ELECTRICITY

PROCUREMENT

Our clients are busy and rarely have the time, tools, or expertise to create, execute and manage a forward-looking electricity procurement strategy. Without a strong working knowledge of every facet of the deregulated energy industry, clients are often blind to the inherent risks and opportunities embedded in their procurement process as well.

That’s where 5 comes in. We are uniquely positioned to design and implement effective energy strategies that ultimately become a competitive advantage for our clients. Our comprehensive procurement strategy always starts with data. We take the time to analyze our client’s energy usage patterns, peak demand, coincidental peaks, operations, controls, utility costs, weather sensitivity, and potential product options by gathering the following:

• Monthly usage data and 15-minute usage data when available

• Current contract terms, end dates, and product details

• Utility invoices and rate code details

• Operational schedules

• Building automation control details

In addition to collecting client data, we also leverage our proprietary market analytics platform, Level5, to review prices and energy market trends including:

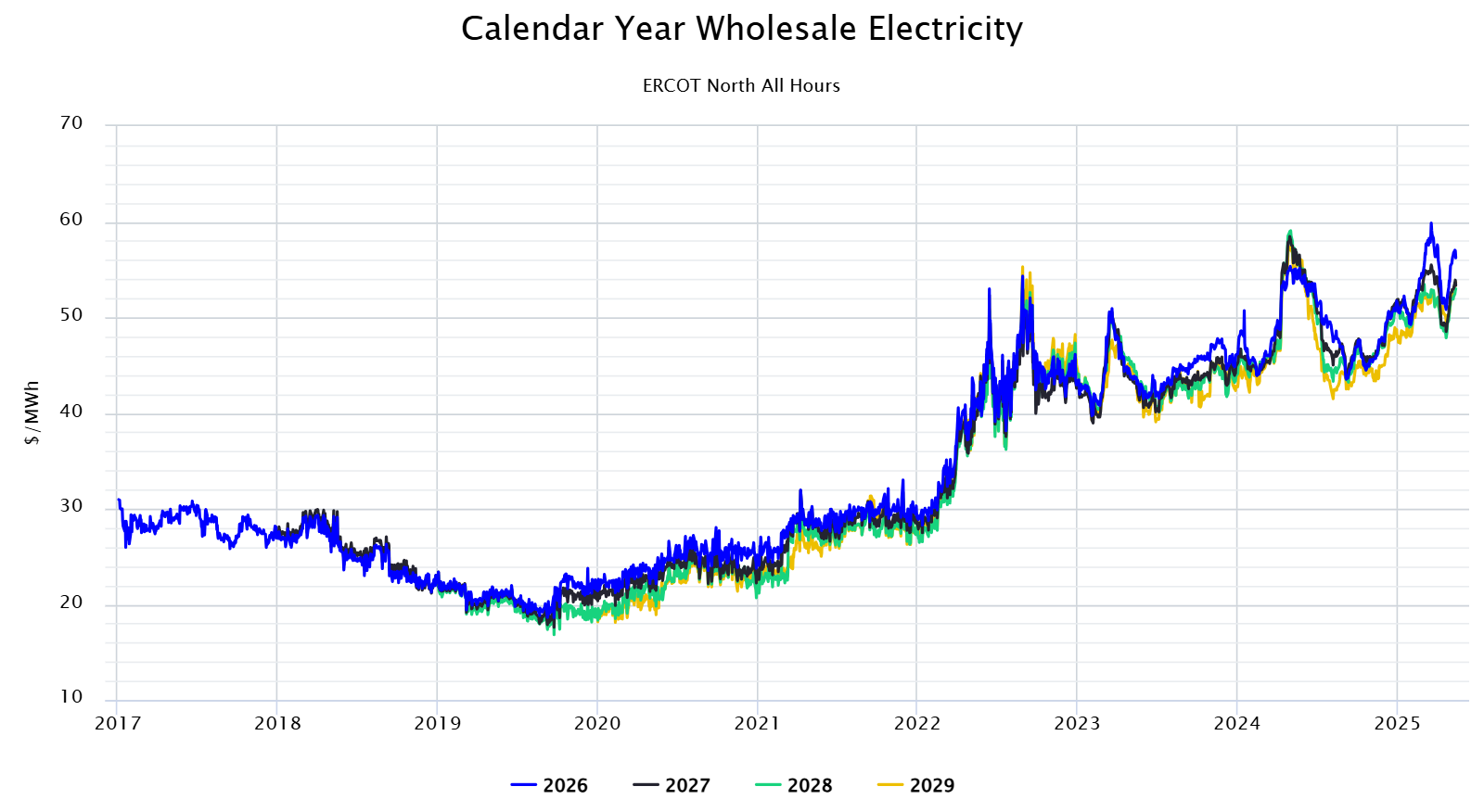

• Historical and forward market prices

• Regional costs for congestion, capacity, transmission, ancillary services, and more

5’s approach to electricity procurement balances each client’s desire to reduce and control energy costs while also considering their decarbonization goals, resiliency needs, operational constraints, optimization opportunities, and their potential appetite to reduce cost within acceptable risk tolerance. After working with 5, clients begin to see their electricity procurement strategy as an asset worth developing, instead of merely an expense to be minimized. No company is better situated than 5 to help clients manage their exposure to volatile energy prices in an ever-changing market.

.jpeg)