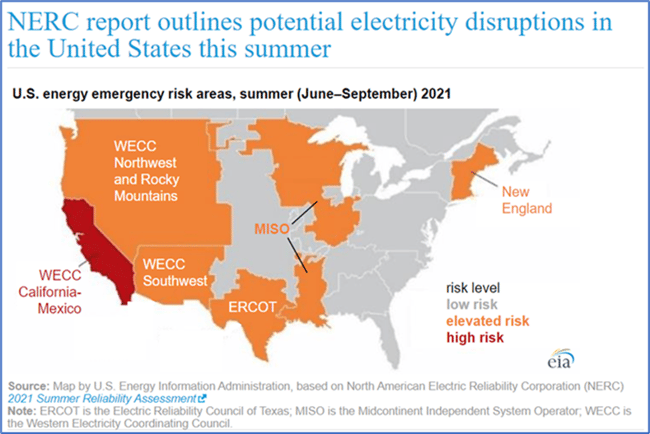

Volatile weather combined with aging infrastructure and increased reliance on intermittent generation stressed the US natural gas and electricity grid; California, New York, and Texas all risked power outages at different times during the last few months. Figure 1 provides an overview of which regions are at risk this summer:

Figure 1: NERC Potential Electricity Disruptions in the US for Summer 2021 from eia.gov

The US energy complex is under growing pressure from conflicting objectives that threaten the reliable supply of electricity. These include: (i) corporations and progressive states pushing to eliminate carbon emissions, (ii) a shifting generation fleet with increasing amounts of intermittent resources and declining amounts of coal, hydro, nuclear, and natural gas fired generation, (iii) increasing demands for electricity driven by efforts to electrify transportation and buildings, and (iv) aging infrastructure that is at risk of failure. And if this was not reason enough for concern, the lack of Federal oversight over the electricity transmission infrastructure makes it almost impossible to permit and build the transmission infrastructure needed to effectively and efficiently move electricity from renewable generators to load.

At 5, we see these trends reflected in discussions with our clients, a growing number of whom are focused on either reducing their carbon footprint or adding additional back-up generation to insure a reliable supply of power. For our clients, we continue to urge a balanced approach to energy management that considers and addresses cost, environmental objectives, and reliability.

Recent Weather Events

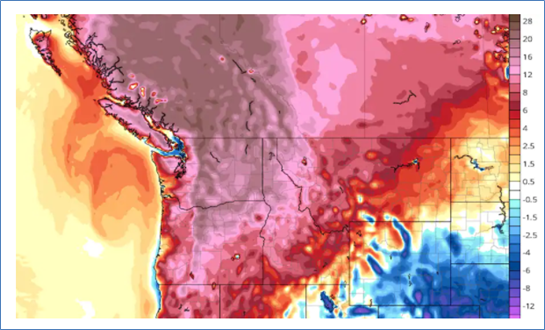

The June/July heat wave in the Pacific Northwest was as unprecedented as Winter Storm Uri. Seattle hit 108 degrees, Portland temperatures rose to 116, and our northern neighbor, Canada, saw record temperatures of 121 in British Columbia. The heat caused numerous fatalities and wildfires. As of the date of this letter, wildfires continue.[1]

The extent of the deviation from normal temperatures (using Celsius) is represented in Figure 2.

The rising temperatures and drought conditions in the Northwest are impacting the electricity supply in California.

On July 7, the California Independent System Operator scrambled to conduct a last-minute solicitation for additional generation capacity for the months of July, August, and September. The solicitation was due to extreme temperatures, combined with the anticipated loss of natural gas generation, delays in getting new storage projects built, and weaker than expected interest in voluntary curtailment programs. The state’s solicitation did not address environmental considerations. California has also had to issue emergency alerts on June 17,18 and July 8 asking individuals and businesses to conserve electricity between 4:00 PM and 9:00 PM. More recently, the Bootleg Fire in Southern Central Oregon threatened the California Oregon intertie that is used to bring a significant amount of power from Oregon into California. Governor Newsom responded to this risk by directing the Air Resources Board to waive permitting requirements to allow ships and other power-generating assets to run their generators to reduce strain on the grid. Reliability took priority over emissions.

While the causal linkage between these extreme weather events and human impacts on climate is debated in the United States, the numerous factors pressuring the reliability of the grid are generally acknowledged by all parties.

Even so, federal and state governments seem unable to formulate a common approach to fixing the current market. With or without continued adverse weather, the risk of increased outages may increase over time. Here are some reasons why:

Aging Infrastructure

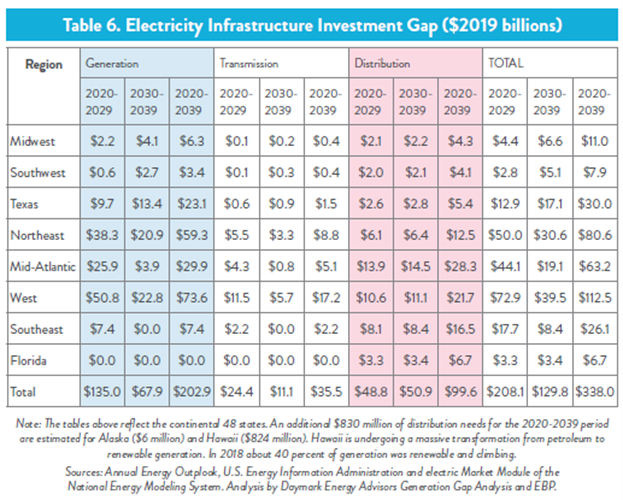

The US natural gas and electricity grids are showing their age. Extreme weather tests the strength of the grid, and heat/fire related outages in California and cold weather outages in Texas are evidence that significant new investment is needed. As noted by the American Society of Civil Engineers in a recent report, “The majority of nation’s grid is aging, with some components over a century old – far past their 50-year life expectancy – and others, including 70% of the T&D lines, are well into the second half of their lifespans.” As shown in Figure 3, this report estimates that there is a gap of some $338 billion between what is needed (between now and 2039) to ensure a reliable grid and what has been committed.

This gap is based in part on the expected growth of renewable power sources.

Renewable Power: Shifting the Generation Mix to Intermittent Supply

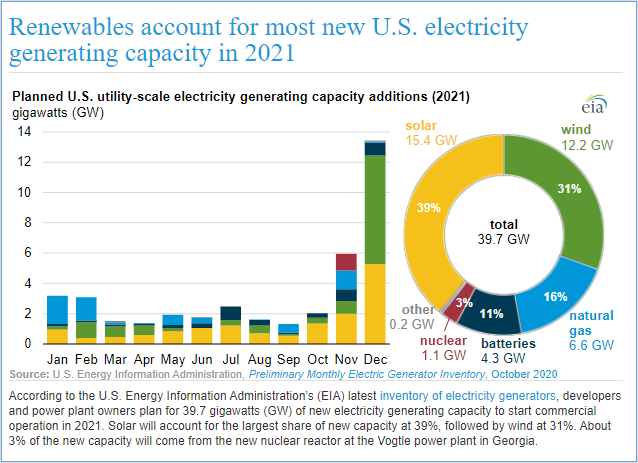

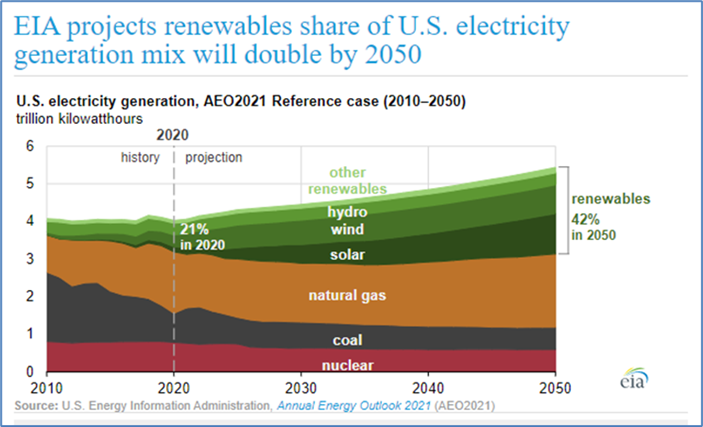

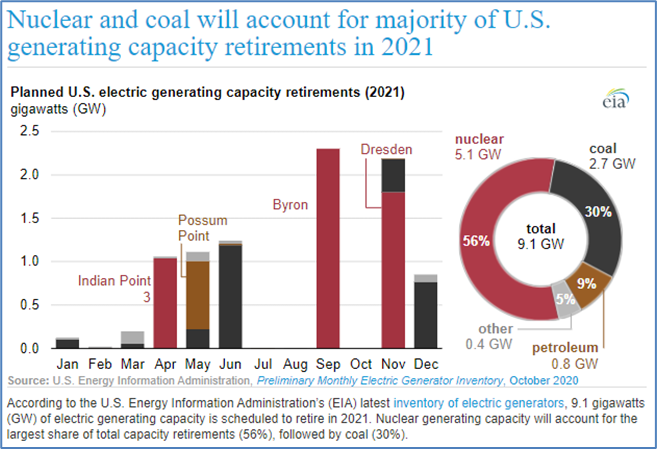

Figures 4 and 5 show that renewable generation accounts for almost all new generation installed in 2021 and how the share of renewable power in the nation’s energy mix is expected to double by 2050. At the same time, Figure 6 shows that there will be accelerated retirements of coal, nuclear, and natural gas-fired generation, all non-intermittent sources.

This shift is explained primarily by the low cost of wind and solar, the low cost of natural gas (which makes coal and nuclear plants expensive relative to natural gas plants), and the increased demand for carbon-free resources.

Figure 4: Renewables Account for new US Electricity Generating Capacity from eia.gov

Figure 5: Doubling of Renewables Share in US Electricity Generation Mix by 2050 from eia.gov

Figure 6: Nuclear and Coal Retirements of 2021 in the US from eia.gov

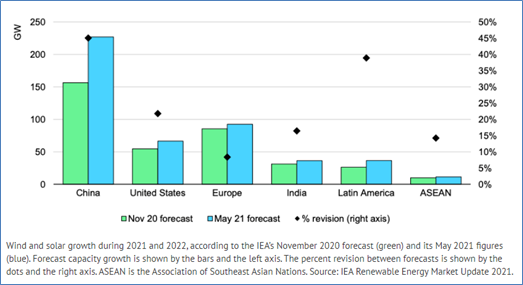

The International Energy Agency (IEA) expects an even faster growth of renewable capacity. The IEA expects renewables to meet 90% of the global power sector’s capacity growth in 2021 and 2022. And as you can see in Figure 7, the expected growth of China’s renewable capacity dwarfs that of the US.

Figure 7: IEA Global Expected Renewable Capacity from iea.org

We tend to agree with the IEA and expect an even faster transition to a low carbon generation fleet. Other reasons for the rapid growth of wind and solar power are government mandates and corporate renewable commitments.

Governmental Mandates

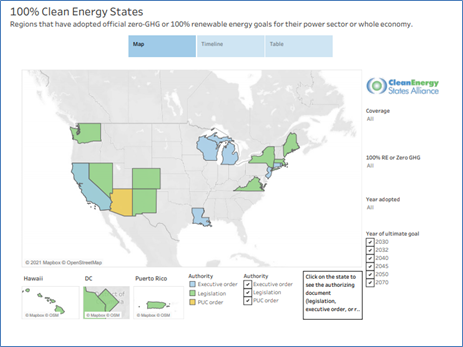

The Federal Government’s inability to reach an agreement on climate change has left a vacuum that is being filled by states and other governmental entities. The map in Figure 8 shows the various states that have made 100% renewable commitments.

Figure 8: States in the US Committed with 100% Renewable Commitments from cesa.gov

Additionally, over 700 cities in 53 countries committed to reduce emissions by 50% by 2030 and reach net zero by 2050. US cities that are part of this commitment include Austin, Boston, Chicago, Houston, Los Angeles, Miami, New Orleans, New York, Philadelphia, Phoenix, Portland, San Francisco, Seattle, and Washington DC. Similar commitments have been made by a broad range of governmental entities including water and sewer authorities, towns, communities, and airports. To meet these commitments, states and other entities are aggressively introducing legislation that promotes the development of renewable generation. At the same time, they are also focused on influencing consumer behavior that should significantly increase the demand for electricity.

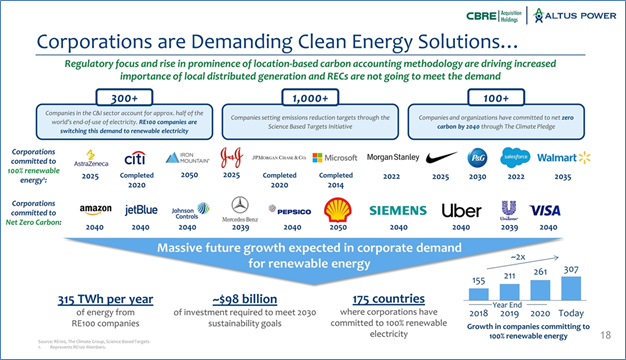

Corporate Renewable Purchases

Open almost any newspaper and you are likely to see reports of corporate commitments to clean energy. RE 100, an international group of large corporates committed to 100% renewable energy, includes 310 companies with 334 TWh of renewable electricity demand – greater than the UK’s total electricity demand in 2020. Of the 310 companies, 79 are based in the US, and their total annual consumption is 35 million MWh. Figure 9 paints a good picture of this demand and how demand is expected to grow over time.

Figure 9: Corporate Demand for Clean Energy Solutions from Altus Power Investor Presentation

While renewable generation significantly reduces carbon emissions, wind and solar power create a growing set of challenges to grid operations. Wind and solar generators only operate when the wind is blowing and the sun is shining. While low-cost battery storage can help offset these patterns, this technology is not yet viable on a large scale. The grid also needs to build the high voltage transmission lines necessary to connect this supply, generally located where the wind blows (Midwest) and the sun shines (South and Southwest), to load centers. The nation’s electricity grid is shifting to increasing amounts of supply from intermittent power sources at the same time as demand for electricity is growing.

Electrification

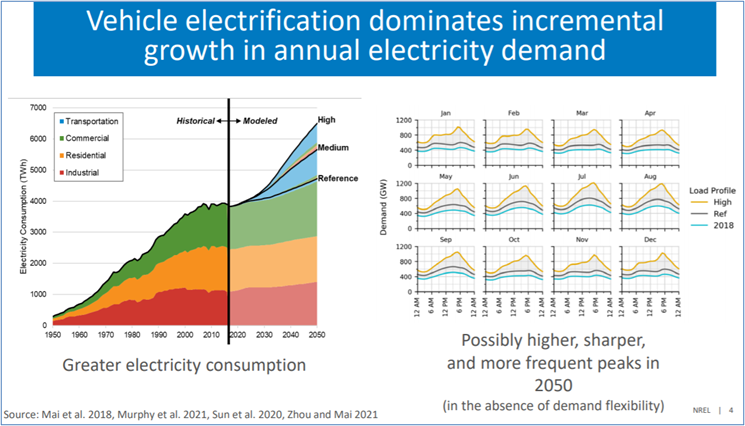

Efforts to reduce carbon emissions logically focus on the transportation sector, the largest single source of carbon emissions in the US. This has resulted in aggressive plans to introduce electrical vehicles for cars, trucks, and buses. Figure 10 shows the importance of vehicle electrification in the expected growth of electricity demand. If President Biden’s infrastructure bill is passed, we will see the Federal Government invest $7.5 billion in charging stations, part of a plan to install 500,000 charging stations across the country.

Figure 10: Vehicle Electrification in Annual Electricity Demand from nrel.gov

The 500,000 target is relatively modest. The California Energy Commission says the state will need 1.2 million public and shared charges to meet the demands of 7.5 million passenger plug-in electric vehicles (EVs) by 2030.

The building industry will be another source of increased demand for electricity. In California, 26 of its counties and cities have banned new natural gas hook ups. In New York (and in other markets), efforts are also underway to replace natural gas with heat pumps for space and water heating. While it is difficult to predict how fast the transition to electric vehicles and electric heating will take place, the shift could have a dramatic impact on electricity demand. This will put additional pressure on our aging infrastructure while the grid is trying to adjust to higher volumes of intermittent supply.

Grid Security: Can Our Energy Grid Keep Up With Demand?

Even without extreme weather, the pressure to decarbonize the grid and the retirement of fossil fuel generation, combined with relatively old and out-of-date infrastructure, put our energy grid at risk. On a positive note, the evolving market that can support EVs and electrified buildings may bring with it new technologies and products (e.g., low-cost storage) that allow power to be used more efficiently. For example, a large amount of EV deployment together with distributed solar and storage may provide grid operators with additional flexibility, reducing the amount of energy needed to meet peak demands.

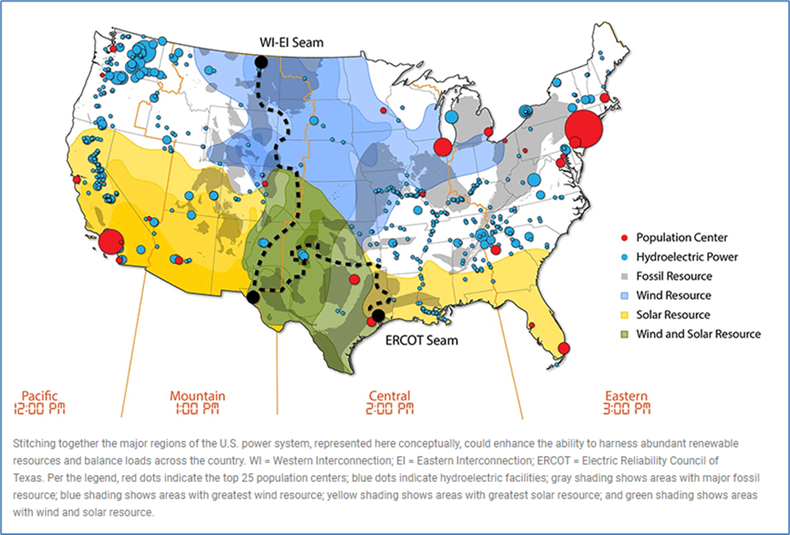

Even with new technologies, as electrification expands and renewable supply grows, high voltage transmission infrastructure will be needed to move power from areas of sun/wind across long distances to areas where people live. Figure 11, produced by The National Renewable Energy Laboratory (NREL), shows in graphic form one of the key challenges; solar power resources are strongest in the South and West, wind resources in the Midwest, with population centers (the red dots) far from those key sources of renewable power. To make matters more complex, wind resources are strongest at night and solar is strongest during the day – and these periods of production vary with the time zones.

Figure 11: Renewable Resources in the US from nrel.gov

The US will need an extensive and sophisticated transmission network to move power efficiently across different markets. According to a recent study by a team at Princeton University, “The current power grid took 150 years to build,” remarked Jesse Jenkins, assistant professor of mechanical and aerospace engineering at the Andlinger Center for Energy and the Environment. “Now, to get to net-zero emissions by 2050, we will have to build that amount of transmission again in the next 15 years and then build that much more again in the 15 years after that.” Yet the current regulatory regime makes the construction of high-speed transmission lines nearly impossible.

As noted in a recent Aspen Institute report, “Though the direct cost of transmission is significant, by most accounts the larger barrier is sitting authority, and particularly the web of authorities – including FERC and various agencies in every state through which a line passes – each of which must approve any interstate transmission proposal. These multiple veto points currently raise an extraordinarily high hurdle to interstate transmission investment.” [2] For example, our complex set of Federal and State laws makes it difficult to permit a gas pipeline even when gas utilities have the ability to use eminent domain. This was painfully evident in PennEast Pipeline v. NJ, a case recently decided at the Supreme Court. It has taken years and a trip to the Supreme Court (decided 5/4) for PennEast to get the right to use eminent domain to cross certain state-owned lands. And even with this decision, the pipeline faces numerous other legal challenges.

Significantly, the eminent domain authority available for permitting a natural gas pipeline does not exist for companies looking to permit interstate electricity transmission. In Washington, the Biden Administration and FERC have started to focus on the need for transmission infrastructure. In recent testimony, a Department of Energy official noted that transmission reform is essential to meeting the Administration’s carbon reduction goals.

Competition with China could assist with the gridlock. Since 2014, China has built some 260 GWs of transmission – bringing power over long distances from renewable-rich areas in Western China to population centers in Eastern China. Over that same period, the US has built only 3 GWs. It will be interesting to see if FERC and other Federal agencies can find a way to promote and implement a national transmission policy. Unfortunately, until a more coherent energy policy is endorsed by all parties, electricity disruptions are likely to be more common.

As always, please do not hesitate to contact me or other members of the 5 team if you have energy-related questions or you would like to discuss the issues covered in this letter in more detail.

[1] The July flooding in Europe is just one more reminder of what can happen with extreme weather conditions.

[2] https://www.economicstrategygroup.org/publication/borenstein-kellogg-energy-infrastructure-policy/